So far, 2022 has proven to be just as unpredictable and hectic as the previous two years. Between the first “major” European land war in 70 years currently ongoing in Ukraine and a worsening global supply chain crisis, it’s been hard to keep up with what’s going on across the pulp & paper industry. To provide a high-level snapshot of some major industry moves, we’ve rounded up some of the leading headlines below.

UPM Strikes End

On January 1, 2022, the Paperworkers’ Union’s strike begun at most of UPM’s Finnish mills. Nearly 2,000 members of the union went on strike, which lasted almost four months until an agreement was reached on April 22. As the strike continued to be extended over the last couple of months, dozens of UPM workers resigned in various parts of Finland, which may make it difficult to start up all of UPM’s paper machines. Since UPM is a global provider of label materials, these strikes exacerbated the paper shortages that were already stressed from last year’s growing demand and lack of resources – further impacting the recovery of the supply chain issues.

UPM’s operating income for 1Q2022 tumbled 35% to €183 million and its net income was down 40% at €133 million. It’s estimated that these strikes impacted 1Q2022 results by around €180-220 million, considering the lost sales, lower fixed costs and various dynamic effects. Additionally, according to ImportYeti, sales of UPM products plummeted from 306 sea shipments in October 2021 to barely 53 shipments in January 2022.

However, now that an agreement has been reached, employees will return to work. The contract period of the new agreements is four years and includes pay increases that are in line with the current industry norm as well as the substitution of periodical pay with hourly pay. All businesses also agreed on added flexibility to shift arrangements and the use of working time.

“In the negotiations, many aspects of the contracts were viewed from a totally new standpoint. The process was long but, in the end, we were able to agree on terms of employment that take the needs and special features of our businesses into account. New terms enhance the productivity and competitiveness of the businesses and mills as well as ensure good terms for employees too,” stated Jyrki Hollmen, Vice President, Labor Markets at UPM.

This resolution is expected to increase productivity at UPM’s mills and hopefully relieve some of the tension that was placed on the supply chain.

Russia/Ukraine War

Recently, we discussed the impacts Russia’s invasion of Ukraine immediately had on the Pulp and Paper industry. Since then, more major players have decided to either divest operations in Russia or halt all deliveries to Russia. Some examples include:

- Duni AB’s decision to stop all deliveries to Russia. Along with a decision to stop deliveries, the company has also worked intensively during the first quarter of 2022 to close its business in the country. The divestment entails a restricting cost of approximately SEK 9 million, said the company. The closure will be implemented during 2Q2022.

- Essity initiates an exit from the Russian market. Essity has reported that conditions to pursue business in Russia have worsened, and as a result its assets in Russia were impaired by SEK 1.4 billion.

- The EU expands sanctions list against Russia. The EU has now included trade of paper, board and pulp in its sanctions list. According to the official announcement, uncoated kraft paper and paperboard, in rolls or sheets, are forbidden to import from Russia. It is also applicable to wood pulp obtained by a combination of mechanical and chemical pulping processes (CTMP) – however, Russian newsprint is not affected. At the same time, EU producers are not allowed to export the paper and board grades listed under Annex XXIII to Russia, which includes exports of kraft paper and kraft board, testliner, filter paper, specialty paper, printing and writing paper, cartonboard and folding cartons, and recovered paper.

- Huhtamaki decides to initiate the process to divest its operations in Russia. This follows an earlier decision to stop all investments in Russia at the outbreak of the invasion of Ukraine. Huhtamaki considers that the current situation and the long-term outlook in Russia will prevent realization of its growth strategy. It will explore the market for potential buyers and will maintain its operations during the transitional period, said the company in a statement.

- Mondi’s board has decided to divest the group’s Russian assets. “The divestment process for these significant assets is operationally and structurally complex and is being undertaken in an evolving political and regulatory environment. Accordingly, there can be no certainty when a transaction will be completed or as to the structure of any possible transaction," said the company in its trading update. As of 31 December 2021, the net asset value of the Russian operations was €687 million. The Russian businesses have, to date, managed supply chain constraints, however, the situation remains fluid, with interruptions to pulp and paper production possible going forward.

Another Acquisition from MM, Another Step in the Premium Packaging Market

The Mayr-Melnhof Group (MM) has acquired 100% of the shares in Eson Pac, a Swedish supplier of pharmaceutical packaging based in Veddige, Sweden. Eson Pac develops, produces and distributes high-quality secondary packaging solutions for the pharmaceutical industry and currently operates three production sites in Sweden along with one in Demark. With around 300 employees and total sales of €48 million, Eson Pac specializes in folding cartons, leaflets and labels.

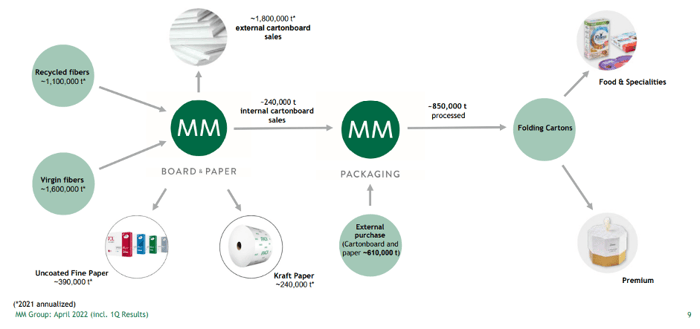

Last year, MM acquired the Kwidzyn (Poland) mill from International Paper and Kotkamills of Finland. The acquisition was part of MM’s strategy to expand its portfolio of high-quality, virgin fiber-based carton board with “innovative, sustainable and cost-efficient grades.” Following the acquisition, MM’s carton division was renamed MM Board & Paper, one of MM’s two divisions (Packaging being the other). The acquisition of Eson Pac is being managed at MM Packaging.

“With this acquisition we strengthen our footprint within the Premium business of the Packaging division. The transaction ideally complements our current customer base and offers attractive new opportunities. In combination with our existing operations we can offer more innovative and sustainable solutions for our customers. We have great confidence that together with the highly qualified team of Eson Pac we will shape the common growth path,” commented MM CEO, Peter Oswald.

MM Group Business Structure

MM Packaging focuses on differentiation through industrial production within the largely commercially structured European folding carton industry. MM Packaging's mission statement is to create the "perfect factory" – all with the aim of maintaining sustainable market leadership through cost leadership.

MM Packaging relies on both organic growth and acquisitions to continuously expand the leading position in young and mature markets.