As I noted in the first installment of this analytical series, the forest products industry has been making headlines since the COVID-19 pandemic struck in 1Q2020. The pulp & paper sector was the talk of the town during the widespread run on toilet paper that took place from March through June, and the lumber sector has been front-page news in recent weeks as prices for finished lumber set new records by huge margins.

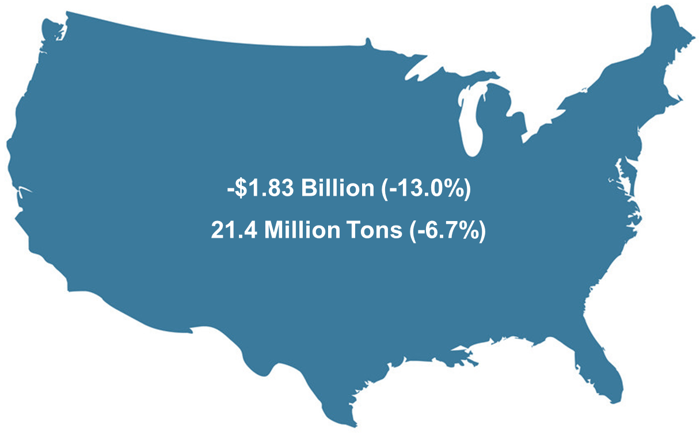

It has taken a few months’ worth of data to see exactly how the pandemic has affected regional wood supply chains and manufacturing. In analyzing some of the data for the American Loggers Council (ALC), Forest2Market found that US raw wood material consumption between January-July 2020 was 6.7% less than the same period in 2019 – dropping by 21.4 million tons of material. This resulted in a 13% reduction ($1.83 billion) in value of the delivered wood.

COVID-19 Impacts to Delivered Wood Raw Material

In the first installment, I analyzed wood raw material consumption (harvests and deliveries) in the US South. Using Forest2Market’s proprietary data, this installment will focus on the same metrics in the Northeast and Lake States regions over the last two quarters, which should give us a clear view into the drivers of the regional wood supply chains during the peak of the pandemic.

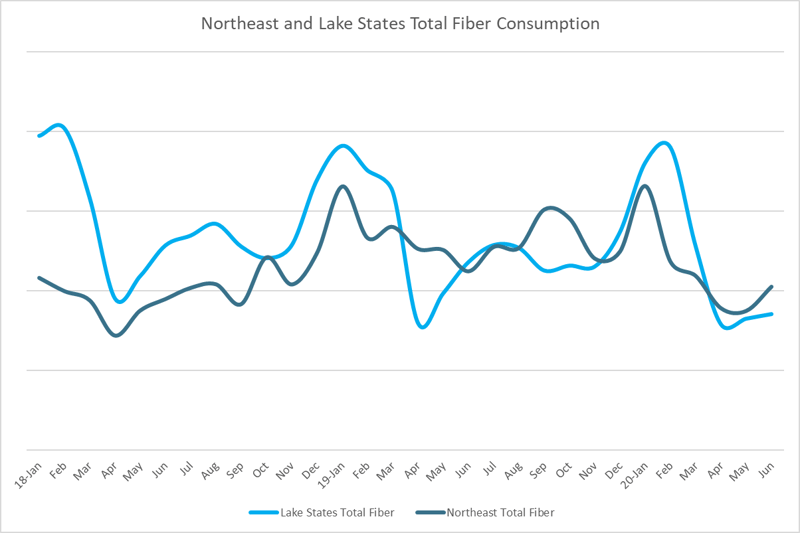

The analysis is more complex in the Northeast and Lake States, however, due to seasonal variability in deliveries. Therefore, identifying any trend that can be attributed directly to COVID is more difficult. Deliveries typically peak from January through March and, depending on when the cold weather hits, can sometimes include December of the prior year. This is the time when harvesting operations generally run at capacity because the ground is frozen, and equipment operators and log transporters are able to efficiently work tracts of land. As a result, regional mills also fill their log inventories during 1Q because spring is traditionally the low point for wood deliveries because the rainy, tepid climate from March - May results in forest conditions that are difficult to operate in, as well as roads that are thawing and can be damaged.

How has COVID-19 impacted wood consumption in these two regions?

The overall decrease in deliveries looks to have hit mostly in Q2, and the steep decline represents a decrease of about 16 percent when comparing 2Q’18 and 2Q’19 to 2020. Reductions in deliveries in the Northeast represent a 10 percent decrease, and reductions in the Lake States represent a 22 percent decrease.

Northeast

It is more difficult to discern a clear trend in the Northeast data, but the low point for deliveries in April seems to have dropped more drastically when compared to the same period in 2019. It also seems to have begun earlier in 1Q than did the drop in deliveries in the Lake States. However, some of this decrease can no doubt be attributed to the Pixelle mill digester explosion that occurred in April at the Jay, Maine facility; this event virtually eliminated a significant amount of consumption at the mill. Even taking this event into account, the consumption trend in the Northeast trended sharply higher in May and June when compared to the Lake States, where consumption has stagnated.

It is also interesting to note that the Northeast appears to have gained some consumption in 2019 that had been lost in previous years due to mill shutdowns; Chinese investment in Maine mills was a big part of this increase from 2018 to 2019.

Lake States

Based on this variability in the weather, Q2 deliveries typically average 50 percent of winter deliveries in a normal year. So, unlike the data for the US South, the effects of COVID-19 didn’t really impact deliveries in the Northeast or Lake States until May and June.

In fact, when analyzing the data from this time period, the Lake States appeared to be hit harder due to the concentration of printing and writing paper mills in the region. The pandemic seems to have accelerated the decline of this sector of the industry; Verso mills in Wisconsin Rapids, WI and Duluth, MN were both shuttered, and many other mills in the area curtailed production.

Unsurprisingly, some mills have not taken deliveries for several consecutive weeks. While this trend is reflective of the regional seasonality in building inventory, it also suggests that COVID has, indeed, had an impact on wood procurement patterns in the Lake States.

Outlook

While the Pixelle explosion will have a long-term impact on the wood fiber supply chain in the Northeast, I don’t believe there will be any significant COVID-related impacts in the near-term. The pulp and paper industry in the Northeast experienced some major changes from 2005 through 2016, but the supply chain is mature and the forest products industry in the region is stable.

However, the situation in the Lake States is more tenuous. There have been a number of regional mill closures and curtailments in recent months that have already impacted the wood fiber supply chain. It’s too early to tell how this shifting environment will affect supply, demand and price relationships, but my feeling is that the supply chain, while resilient, will need to adapt in a post-COVID environment.