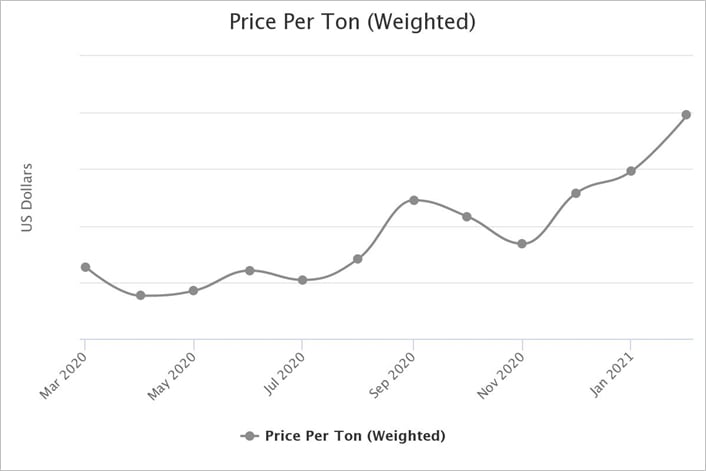

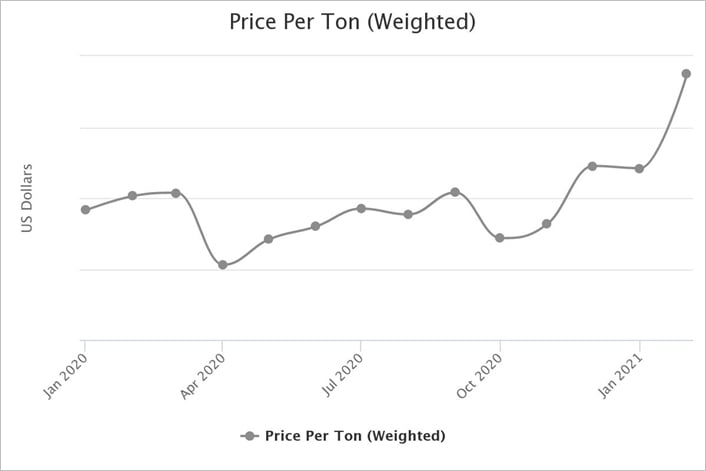

After predictably losing ground during the worst of the COVID-19 pandemic in 2Q2020, the southern timber market bounced back in 3Q and 4Q led by strong demand for pine products across the board. However, the torrential precipitation that battered much of the South in late 4Q2020 and now into 1Q2021 has resulted in some tremendous spikes in regional wood demand… and prices.

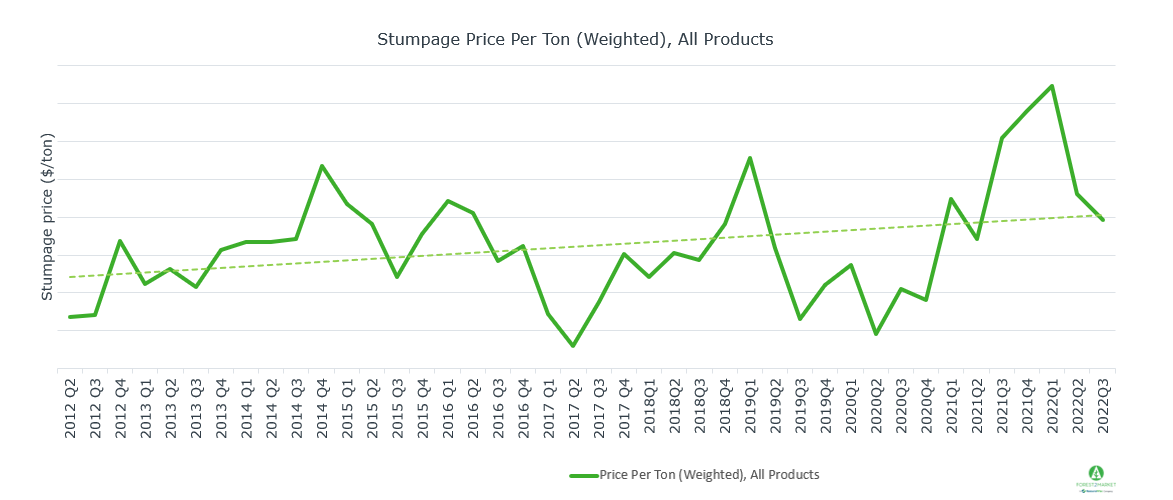

Thus far into 1Q2021, the weighted average price per ton of all southern timber products has increased +15 percent compared to FY2020. (However, prices are still down roughly -3 percent when compared to the most recent “peak” in regional prices, which occurred during the 4Q2018/1Q2019 time period.) Because the situation is changing so quickly in 1Q2021, I have chosen to focus on what’s currently going on in southern stumpage markets.

East South

The weighted average stumpage price for all products has increased +5% in the East South during 1Q2021. The most notable price swings have been in localized markets, particularly in northern Florida/southern Georgia and the NC/VA region.

- Northern Florida/southern Georgia: +17% pine pulpwood; +7% pine CNS

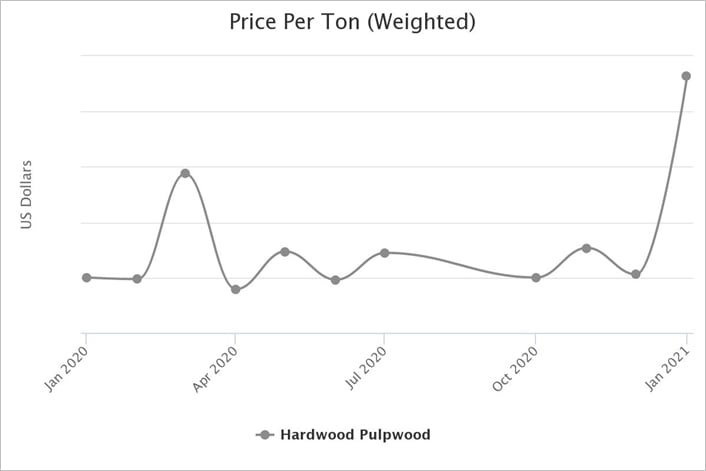

- NC/VA: +88% hardwood pulpwood; +54% pine pulpwood

I believe the increases in FL/GA vs. those in NC/VA are being driven by separate market dynamics. The northern markets are largely inflated due to extreme rainfall (as much as +80 inches in localized markets), while precipitation in SE Georgia and NE Florida has been below average. The increases further south are likely being driven by mill-to-mill competition with sawmills putting increasing pressure on pulp mills to stay competitive. This particular region has also dealt with significant hurricane damage over the last few years, which has impacted timber supply and availability.

Mid-South

The weighted average stumpage price for all products has increased +25% in the Mid-South during 1Q2021. The price jump has largely been driven by developments in the eastern portion of this region:

- Southwestern Georgia/northwestern Florida: +44% all pine products

Heavy precipitation has been a pretty big factor across the Mid-South, but it has not been as extreme as in the NC/VA region. I believe a combination of winter weather/extreme weather in localized pockets and increased mill competition has been driving prices upward.

West South

The weighted average stumpage price for all products has increased +14% in the West South during 1Q2021. The largest price increase has occurred in the southern Arkansas/northern Louisiana market:

- Southern Arkansas: +35% all pine products

- Northern Louisiana +15% all pine products

The increases in certain areas of the West South are indicative of normal seasonal activity largely driven by winter weather. However, in some conversations I have had with landowners, current markets are challenging in the region – particularly in East Texas, where the ground is so saturated that timber harvesting has become extremely difficult.

Outlook

To say that the last year has been “uncertain” would be an understatement. Despite a record stock market, a booming housing market and a transfer of power in Washington that could have near- and long-term impacts, the uncertainty is still pervasive.

Southern stumpage markets were largely soft in 2020, and the ongoing pandemic situation has not helped matters. The southern timber market has been oversupplied for a decade, which is reflected in price reactions during most of 2020. However, the abnormally high amounts of rainfall we have seen over the last few months in the South have caused stumpage prices to surge in some pockets and based on the continued wet weather predictions, these prices will not reverse anytime soon.

Forest2Market’s 1Q data is incomplete at this point but based on the extreme wet weather and the sharp uptick we are witnessing, more price volatility will be ahead as we move further into the new year. If you are not a subscriber to our Stumpage 360 database, now is the time to stay ahead of your local market with the power of transactional data.