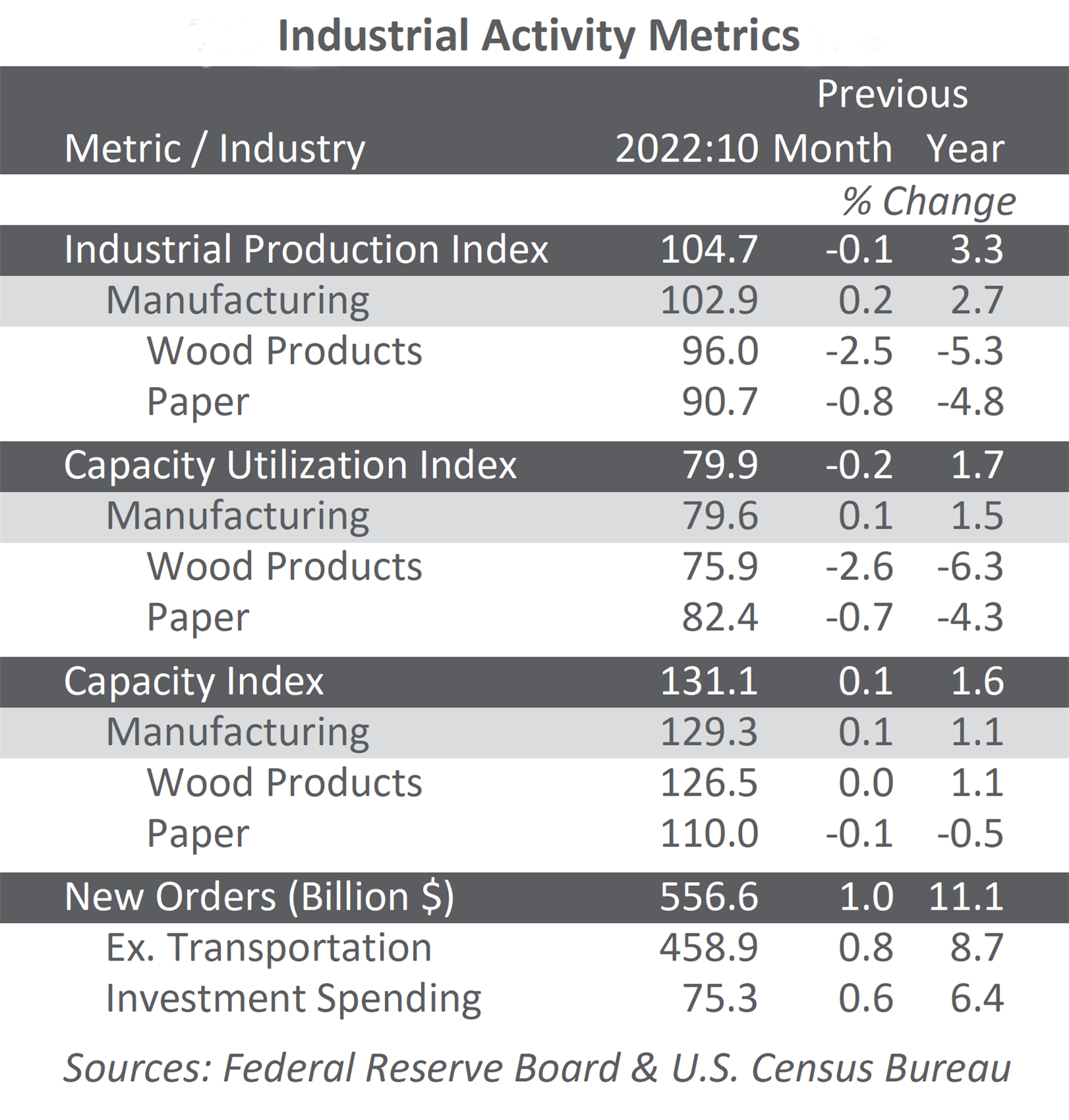

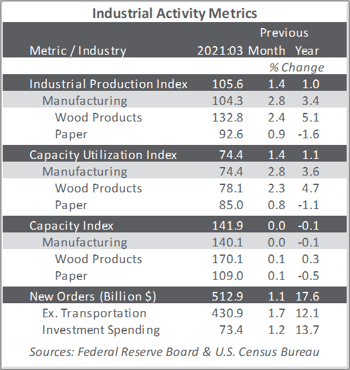

US forest industry performance in March and April was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) increased 1.4 percent in March (+1.0 percent YoY, but was still 3.4 percent below its pre-pandemic level of February 2020). The gain in March followed February’s drop of 2.6 percent, which largely resulted from widespread outages related to severe winter weather in the south central United States. For 1Q2021 as a whole, total IP rose 2.5 percent at an annual rate.

In light of stratospheric wood products prices, we are surprised that capacity utilization was “only” 78.1 percent in March; granted that is +2.3 percent MoM and +4.7 percent YoY on a gradually expanding manufacturing base (i.e., capacity), but it seems producers are passing up an opportunity to capitalize on an already stellar performance. If pressed for one or more explanations, potential candidates might include a shortage of truck drivers, high unemployment benefits that reduce the incentive to return to work, and reluctance by companies to raise wages and/or add employees they might have to let go if/when demand cools.

New factory orders rose by 1.1 percent (+17.6 percent YoY). Reflecting the adverse impact of microchip shortages on airplane and vehicle output, new orders excluding transportation jumped 1.7 percent. Business investment spending saw a respectable gain as well (+1.2 percent MoM; +13.7 percent YoY).

The Institute for Supply Management’s (ISM) monthly sentiment survey reflected a decrease in the proportion of US manufacturers reporting expansion in April. Despite the headline retreat, “manufacturing performed well for the 11th straight month, with demand, consumption and inputs registering strong growth compared to March,” observed ISM’s Timothy Fiore. “Labor-market difficulties at [respondent] companies and their suppliers persist. End-user lead times (for refilling customers’ inventories) are extending. This is due to very high demand and output restrictions, as supply chains continue to respond to strong demand amid COVID-19 impacts.”

The services PMI edged lower from March’s all-time high of service-sector respondents reporting expansion (-1.0PP, to 62.7 percent). The most noteworthy changes in the sub-indexes included new orders (-4.0PP), slow deliveries (+5.1PP), and order backlogs (+5.5PP).

Of the industries we track, only Ag & Forestry contracted. Respondents included the following:

- Construction: “Consistent with the past year, labor continues to be the biggest issue we are facing. Finding and retaining labor—skilled and unskilled—is highly challenging and frustrating. As the challenges continue, we are not accepting all the work that we could if we had the labor.”

- Real Estate: “Business levels are quite strong as we head into the spring construction season.”

Findings of IHS Markit’s April survey results were generally consistent with their ISM counterparts. “U.S. manufacturers reported the biggest boom in at least 14 years during April,” wrote Markit’s Chris Williamson. “Demand surged at a pace not seen for 11 years amid growing recovery hopes and fresh stimulus measures.

“Supply chain delays worsened, however, running at the highest yet recorded by the survey, choking production at many companies. Worst affected were consumer-facing firms, where a lack of inputs has caused production to fall below order book growth to a record extent in over the past two months as household spending leapt higher,” Williamson concluded.

The consumer price index (CPI) increased 0.6 percent in March (+2.6 percent YoY), the largest MoM rise since August 2012. Gasoline’s 9.1 percent jump accounted for nearly half of the increase in the all-items index. The natural gas index also rose, contributing to a 5.0 percent increase in the energy index over the month.

Meanwhile, the producer price index (PPI) increased 1.0 percent (+4.2 percent YoY). Almost 60 percent of the increase in the index for final demand can be traced to a 1.7 percent advance in prices for final-demand goods, especially gasoline (+8.8 percent). The index for final-demand services moved up 0.7 percent, led by margins for machinery and vehicle wholesaling (+6.7 percent).

In the forest products sector, price index performance included:

- Pulp, Paper & Allied Products: + 1.1 percent (+6.0 percent YoY)

- Lumber & Wood Products: +4.4 percent (+28.8 percent YoY)

- Softwood Lumber: +6.8 percent (+83.4 percent YoY)

- Wood Fiber: +1.5 percent (+9.0 percent YoY)