Ever since the COVID-19 pandemic impacted the world at the beginning of 2020, mask mandates, lockdowns, and remote schooling and working from home have become the new normal. Globally, as of August 30, 2021, there have been 216,229,741 total confirmed cases, 4,298,451 deaths and 5,019,907,027 vaccine doses administered.

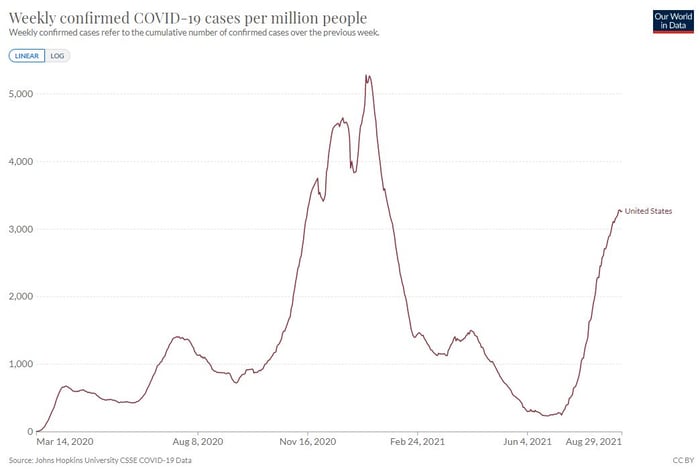

The image below illustrates the weekly confirmed COVID-19 cases per million people in the United States, and the number of confirmed cases continuously increased from the beginning of March 2020 until the beginning of January 2021. It was during this time that the Pulp and Paper industry saw a number of unexpected changes in demand that forced many companies to adapt to rapidly shifting market trends, such as the massive spike in demand in the Tissue and Towel (T&T) and Corrugated segments, the accelerated decline of the Printing and Writing segment, and skyrocketing market pulp prices.

However, around mid-January 2021, the number of confirmed weekly COVID cases began to decrease as vaccines were deployed at scale. As of August 29, 2021, vaccines have been distributed to 173,520,211 eligible people in the United States — representing 52.3% of the population that is fully vaccinated. As the number of distributed vaccines increased and the number of Covid cases decreased during 1Q2021, state economies began to open back up as cities lifted mask mandates, people returned to in-person school and work, and businesses were able to operate at full capacity — instilling a sense of hope in many that we could soon return to life as we knew it before the pandemic.

Companies developed plans to move employees back to office environments, small businesses prepped for reopenings, and schools developed back-to-school plans. However, by early July, the highly transmissible delta variant began to run rampant across Europe and North America— causing a spike in cases, as we can see in the image above.

The new data has been cause for alarm, as many municipalities have reinstated mask mandates in response, and several companies have extended or sent employees back to remote working conditions. As the number of confirmed cases continues to rise, many are left wondering if we will end up exactly where we were last year, in the midst of lockdowns and at-home schooling and work, and if so, what will that mean for the industry?

While we can’t accurately predict the future, we can look at what we do know.

As a result of the pandemic, remote work has taken over the global corporate sector and based on recent statistics, it doesn’t look like will be reversing any time soon, especially with new variants now in the mix. In a recent survey by Accenture, 83% of 9,000 workers said they preferred a hybrid work model, and Global Workplace Analytics predicts that 25-30% of the workforce will be working from home multiple days a week by the end of 2021 for reasons such as:

- Increased demand for work-from-home from employees

- Reduced fear about work-from-home among managers and executives

- Increased pressure for work-from-home for disaster preparedness

- Increased awareness of cost-saving opportunities in work-from-home

- Increased awareness of the potential impact of work-from-home on sustainability

More companies may be returning to a hybrid model or a full-time work-from-home model as new variants continue to develop and impact populations around the world. Should any of these variants prompt heavier restrictions, a number of industries and segments might experience significant supply and demand changes. Important questions for pulp & paper participants to consider include:

- Will at-home tissue see another spike in demand, and are supply chains ready to handle any significant changes in demand?

- Will away-from-home tissue continue to decline?

- Will printing and writing papers bounce back if schools stay open?

- Will the prospect of more lockdowns increase home deliveries, i.e., more shipping boxes?

- Will increased fear of in-person dining drive another surge in frozen and packaged foods?

- Will carbon- and emissions-related legislation be put on hold until the pandemic is largely behind us?

While I do not foresee another lockdown like we experienced last year, if we do end up in a similar situation however, the Tissue and Towel sector will be better equipped to handle it. Hoarding will most likely occur again, but there will not be a large increase in the production of T&T products. The Away-from-Home sector will suffer again but not to the same extent. In addition, demand for some Printing and Writing products will bounce back sooner because of more flexibility in schools and offices, but it will not be what it was prior to 2020. There will be steady use of some copy paper, but we will no longer see high-quality presentation coated papers with 20 copies for participants in a single meeting.

For a deeper analysis into what the pulp and paper industry might expect as we enter a new period of uncertainty, talk with an expert at Fisher International who can help you formulate an actionable plan with a high degree of accuracy that will provide the reassurance and confidence needed to optimize your decision-making.