Japan is the world’s second-largest importer of wood chips behind China, accounting for about one-third of the world’s total imports. While China is a relative newcomer in the overseas wood chip market, pulpmills in Japan have a long history of relying on imported wood fiber, with their first shipments arriving in Japan in the mid-1960s.

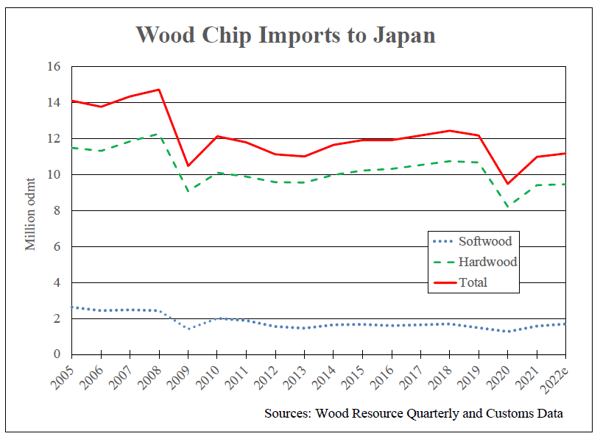

The all-time high was almost 15 million odmt back in 2008, followed by a long period when total volumes averaged around 12 million odmt annually. The most significant y-o-y decline in 10 years occurred in 2020 when wood chip import demand in Japan fell to its lowest level since the first year of the COVID-19 epidemic (see chart). However, importation grew in 2021 and the first six months of 2022, with the total volume for 2022 on pace to reach the highest level in three years, reports the Wood Resource Quarterly.

About 85% of wood chip shipments to Japan have been hardwood species, with the remainder being softwood chips, predominantly from the US and Australia. Deliveries of hardwood chips have increased from 8.2 million odmt in 2020 to an estimated 9.5 million odmt in 2021 and 2022. However, this volume is still lower than the annual average of just over ten million odmt during 2010-2019.

The biggest suppliers during the first six months of 2022 have been Vietnam (45% of total imports), Chile (13%), South Africa (12%), and Australia (11%). During most of the past 30 years, a clear majority of hardwood chips imported to Japan have originated from Australia, Chile, and South Africa, all countries with vast areas of fast-growing plantations of higher-yield Eucalyptus wood fiber (HYF). Their share of total imports peaked about 15 years ago at 75%, and shipments from countries with lower-yield wood fiber (LYF) have increased their share, reports the Wood Resource Quarterly.

The primary supplier of LYF to Japan is Vietnam, which in 2010 exported less than one million odmt and in 2022 is expected to supply over four million odmt or about 45% of total imports to Japan. Lower quality wood chips of Acacia and low-density Eucalyptus from Southeast Asia (Vietnam, Thailand, Malaysia, and Indonesia) have increased their share to almost two-thirds of the total fiber supply imported by Japanese pulpmills in 2022. The switch to LYF over the past decade has been driven by intense competition, a rise in the cost of higher quality hardwood chips, and the expanded availability of wood fiber from Acacia plantations established over the past 10-15 years.

Are you interested in worldwide wood products market information? The Wood Resource Quarterly (WRQ) is a 70-page report established in 1988 with subscribers in over 30 countries. The publication tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the latest international forest product market trends, please go to www.WoodPrices.com.