As we’ve discussed before, ESG (Environmental, Social and Governance) issues are becoming increasingly important amongst business owners and consumers alike. As a result, legislative bodies, industries and individual companies continue to evolve and develop meaningful emissions regulations and carbon goals, and we’re seeing a rapid increase in demand for innovative alternatives that can be utilized to help achieve these goals.

For manufacturers, this is of particular importance based on their significant energy needs – both fossil and renewable sources.

Although negatively impacted by the pandemic, a renewed increase in demand for bio-distillates (bio-diesel) and ethanol for fuel can be expected in the coming years. While some countries have created targets for reducing carbon intensity (GHG emissions per unit of energy), other countries have created targets focused on increasing the volume of biofuels and blend mandates.

With climate change policies becoming more ambitious over time, in combination with a resurging interest in biofuels from non-food biomass, will the paper industry be a good candidate to supply equipment and/or technologies to future facilities, or even produce additional bio-products?

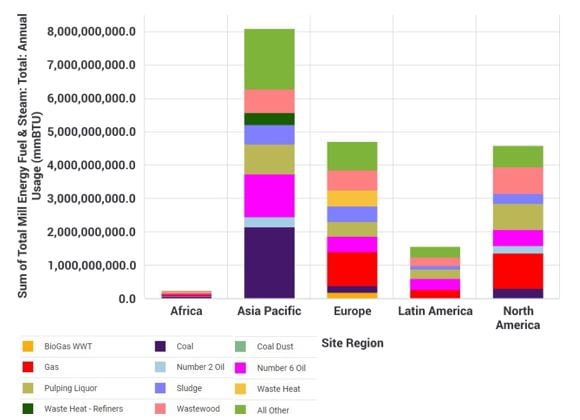

Currently, the pulp and paper industry is commonly known for generating energy out of renewable sources, such as pulping liquor and wastewood. As illustrated in the image below, 43% of the energy inputs to pulp and paper mills worldwide come from renewable sources. However, the percentage varies by region. For instance, 90% of the worldwide coal consumption for pulp and paper mills occurs in the Asia Pacific region, while in Latin America more than 70% of the fuel used in pulp and paper mills is from renewable sources.

Annual Usage of Fuels

Source: FisherSolve Next

Biofuels are a renewable energy source derived from microbial, plant, or animal materials. In addition to the biofuels described before, some of the most common biofuels include corn and sugar cane ethanol, biodiesel and biogas from organic byproducts.

Significant research was done on biofuels from wood sources between 2005-2015, mainly due to the Renewable Fuel Standard (RFS) initiatives. But since then, research largely decreased as fossil energy sources became more affordable from 2016-2020. In the meantime, additional feedstock processes for biofuels production were also investigated – such as the utilization of algae. However, recent research into biofuels involving forest raw materials and the pulp and paper industry has started to pick back up as more companies seek solutions for their ESG goals. Some recent initiatives include:

- Defense Logistics Agency Energy (DLA Energy) and the University of Maine teaming up to transform forest residues, sawmill residues, municipal solid waste and construction wood wastes into hydrocarbon fuel oil in an attempt to meet the increasing need for sustainable and efficient fuel resources.

- ExxonMobil, one of the largest publicly traded international energy companies, expanding its interests in biofuels by aiming to reduce greenhouse gas emissions in the transportation sector. The company has acquired a 49.9% stake in Biojet AS, a Norwegian biofuels company that plans to convert forestry and wood-based construction waste into lower-emissions biofuels and biofuel components.

- The Federal Aviation Administration (FAA) awarding a grant to Washington State University, who has been collaborating with USDA to examine the potential to retrofit existing pulp and paper mills, sugarcane mills, dry corn ethanol plants, and petroleum refineries to enable jet fuel production from forest harvest residues, waste materials, and various crops.

This recent return to biofuels research, in combination with ongoing ESG trends, suggests new opportunities for today’s pulp and paper producers.

- Improved utilization of biomaterials that are considered waste today

- Capitalization on forest harvest synergies or purchasing partnerships

- Utilization of existing mill equipment to add new capacity of biofuels and biomaterials

- Process innovation to realize a higher/better use for cellulose byproducts currently underutilized

The P&P industry has a chance to lead and help define some of the solutions to our global carbon challenges. This will be an important transition for energy-intensive manufacturers who must be proactive rather than reactive, and who can no longer remain as just another contributor or bystander to the problem.

Fisher International’s business intelligence system, FisherSolve Next, provides detailed information on every paper and pulp mill in the world. Because this is the only database with integration and true data transparency for every mill, line and machine, subscribers can drill down to the specifics that differentiate each mill – including ecological footprint, biofuels integrations and much more - and roll the details up for strategic analysis and improved decision making.