2 min read

An Overview of the Energy Crisis in Europe and Ways to Respond: 4Q2022

Fisher International

:

Nov 8, 2022 12:00:00 AM

From individual consumers to executive meetings at major companies, energy consumption, the crisis that follows it and the uncertainty of the future has been the recent “matter of the moment” in Europe. The latest developments regarding the sabotage of the Nordstream pipelines make it very unlikely, if not impossible, that the natural gas crisis will be over in the short term. In August, prices reached the worst spike Europe’s seen in years as it reached €340/MWH – creating costly consequences for both households and businesses.

The Pulp and Paper industry is one of the largest energy consumers in Europe, as it is heavily dependent on fossil fuels and purchased electricity to maintain operations. It’s important—now more than ever—to “brace for impact,” though it will be a tough situation to navigate. However, it’s important to keep in mind that these changes will not affect all players in the same way.

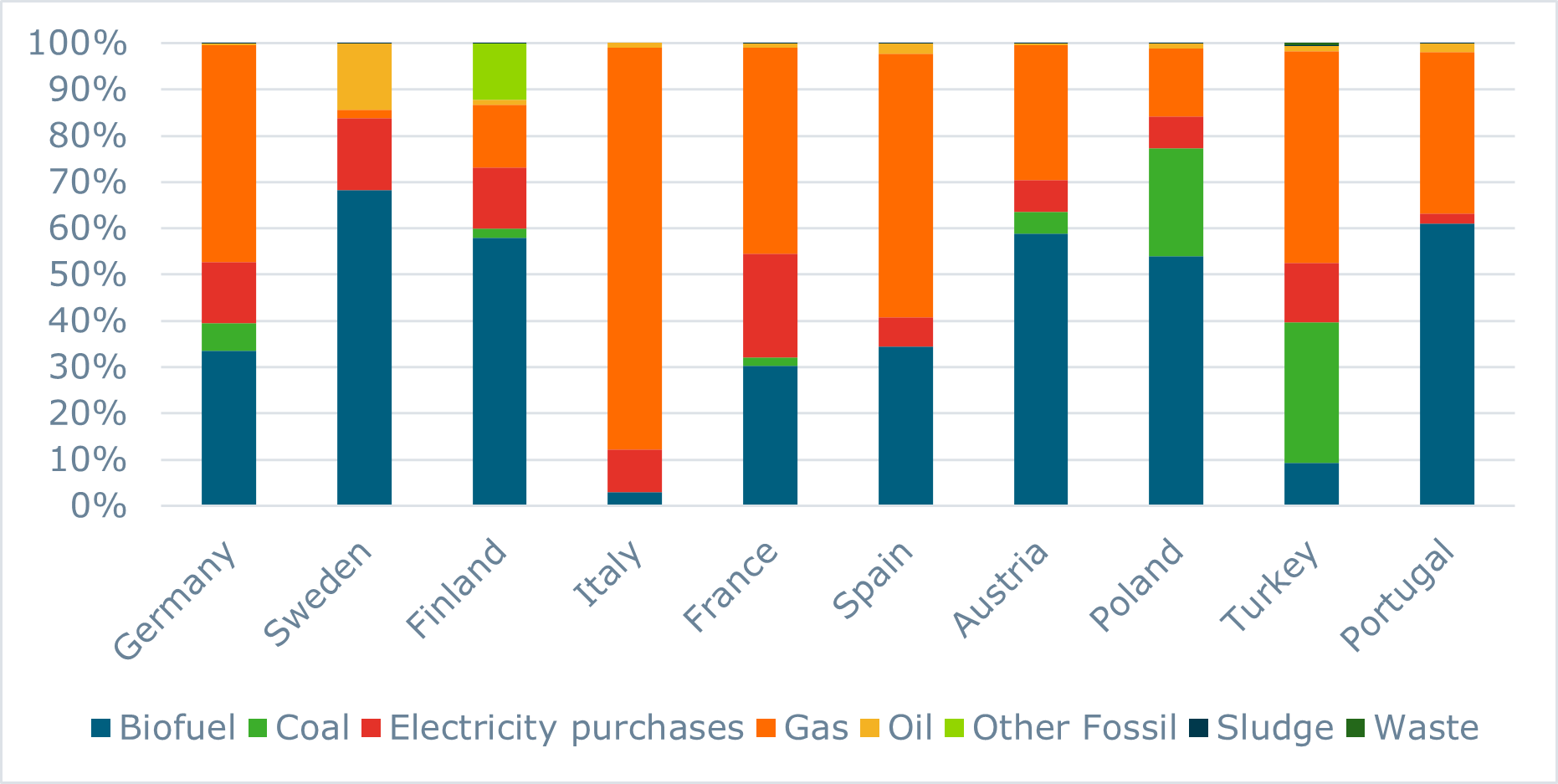

As illustrated in Figure 1, players in the paper industry in different countries across the EU have varying shares of energy sources that make up their total energy portfolios, which will have disparate results on the viability for those operating in these regions. Other factors that will impact viability also include the technical age of assets, as well as geography and energy source exposure.

Figure 1: Top 10 Energy Users in Europe and Their Share of Energy by Source

Source: FisherSolve

As illustrated in Figure 1, players in the paper industry in different countries across the EU have varying shares of energy sources that make up their total energy portfolios, which will have disparate results on the viability for those operating in these regions. Other factors that will impact viability also include the technical age of assets, as well as geography and energy source exposure.

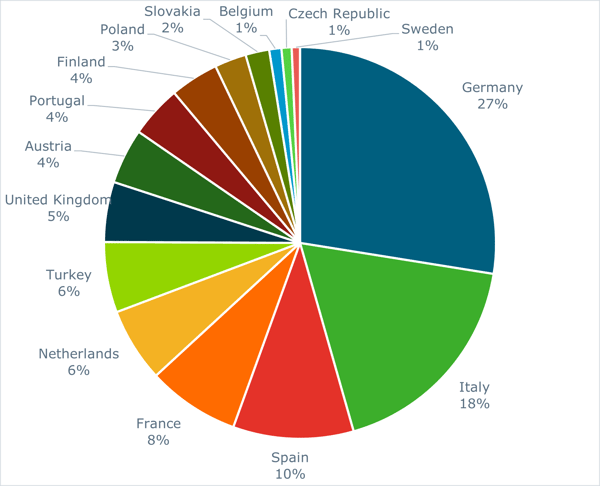

Figure 2: Gas Consumed by P&P Mills in the Top 15 Paper Producing European Countries

Source: FisherSolve

Figure 2 illustrates the gas consumed by P&P mills according to FisherSolve of the top 15 paper producing countries in Europe. As we can see, paper industry powerhouses Germany and Italy are among the heaviest gas users in Europe. While it’s important for all companies around the world to consider action related to the energy crisis, it’s imperative for companies located in these 10 regions to develop a plan sooner rather than later.

Figure 3: Average Operating Cash Cost of European Specialty and Kraft Paper Mills 2021 vs. 2022

Source: FisherSolve

Even though many companies are hedging their electricity and gas purchases, the effect of increased energy costs is creeping into production costs – not only from pure energy and fuel purchases, but also from increased costs of chemicals, consumables, transport, and pulp, as seen in Figure 3. At this moment, companies are facing two key challenges:

-

How to optimize energy usage in a highly volatile market

-

How to create long-term and short-term strategies to optimize profits in the future

Fisher has uncovered two innovative approaches to help companies not only survive, but pivot to address the challenge and even benefit from the situation. For more information, download the rest of our white paper below.

About the Author:

Pirita Huotari began her paper industry career as a Project Manager supporting business development initiatives including shutdown coordination and project delivery management. Pirita helps FisherSolve™ users cultivate enterprise-wide adoption of data-driven management principles, so they can become more deliberate in their use of data when developing and executing strategy.