China was recently hit by one of the worst power shortages in a decade. So far, around 20 provinces/municipalities are undergoing local power restrictions of varying degrees. Currently, the temporary power shutdowns that have been occurring in most provinces since September are only targeting industrial users. For example, Guangdong (one of the biggest papermaking provinces) implemented a reduced supply schedule on September 16 to its industrial users, according to Guangdong Power Grid.

The root-cause of this energy crisis is complex. Key factors including the coal supply gap, which was caused by the closure of mines and reduced imports from Australia, and skyrocketing coal prices, which can’t be passed on to electricity customers since China has rigid electricity price guidelines for its state-owned grids. The “red light” of energy consumption lit up in many provinces as the targets of reducing energy intensity (total energy consumption per unit of GDP) and total energy consumption were not met in half year 1H2021.

This significant power cut has negatively impacted production for many industries, especially those with high energy consumption rates and low energy efficiency such as producers of steel, cement, electrolytic aluminum, chemicals, etc., which are the most strictly monitored industries during this outage. The paper industry only consumed around 1% of China’s total electricity during 1H2021 — so it is not considered a target industry being restricted during the power cut. However, since the rollout of massive outages in different provinces, all manufacturers in specific areas have been affected, including paper mills and their downstream printing houses/converters/corrugators, etc. depending on location.

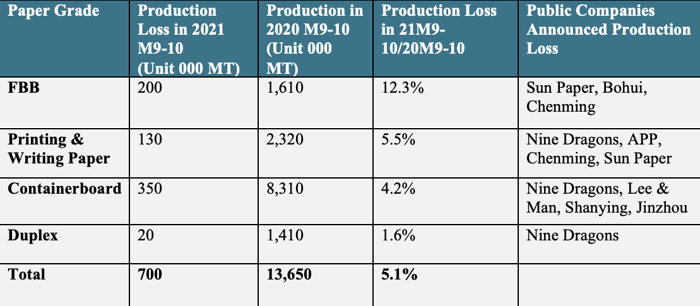

So far, the estimated production loss announced by the leading public producers is around 700,000 MT from September to October 2021 (Table 1). Compared with production during the same period in 2020, 2021 represents a loss of 5.1% of production due to the power crisis so far. However, based on Fisher’s research, there are many other non-public producers also being impacted, and it is reasonable to estimate that the entire Chinese paper industry will experience production losses of roughly 5-10% of as a result of the energy crisis in 2021.

Table 1. Estimated production loss announced by leading public producers

Not only is the paper-making capacity affected during this time, but the downstream converting industry has also been hit, especially in southern and eastern China which represents most converting capacities in China. It is difficult to estimate how much production loss there would be since the operating rate of downstream converting is always quite low, with lots of excess capacity that could later help make up production if the electrical supply returns to normal.

That said, the outages have slowed the paper supply chain and impacted downstream industries; as a result, lost production in the converting sector has already resulted in price increases of 3-5%, and 50 to 100 RMB/MT in the containerboard sector.

The energy crisis might last into late 4Q2021 if the situation continues. It is reasonable to think that in the future, Beijing's dual-control system on energy consumption would carry more weight than it does today in the context of China's pledge to reduce carbon emissions. Smaller paper mills with high energy consumption and energy intensity might be phased out quicker than expected—for example, during outages, small mills would face more serious cash-flow problems as they are not exposed to the same financing channels as big public companies.

This raises an important question for both the near- and long-term industry in China: If the energy crisis intensifies as the government continues to pursue low-carbon economic policies, will this dynamic accelerate consolidation within the industry? If so, who is most advantaged—and who is most disadvantaged—in the current market? Talk to a Fisher expert to learn more.