3 min read

Pulpwood Prices in Stressed Florida/Georgia Market Surge to Record Highs

Joe Clark

:

Mar 31, 2022 12:00:00 AM

Joe Clark

:

Mar 31, 2022 12:00:00 AM

In June 2020, we wrote a piece covering the sale of the shuttered Klausner Lumber One facility in Live Oak, FL in which we noted that the region’s intense forest industry activity was likely to result in some fierce competition… and very high prices. At the time, there were three events coalescing in the south Georgia/north Florida wood basket that we believed to be predictive of a coming supply squeeze:

- Timberland damage from Hurricane Michael, which affected over 3.5 million acres; about half of these acres were impacted severely

- Increased fiber demand from greenfield mill construction and existing mill expansions

- A potential sale and restart of the shuttered Klausner facility

The south Georgia/north Florida area has long been a vibrant timber market, and it is home to a diverse group of wood products manufacturing facilities. It’s no surprise that the first two events resulted in unavoidable pressures on fiber supply within the regional wood basket. However, timber prices have skyrocketed to near inconceivable levels since the third event came to pass in 2Q2021.

Austria-based Binderholz Group purchased the Klausner Live Oak mill in 3Q2020, and the facility became operational in March 2021. As production ramped up, the weighted average price for all pine products in the region surged 33% quarter-over-quarter (QoQ) to a new high in 3Q.

A more detailed view illustrates individual pine product performance, which is largely driven by demand for small logs in this particular wood basket. Intense demand for pulpwood in the region has caused many pulpwood consumers to reach up into CNS-sized material when procuring fiber, which has pushed prices to record highs. In 3Q2021, pine pulpwood prices were up 71% QoQ, and CNS prices were up 41%. Year-over-year (YoY) increases were even more extreme; pine pulpwood prices were up 105%, and CNS prices were up 57% YoY.

What’s Driving Record Prices?

Strong, consistent demand driven by evolving customer preferences and changing end-use products has made pine pulpwood and small pine logs a desirable raw material throughout the South. Additionally, there are a few unique dynamics at work in the south Georgia/north Florida region that have intensified competition for fiber and pushed this market to the highest-priced area in the US South.

- 3Q2021 precipitation across this area totaled 22”, which was 43% above the historical average of 16”. Soggy conditions likely impacted harvesting capacity, which pinched supply and increased competition and price.

- Demand for finished lumber was insatiable in 1H2021. Per Forest2Market’s southern yellow pine (SYP) lumber price composite, prices fluctuated between $900/MBF and $1,200/MBF during 1Q and 2Q2021 — significantly higher than the historical floor price of roughly $350/MBF. Chasing these kinds of margins, small log lumber mills in the region could afford to pay more and compete with other consumers. While lumber prices have been flat for the last two months, there are signs that volatility is creeping back into the market.

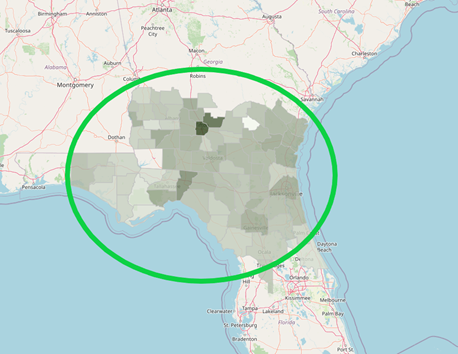

- The pulpwood growth-to-removal rate (GRR) in this region has been stressed for several years due to strong demand for small logs. GRR for loblolly and shortleaf pine pulpwood now hovers around 1.03 in most of the area, though some counties are well below 1.0 — the number where growth and removals are in balance. (Pine pulpwood GRR throughout the entire US South is roughly 1.5.)

- When the Live Oak mill came online at a higher rate of capacity (after running at lower capacity over the last few years), the new demand drove stumpage prices higher in its immediate procurement zone, which has caused a chain reaction that has impacted pulpwood- and small log- consuming mills in the region.

How Will This Procurement Area Change Going Forward?

Some of these influences will be temporary, i.e., precipitation patterns and lumber prices will always fluctuate. However, low pine pulpwood GRR in combination with additional demand in the area suggest there are some longer-term, structural changes to watch very carefully. Questions that regional manufacturers must address include:

- What is the total volume of timber resources in the region?

- What is the makeup of those timber resources by type and age class?

- What is the growth rate and removal rate?

- What is the current and projected competitive demand?

- What is the current and future sustainability of supply?

- What is the current and historical demand and price for the target materials?

- What is the forecast price for the target materials based on projected availability and demand by all consumers?

- How can I best prepare for a series of potential scenarios based on these developments?

For forward-looking consumers of wood fiber in the south Georgia/north Florida wood basket, Forest2Market can answer these questions.