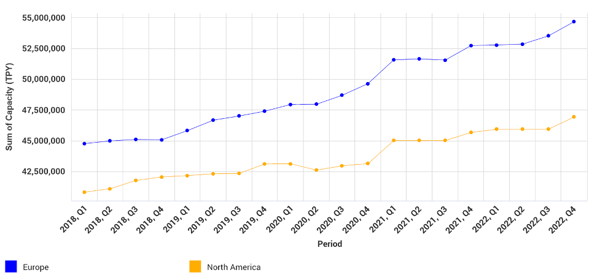

Global containerboard capacity has increased rapidly over the past 2 years. With the increase in at-home deliveries combined with strong anti-plastics sentiment, we don’t expect this trend to slow down any time soon. Containerboard has demonstrated the highest rate of growth for any major paper grade over the past 5 years, and paper producers are making large investments to keep up with the growing demand.

In figure 1, we can see the historical actual capacity and future actual and announced capacity trends for containerboard in North America and Europe—and this accounts for capacity increases that we only know about today!

Source: FisherSolveTM Next 2021 Fisher International, Inc.

Source: FisherSolveTM Next 2021 Fisher International, Inc.

Figure 1: Containerboard Capacity Trends

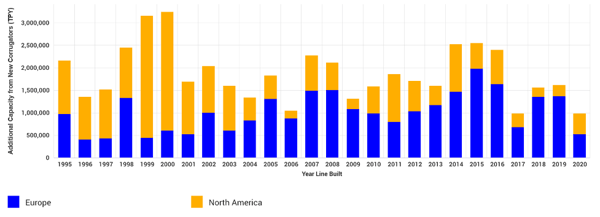

However, corrugated investments in the past couple of years have been relatively modest when compared to previous periods of growth. When looking at figure 2, we can see that there has been minimal incremental capacity added in terms of new corrugators.

Source: FisherSolveTM Next 2021 Fisher International, Inc.

Figure 2: New Corrugator Investment Rate

What does the unique data for corrugators in FisherSolve tell us about this dynamic change in the market? Containerboard growth is outpacing corrugated growth, and as a result, we’re anticipating that the corrugated industry will race to catch up, meaning that the next couple of years will be a time of great investment and production for the industry.

Source: FisherSolveTM Next 2021 Fisher International, Inc.

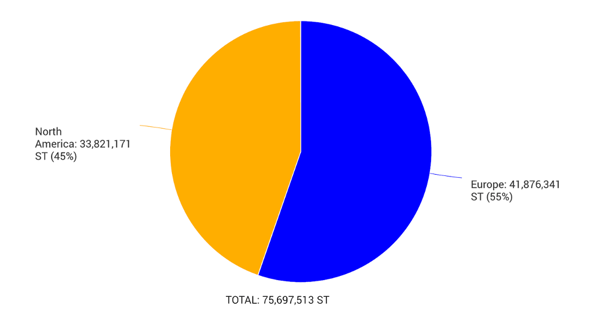

Figure 3: Current Corrugated Capacity

So, after looking at the facts, is the global corrugator sector prepared to meet this unprecedented demand? Fisher International has the tools necessary for suppliers in the corrugated industry to better understand the directional trends in the market and their unique place within it.

Our breakthrough analysis tool for corrugators describes every integrated and independent corrugator in the US and Canada, including:

Plants

- Location & Ownership

- Corrugator Widths & Speeds

- Suppliers & Viability Ranking

- Production & Operations

Production Costs and MSF by:

- Number of Walls & Fluting Types

- Number of Shifts

- Rates

Contacts

- Names & Titles

- Functions

- Surface and Email Addresses

- Telephone Numbers

Whether you provide equipment, wearables, chemicals, paper or anything else, FisherSolve can provide you with highly detailed and complete information that will give you the competitive advantage you need to succeed in this segment undergoing rapid growth.