Establishing a sustainable competitive advantage within your company is crucial to its success because without one, it’s hard for any company to earn more than its cost of capital. So, while many big investments may deliver temporary advantages, they don’t always deliver sustainable ones.

Sustainable competitive advantage not only comes from having assets, but from capitalizing on them better than competitors do. This only happens with a constant flow of superior internal decisions made frequently. In other words, new products have to be developed more creatively, plants have to run more efficiently, marketing has to reach more of the right people, and sales forces have to close more orders than their competitors.

Cumulative Value of the Decision Chain

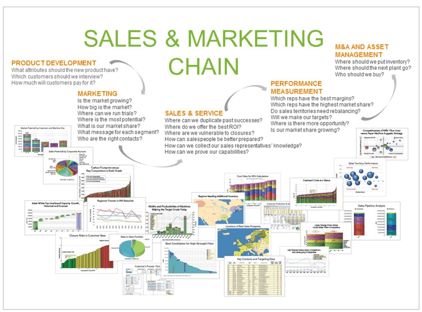

Every supplier makes important decisions daily; from which customers to pursue to which products to develop, there’s an entire chain of decisions that address product development, marketing, sales and service, performance measurement, M&A, asset management, etc.

Improving the quality, speed, and frequency of the decisions your company makes is key to optimizing existing resources and building a sustainable competitive advantage. The cumulative value that such decisions create can have a powerful impact overall.

- Targeting: Targeting is extremely critical for suppliers given the high cost of sales in the paper industry. What makes a mill a good target varies by supplier, but the more specific the supplier can be with matching their product with the needs of prospects, the higher value the targets.

- Sales Call Preparation: Another critical application of data is sales call preparation. Mill operators are busy people, so the most prepared salespeople earn the most customer time. Knowledge of the marketplace, the customer’s mill, and its unique situation can be what causes a buyer to prefer one supplier over another. To compete for time, good salespeople start with accurate, current, detailed customer data.

- Product Development: It is the supplier community that develops a large portion of the industry’s new products and applications. R&D is expensive, especially since a large number of initiatives fail technically or the marketplace doesn’t adopt them. A simple way to make R&D money stretch further is to validate the new product idea fully before developing it in the lab.

Competitive advantage comes from things like targeting sales calls, preparation, and spending R&D money more effectively. These initiatives require a complete, accurate, and reliable data source available across departments able to serve a wide range of business needs and support a company culture of data-driven decision making.

The use of business intelligence is so advantageous because compared to all the other truly expensive investments we can make, the cost of acquiring information is extremely low, and when you acquire the best information available, it brings powerful leverage.

Fisher International specializes in helping participants in the pulp and paper supply chain maximize their use of valuable business intelligence. For more insight into this specific issue, download the Fisher white paper titled “Business Intelligence: The Least Expensive Source of Sustainable Competitive Advantage” by clicking here.