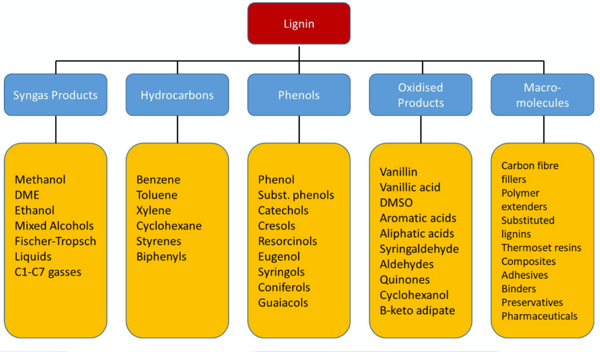

Lignin is expected to play a significant role as a new chemical feedstock particularly in the formation of supramolecular materials and aromatic chemicals. Lignin is a complex plant-derived macromolecule found in the cell walls of almost all dry plants. It makes up 20-30% of the composition of wood.

According to a European Commission (EC) report “Top emerging bio-based Products, their properties and industrial applications” published by Germany-based Ecologic Institute on June 2018, lignin - among the most relevant large-volume biomass components – was found to generate the highest number of innovative products together with terpenes and urban wastes. Its natural abundance and global availability represent the main drivers for the persistent attempts at its exploitation beyond its actual relevant role as a bioenergy source, although its chemical versatility and uniqueness as a source of aromatic building blocks also play a role.

Innovative products derived from lignin range from fundamental chemical building blocks such as BTX aromatics to material for advanced applications in technical fields like construction engineering, where for instance both carbon fibres and thermoset resins play a major role but are currently not available from renewable sources.

Lignin in carbon fibres and composites

The use of low-cost lignin-based carbon nanofibres could enable a broader use of lightweight materials in the automotive and aerospace industries. Carbon fibre composites can reduce the weight of a vehicle by up to 50% and improve fuel efficiency. In February 2019, US-based Attis Industries announced a partnership with Iowa State University for a funded research program to develop carbon nanofibers from lignin produced at Attis’ planned cellulosic ethanol biorefineries. Polyacrylonitrile (PAN) is currently the most common precursor used in the manufacturing of carbon fibre and accounted for 50% of the total finished cost of the product. Carbon fibres using PAN use a delicate and tedious web spinning process that accounts for half the cost of carbon fibre production.

Due to the cost of PAN at roughly $3-5/kg, commodity applications like automotive are forced to incur costs of more than $10/kg for carbon fibre material, all but limiting its use to high-end luxury vehicles. Attis believes the unique, melt-flowable lignin manufactured through its proprietary biomass process can substantially reduce the base precursor cost in producing carbon fibre while meeting the performance characteristics required for automotive applications. Attis estimates that each of its biorefineries could produce enough high-purity lignin at around 10,000 tpa of carbon fibre and could do so at a fraction of the cost of PAN precursor.

The partnership will involve a significant amount of laboratory and pilot testing of Attis’ lignin by Iowa State University to maximise the amount of lignin in a finished carbon fibre formulation while meeting the industry standard for carbon fibre in automotive applications.

Several EU-funded programs have been looking at developing lignin-derived products and chemicals. A four-year project called LIBRE (lignin-based carbon fibres for composites) that will run until 2020 is investigating lignin for its suitability as a precursor for renewable carbon fibre manufacture. The consortium was able to prepare precursor fibres using a cheaper melt-spinning process although it requires the use of solvents as lignin has reported high melting point. The resulting lignin-based carbon fibre has a tensile strength of 1.8 gigapascals and a stiffness of up to 200 gigapascals that are said to have higher values than those of the much heavier high-alloy steel. The carbon yield is reportedly similar to PAN-based carbon fibre, and higher than that using cellulose. Project partners will test the carbon fibre composites for use in wind turbines and automotive components.

LignoCOST, a large European network coordinated by Wageningen Food & Biobased Research, aims to stimulate industrial application of lignin from raw materials to cost-effective and sustainable end products by establishing a sound network covering the entire value chain in which relevant information can be produced and shared. LignoCOST consists of five work programs that each focus on their own objectives and results and has a duration until October 2022. More than 200 partners from 38 countries have joined this ambitious program.

There is no commercial production of lignin carbon fibres as of yet but it is assumed that lignin fibres would be less expensive because of the low-cost precursor lignin at around $2-3/kg. Lignin has an average gross price of $660/ton dry solid as of 2013, according to the EC report. Non-aerospace grade carbon fibre is around $20-30/kg. In 2017, the global production of carbon fibre was reported at around 80,000 tons. Its market size in 2015 was valued at around $2.5 billion.

In biocomposites, lignin-based materials with natural fibres reportedly behave like standard thermoplastics, with mechanical properties ranging from standard commodities such as polypropylene, polyethylene and polystyrene to technical polymers such as polyamides. The global market of lignin biocomposites is between one million and 1.1 million tpa according to the EC report. Lignin biocomposites could reportedly be price competitive alongside oil-based commodity plastics. The annual growth rate (CAGR) of natural fibres and composites is said to be around 2%/year.

US-based Prisma Renewable Composites announced in 2019 its partnership with Shanghai-based Yanfeng Automotive Interiors (YFAI) for exclusive use of its BioLAN™ lignin-based composite materials. Domtar supplies the lignin used by Prisma and is also a major stakeholder of the company. BioLAN™ reportedly improves key properties of traditional acrylonitrile butadiene styrene (ABS) plastic, including cost, higher UV resistance, and higher tensile strength while reducing total greenhouse gas emissions. BioLAN™ will be for use in various automotive interior applications.

Last year, scientists at the US Department of Energy’s Oak Ridge National Laboratory (ORNL) has created a renewable-based 3D printing material that combines melt-stable hardwood lignin with a low-melting nylon and carbon fibre to create a composite with just the right characteristics for extrusion and weld strength between layers during the printing process as well as reportedly excellent mechanical properties.

Developing the material was initially challenging as lignin chars easily compared to ABS. Lignin can only be heated to a certain temperature for softening and extrusion from a 3D printing nozzle. The researchers found that combining lignin with nylon increased the composite’s room temperature stiffness while its melt viscosity decreased. The lignin-nylon material had tensile strength reportedly similar to nylon alone and has lower viscosity compared to conventional ABS or even high-impact polystyrene. The combination also appeared to have almost a lubrication or plasticising effect on the composite.

The researchers are also able to mix in a higher percentage of lignin by 40-50% by weight. The ORNL scientists then added 4-16% carbon fibre into the mix leading to a new composite that heats up more easily, flows faster for speedier printing, and results in a stronger product. The lignin-nylon composite is patent-pending and work is ongoing to refine the material and find other ways to process it.

Stora Enso, meanwhile is looking to target the rapidly growing battery market in which companies are looking for high-quality, attractively-priced and sustainable materials.

Stora Enso invested €10 million in 2019 to build a pilot facility for producing lignin-based carbon materials at its Sunila Mill in Finland. With the new investment, Stora Enso will pilot the processing of its Lineo™ lignin produced at Sunila Mill into hard carbon anode materials for lithium-ion batteries with properties similar to graphite. The pilot facility is expected to be completed by early 2021. Decisions about commercialisation will follow after evaluating the results of the pilot-scale production. Annual production capacity of the mill, which started industrial production of lignin in 2015, is at 50,000 tpa reportedly making Stora Enso the largest kraft lignin producer worldwide.

Lignin in aromatics and adhesives

Stora Enso launched in 2018 its Lineo™ line of lignin-based phenol as alternative to benzene-based phenol. Lignin is a high molecular-weight polymer composed of alkylphenol units. It is regarded as a rich source of phenols. Phenolic resins are commonly used to manufacture construction materials such as plywood, oriented strand board, laminated veneer lumber, paper lamination and insulation materials.

Stora Enso estimated the potential market value for lignin in phenolic resin applications at €1.7 billion with a CAGR of 4%/year. The EC report estimated production of petro-based phenolic resins worldwide at 6 million tpa while phenol production is estimated to be around 8 million tpa with a market value of around $1500/ton. Stora Enso did not disclose the market price of its lignin-based phenol, however, it claimed that it would be competitive with traditional petro-phenol at current prices.

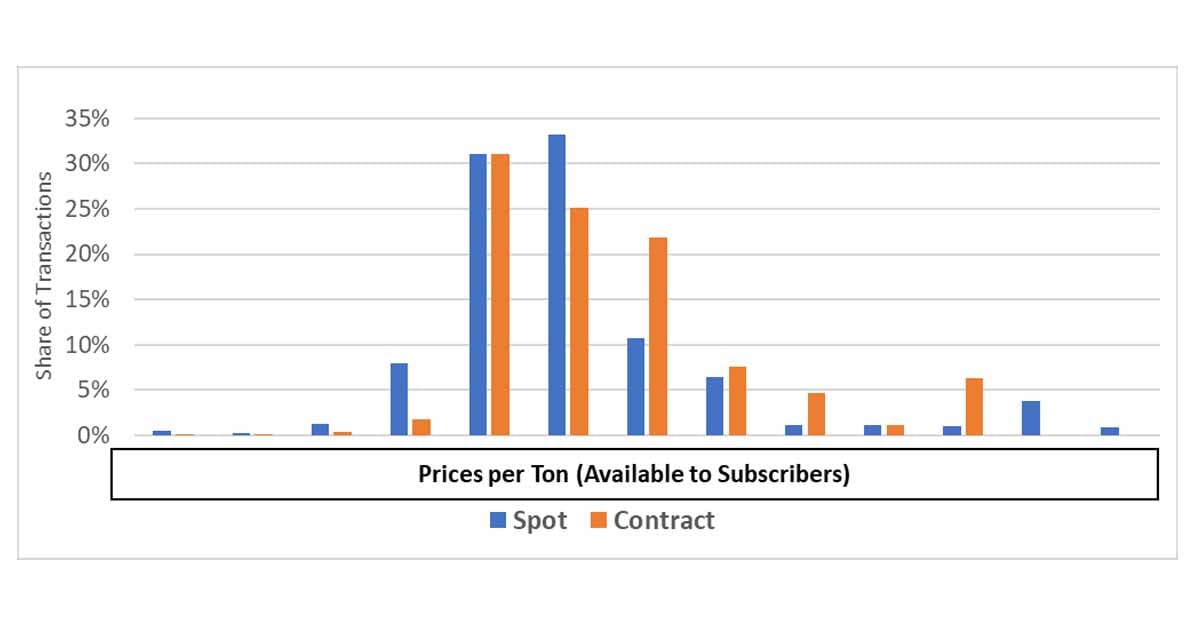

The price of phenol is volatile due to fluctuation of oil price and can cost from $1100-2000/ton. Phenolic resins price could vary between $1100/ton and $2300/ton depending on the purity, quality and application of the final resin. According to the EC report, phenols extracted from lignin that has a yield of 40% would reportedly induce a raw material price of around $800/ton specifically for the lignin-based phenol. Current price of lignin-based phenolic resins is not publicly available. It is estimated that technology improvements could make the bio-based resins cost less than phenolic resins.

Low-purity lignin typically used for energy is believed to be between $100-300/dry ton. Industry observers believe the maximum theoretical yield of pure phenol from lignin is 60% but in practice 40% is more likely. High-purity lignin or high-grade lignin is the starting point for the development of further formulations suited for use as raw chemicals and advanced materials. Their prices can range between $650/ton and $1000/ton, and high-purity lignin-based products can reportedly reach a value of $1300-6500/ton. High-purity lignin applications can reportedly be more easily recycled, re-used and composted, according to the EC report.

Stora Enso has not disclosed its lignin-based phenol yield. UPM BioPiva has been selling its high-purity dried softwood kraft lignin for phenolic resins at €600 in 10-kg bag excluding shipping costs, taxes and custom fees. UPM started in 2018 its 100% lignin-based phenolic resins production on a commercial scale, a technology called WISA BioBond. UPM said it can replace 50% of the phenol used in the bonding of plywood and its goal is to increase the amount close to 100% in the next several years.

UPM Plywood plans to gradually adopt the new bonding technology at all of its production facilities. The bonding technology is based on the UPM BioPiva lignin technology, which was developed and patented by UPM Biochemicals.

Currently all lignin-based BTX aromatics are still in the R&D phase, and experts indicate the commercial scale production could begin within 10-20 years. Lignin-based BTX price is projected at around €1.40/ton compared to petro-based aromatics prices that are between €0.52-0.86/litre, according to the EC report.

Environmental impacts depend on the energy demand for cracking the lignin as well as on the catalysts and solvents needed in the production process. Bio-derived methoxylated alkylphenols are promising alternatives to traditional alkylphenols as their toxicity is significantly lower. Furthermore, methoxylated alkylphenols from lignin can possess unsaturated alkyl chain (i.e. eugenol). The unsaturation is also proposed to benefit the biodegradability of the alkylphenol, as unsaturated compounds often degrade faster in various environments than their saturated counterparts.

A 3-year project funded by the Bio-Based Industries Joint Undertaking (BBI JU) called SmartLi aims to develop and demonstrate technologies and processes to use technical lignin (kraft lignin, lignosulphonate and bleaching effluents) as raw materials to produce biomaterials such as composites and resins. Particular targets are replacing 25-75% of phenol in formaldehyde resins, 50-70% of polyols in polyurethane foams, and BPA in epoxy resins. BBI JU is a €3.7 billion public-private partnership between the EU and the Bio-based Industries Consortium which focuses on turning biological residues and wastes into everyday products through innovative technologies and biorefineries.

Belgium-based Biorizon, its co-initiator VITO and partners, Worley België and Flemish Environmental Holding (VMH) have launched a €4.3 million LignoValue project in 2018 with the aim of producing bio-aromatics from lignin at a pilot plant being built in Flanders with a capacity of around 200 kg/day. The pilot plant is expected to be in production by May 2021. The project recently calls for participation in the form of application testing, feedstock testing and demo plant building, and more than 30 companies have reportedly already signed a letter of intent. The pilot project uses a metal-catalysed lignin depolymerisation technology using a heterogenous catalyst in solvent medium under hydrogen atmosphere.

Lignin’s growing applications

Another project funded by BBI JU is to demonstrate the techno-economic viability of its LigniOx technology based on alkali-oxygen oxidation for the conversion of lignin-rich side streams into versatile dispersants, especially high-performance concrete and mortar plasticisers. The plasticiser reportedly has higher performance compared to lignosulfonates and most synthetic admixtures; is more sustainable as economic alternative to current synthetic super plasticisers; and that the LigniOx technology can reportedly be readily integrated into biorefineries or applied by chemical producers. In addition to cement, LigniOx lignins can disperse several pigments such as carbon black, titanium dioxide, calcium carbonate, kaolin and gypsum. The duration of the project is between May 2017 to April 2021. Collaborators of the project include Metsa Fibre Oy, VTT Technical Research Centre of Finland, the Flemish Institute for Technological Research (VITO), Andritz, St1 Biofuels, CIMV, Biochemtex, Dow Deutschland, Vertech Group and Exergy Ltd.

Wageningen Food & Biobased Research has also been exploring the use of lignin as a natural binder to produce bio-based asphalt. While between 60 tons and 70 tons of lignin has already been processed in asphalt since 2015 in the Netherlands, the supply still lags behind demand as lignin is said to be more expensive than bitumen, which is used to create asphalt. Like bitumen, lignin gives structure and support to asphalt. An advantage of lignin, however, is that lignin-based bio-asphalt can be produced at much lower temperatures. The researchers are focusing on finding cost-efficient lignin sources as follow-up research. The ultimate goal is to develop bitumen-free asphalt that consists entirely of bio-based components.

Dutch technical validation institute InSciTe has been investing a few million euros in a new multi-purpose pilot plant located at the Brightlands Chemelot Campus in Geleen, the Netherlands, which converts lignin into high-quality products. The first customer is InSciTe’s spin-off company Vertoro, which will convert lignin into bio-oil. The pilot plant can also be used by other parties, according to InSciTe. If Vertoro does license their technology process, part of the process will go to InSciTe.

Lignin bio-oil is the fluid product of the chemo-thermal conversion of biomass that contain lignin. It constitutes a complex mixtures of hundreds of organic compounds like acids, ketones, phenols, lignin-derived oligomers and solid particles, etc. Presently, bio-oil cannot be considered cost-competitive compared to its petroleum equivalents for various reasons, such as the lack of economy of scales or feedstock prices. Pyrolysis oil production is estimated to exceed 500,000 tons by 2018 with a potential market value of about $114 million, according to the EC report. In terms of global warming potential, lignin bio-oil fares better than its petroleum counterparts.

BTG Biomass Technology Group, which coordinates the EU Horizon 2020 project called Bio4Products started last year the operation of a thermochemical fractionation pilot plant which aims to commercialise a fast pyrolysis-based biorefinery that will transform lignocellulosic biomass into phenolic resins, furan-based resins, paints, engineered wood and natural fibre-reinforced products. The pilot plant has a throughput capacity of 3 tpd of fast pyrolysis bio-oil, which can then be used with downstream partners interested in using the fractions to develop bio-based products.

BTG has already partnered with Hexion GmbH for the development of new products using pyrolytic lignin. Hexion has been using the lignin stream to partially replace fossil phenol in a variety of its existing resin formulations, with possible applications in the automotive industry, insulation, steel industry/metal casting, household products and abrasives.

Under a grant funding from Innovate UK, Biome Technologies has been developing a process to produce a novel bioplastic building block, 2,5 pyridinecarboxylic acid (PDCA) that can be obtained from lignin. Biome is collaborating with the University of Nottingham to use an organism, Cupriavidus necator, to produce PDCA at pilot-scale. PDCA could reportedly be an alternative to terephthalic acid.

In the USA, Domtar has also been exploring more application opportunities for its BioChoice™ lignin produced at its 30 ktpa lignin separation plant in Plymouth, North Carolina mill. Beyond its internal use as a fuel, Domtar has been selling and developing its BioChoice™ lignin in a variety of applications such as adhesives, agricultural chemicals, coatings, dispersants, fuel additives, natural binders and resins. The company is also developing lignin-based thermoplastics and composite fibres products in several facilities in Canada under publicly-funded Canadian biorefinery initiatives.

US-based cellulosic sugar producer Renmatix launched in 2019 its Celltice™ self-emulsifying ingredient consisting of cellulose and lignin. Celltice™ reportedly delivers a variety of benefits in personal care and cosmetic applications, functioning both as an active and an excipient in formulations. Renmatix uses its Plantrose® Process to gently release cellulose and lignin material from sustainably-grown, non-genetically modified red maple (Acer rubrum) using only heat, pressure and water.

In New Zealand, Scion, a government-owned research institute has developed a water-soluble, 100% Biobased adhesive technology called Ligate which is based on lignin. The bio-adhesive’s composition reportedly also scavenges formaldehyde from the air contributing lo lower formaldehyde emissions than those of natural wood. Scion produced four tonnes of the Ligate adhesive technology in September 2018 for use in plywood panels.

Doris is a senior consultant for Tecnon OrbiChem covering chemicals and materials derived from renewable carbon. She provides expert analysis on a wide range of pertinent subjects including oleochemicals, biopolymers, industrial biotechnology, biofuels and other renewable chemical products. Doris is also the founder and author of the Green Chemicals Blog, established in 2007.