In February 2021, Malaysia released guidelines on imports of recovered fiber into the country, but the regulations on inspection and issuance of approval certificates for importers had not yet been implemented. That will change in September 2021, when Malaysian authorities are expected to introduce regulations enforcing a 100% inspection of recovered paper imports.

Further, imports of all permitted grades must meet the EN643 standard before being received into Malaysia, and mills that are importing these materials must receive approval from Malaysia’s Ministry of International Trade and Industry (MITI) and not exceed their annual capacity volume. However, certain grades such as unsorted waste and scrap (mixed paper) will not be permitted for import into Malaysia regardless of the circumstance.

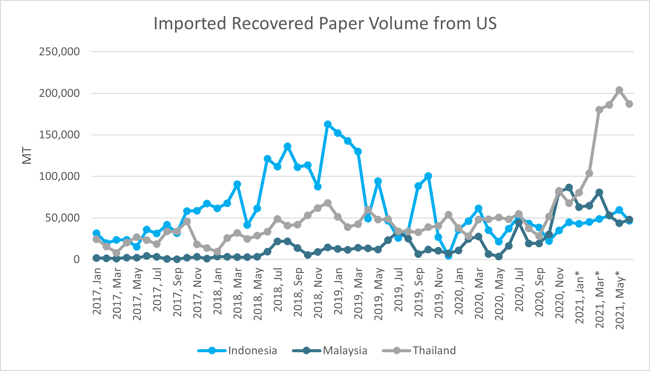

Along with Malaysia, Indonesia has also implemented strict policies governing imports of recycled fiber. Recovered fiber will be allowed a maximum contamination rate of 2% when shipped into Indonesia, which is currently the ninth-largest market for US exports of this material. Since China’s scrap import restrictions took effect in 2018, US exporters have dramatically increased shipments into Indonesia compared to the prior year.

Source: FisherSolve™ Next

Source: FisherSolve™ Next

As a result, Indonesia announced stricter import inspections, developing and finalizing these rules in June 2020. The Institute of Scrap Recycling Industries (ISRI) received confirmation of this new change in policy and stated that it will take effect in September 2021. From January-May of this year, Indonesia imported 3.6% of all US recovered fiber exports.

In addition, a 2% contamination limit on waste paper imports has now been agreed upon between the Thai government and Siam Kraft Industry after the company had to return waste paper bales that contained plastic contamination to an unnamed country of origin. The new agreement states that Siam will now sort to an international standard that states no more than 2% of the material can be contaminated. Moving forward, once the company inspects imported products and ensures the quality of the material does not exceed contamination levels, it can be imported as a raw material used in the paper/cardboard production process. However, if imports exceed that standard, Siam will cease doing business with that trading partner.

Other Asian countries have also established recycled fiber facilities to manufacture fiber out of recycled papers that can be exported to China and used in the papermaking processes. This trend raises an important question: If other Asian countries are going to begin processing mixed paper exports from around the world, which could potentially add significant costs (inspections, duties/fees, freight, etc.), how might this impact the production and cost of recycled fiber going forward?

Based on these emerging trends in the Asian pulp and paper industry, Fisher believes there are some important developments and potential impacts to follow closely:

- Finished product quality will increase.

- Recycled fiber prices will increase, which will drive manufacturing costs higher.

- Producers may need to compete for quotas, and governments may issue further criteria on who is eligible for quotas, i.e., company size, environmental certification, whether it is a local or international company, etc. This means that Chinese producers need to build a relationship with their local government to get sufficient quotas, which will hinder further investment.

- Small players may be forced out of the market, which will drive further M&A activity.

ASEA’s pulp and paper industry is in the process of transitioning to a more environmentally friendly and technologically advanced approach. To stay ahead of these coming changes and the likely reactions to numerous policies being implemented, talk with an expert at Fisher International today.