ResourceWise Blog

Market News, Analysis, and Trends

Sign Up Today

FILTER BY MARKET OR TOPIC

Biofuels and Feedstocks | Chemicals | Forest Products | Pulp and Paper

2 min read

2025 Sees Continued Pulp and Paper Mill Closures: What's Driving the Trend?

The global pulp and paper industry has moved through 2025 with more signs of strain thus far as mill closures and production curtailments continue to...

2 min read

DCM Shriram's Strategic Leap: Acquiring HSCL for ₹375 Crore

On June 12, 2025, DCM Shriram Ltd. announced a transformative step in its growth journey, approving a definitive agreement to acquire 100% equity...

2 min read

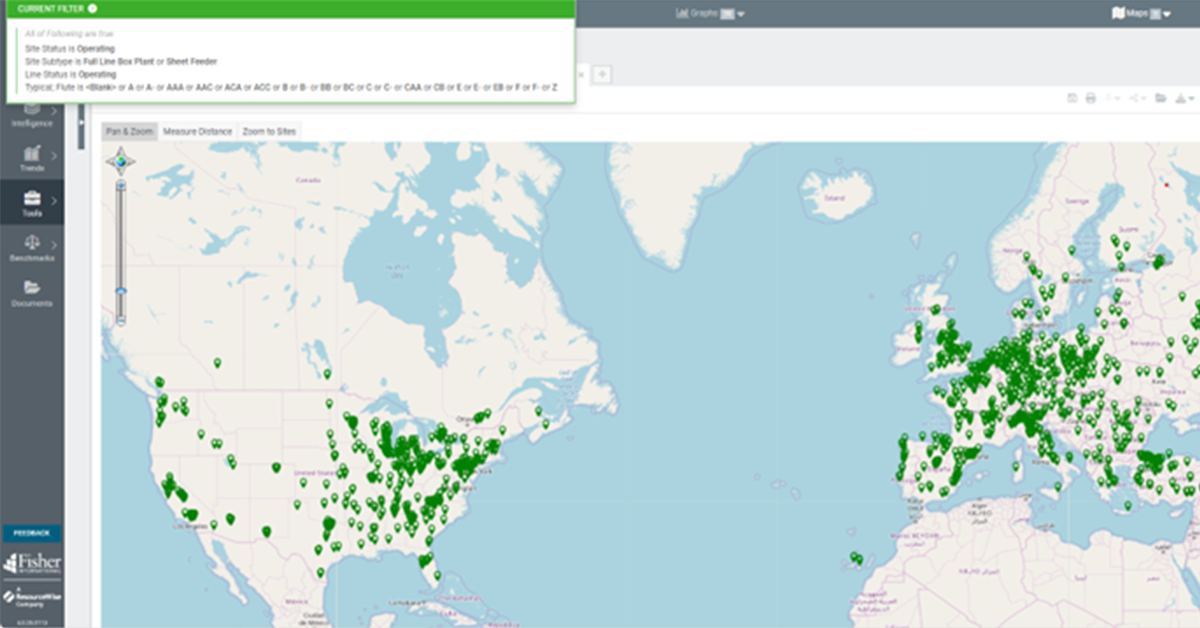

Unlocking Opportunity in Corrugated Packaging: What Market Participants Must Know

The corrugated packaging industry continues to grow, driven by steady demand from e-commerce, increasing sustainability requirements, and ongoing...

5 min read

How Feedstocks from Crops Create Advanced Biofuels

As the world pushes toward a greener future, one very important concern is waste reduction. Waste reduction aims to reduce landfill volume, promote...

3 min read

Why Sustainable Aviation Fuel Needs More Than Mandates

The aviation sector faces a serious challenge on the road to decarbonization. While other industries begin to make headway in cutting emissions,...

4 min read

Saccharomyces Cerevisiae: How This Common Baking Ingredient is Being Used in Biofuel and Oleochemical Production

Baker’s yeast isn’t just for bread anymore. In a breakthrough study published in Nature Communications (DOI: 10.1038/ncomms11709), researchers...

1 min read

Nordic Forest Products Sector Under Pressure from High Wood Costs and European Environmental Regulations

Forest products professionals in the Nordic region are being squeezed by high raw material costs and evolving environmental regulations that have...

3 min read

EU Anti-Dumping Investigation into 1,4-Butanediol Imports

On April 3, 2025, INEOS Solvents SA lodged a complaint prompting the European Commission to initiate an anti-dumping investigation into imports of...

3 min read

ClimeCo Champions Integrity in Adipic Acid Protocols for High‑Impact Climate Action

In a pivotal step toward tackling greenhouse gas emissions, ClimeCo has supported the approval of the Climate Action Reserve’s (CAR) US and China...