Renewed interest in fibers derived from natural cellulose (non-petrochemical) sources has seen demand for such fibers grow to 6 million tons per year currently, an approximate doubling of demand since 2000, according to Tecnon OrbiChem’s supply and demand data.

The term ‘’cellulose fibers’’ or ‘’cellulosic fibers’’ covers a variety of sub-types of fiber that are sometimes better known as Rayon or by their brand-names, or sub-type names such as Viscose, Lyocell, Modal, etc. The key feature of all of these fibers is that they are manufactured from natural cellulose pulp (or in some cases nowadays from a proportion of recycled cellulose pulp – which we will talk about more below), hence are not considered to be synthetic. However, cellulose fibers are also frequently referred to in the industry as ‘’manmade cellulosic fibers’’ (MMCF) because their generation requires processing with petrochemicals to take cellulosic pulp and regenerate it in a form which allows fibers to be spun, or processed for other (more minor) uses such as films.

Non-natural fibers are often sub-classified as “synthetic” if derived from petroleum, “artificial” if derived from working up natural materials, with both together referred to as “man-made fibers”.

Why is there renewed interest in cellulose fibers? Tecnon OrbiChem understands that the main drive comes from the use of blends of viscose staple with cotton or synthetic staple, in order to confer softness and moisture absorbency on the fabric. Viscose has 50% greater moisture absorbency than cotton, which means that another important outlet is in hygiene wipes. Does the sustainability of a wood-derived fiber have a role in the promotion of viscose and lyocell? Feedback from fashion brand owners, using various types of synthetic and natural fibers in garments, suggests that the buying choice of consumers often doesn’t really take into account the fiber type – many consumers do not know the difference between synthetic and natural fibers - and so demand is not always being driven from the consumer level of the value chain despite negative information circulating in the media about plastics and the shedding of microplastics from textiles. There is however some market pull from end customers, some of whom like the idea of nature-derived fibers. Some makers of, for example, underwear or socks, proclaim that they are using bamboo-based viscose.

On the other hand, cellulose fibers can offer properties closer to those of cotton than can be provided by synthetic fibers, plus brand owners themselves are conscious of green objectives and the need for the world to reduce reliance on the petrochemical feedstocks which lead to increasing concentrations of CO2 in the atmosphere. Cellulose fibers from natural feedstocks thus seem an attractive way of addressing the need for alternative, green solutions to petrochemical sourced fibers for the world’s growing demand for fibers.

Viscose fibers are very soft and comfortable and are increasingly being used in articles that are worn next to the skin (underwear), or in outerwear where softness is at a premium (cardigans, jerseys). But almost always in blends with tougher fibers since viscose has poor abrasion resistance (100% viscose socks would fall to pieces in a few wearings). A growing use is in wipes, where softness is combined with water absorption and degradability.

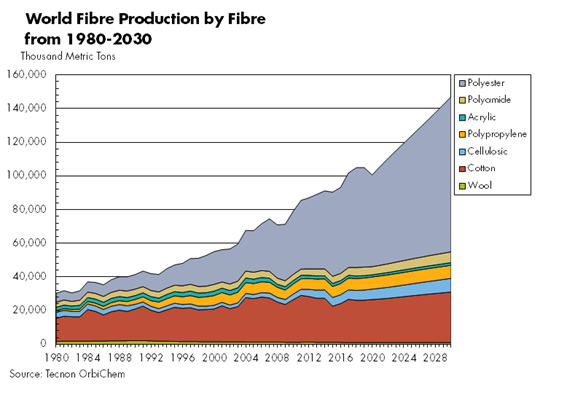

Tecnon OrbiChem has monitored the rising world demand for fibers since 1980 and the chart below shows the development. Demand for fibre is very strongly linked to growth in overall world GDP and this drives the trend seen. Total demand is forecast to reach ~147 million tons by 2030 (as shown in the diagram).

Given the objective of reducing CO2 output, substituting a part of the polyester fiber demand shown in the chart with cellulose fibers seems in the first instance an obvious step, albeit from a relatively small start point when cellulose fibers are only 6 million tons of the total demand.

However, cellulosic fibers are not as ‘green’ as the simple statement that they are from natural sources suggests. The cellulose fiber industry itself admits freely that more could and should be done to make the chemical processes to cellulose fibers more environmentally friendly. The two key processes in operation worldwide are the viscose process – producing almost 90% of the world’s viscose filament and staple fiber, and the Lyocell process accounting for a further 10%. The viscose process relies on highly toxic carbon disulphide (CS2) as a solvent and although this is recovered within the process, there is the challenge of handling this material as well as discharges to atmosphere of wastes including sulphur to air and sulphuric acid. In recent years, standards have been improved as latest technologies have been more widely implemented.

The Lyocell process uses N-methylmorpholine N-oxide (NMNO) as the solvent and with reduced waste volumes is seen as more environmentally friendly. Focus on decreasing the input of highly toxic CS2 has led to the development of the cellulose carbamate process currently seen as the most viable option to substitute or retrofit existing viscose technology.

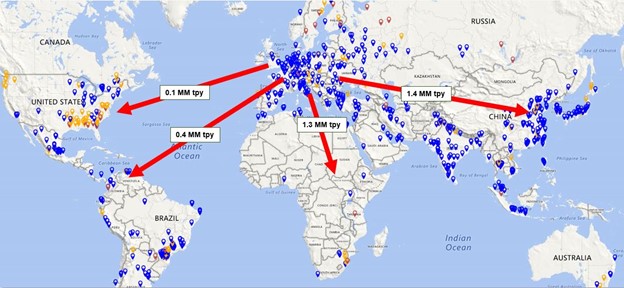

China is currently by far the world’s leading viscose fiber producer. In 2019, production of viscose staple in China was 3,672 kt according to China Chemical and Fiber Economic Information (CCFEI) figures. Tecnon OrbiChem’s estimation is that world production in 2019 was 4,528 kt, meaning that China accounted for 81% of global production.

These issues have prompted further development of solutions for the ‘greening’ of the cellulose fibre industry with the most widely discussed development being the possibility of recycling. A number of companies and organisations present at the conference described progress in recycle of cellulose fibers from garment factories or from post-consumer recycle back to cellulose pulp. The general principle is to extract cellulose fibers from cotton or viscose scraps, garments or even mixed textile containing cellulose fibers and from these, generate pulp which can be mixed with virgin feed generated from wood. One source suggested that there could be the availability of 20 million tons per year of cotton waste and 10 million tons per year of viscose waste, though these numbers seem large given the production volume for cotton does not exceed ~25 million tons per year.

Companies with such projects include fibers major Lenzing, with its REFIBRA™ brand making Lyocell fibre based on re-use of cotton scraps, and a corporate target for 50% CO2 emissions reduction by 2030; Infinited Fiber (Finland), also using a CS2-free process and with links with high-volume fashion brands; and Re:newcell in Sweden, also with its Circulose® dissolving pulp product made by recovering cotton from worn-out clothes. In Sweden, Södra is working on dissolving pulp from recycled textile though it remains in the development stage. It claims a long-term goal is to reuse every type of textile product.

In the Netherlands, KNN Cellulose has developed a product branded Recell®, where cellulose fibers are recovered from sewage treatment plants. KNN Cellulose has so far explored use of this material in composites though use in fibers is also being promoted.

One obstacle is the availability of post-consumer textile/waste textile. While plastics are now widely collected and recycled via municipal collections, the same cannot be said for textiles. Greater availability of such recycled material at low cost would certainly help and there are EU initiatives to implement recycle schemes. Suppliers and partners with availability of used textiles are sought.

Further, while most of the recyclers have had success with white coloured cotton scraps, post-consumer fibre containing mixed fibers and dyes are significantly more difficult to handle.

Cost of production or cost of the recycle loop for the cellulose fibre process remains an issue. None of the producers have suggested that the economics of production come close to processing virgin wood pulp, though there is the expectation that greater pull from consumers via brand owners for ‘greener’ products, better availability of recycled material and economies of scale as plant size for recycled product grows will all contribute to costs of production much closer to that of virgin fibre.

Metsä Group’s innovation company Metsä Spring Ltd. and Japanese Itochu Corporation have established a joint venture and a test plant for a new technology for converting paper-grade pulp into textile fibers.

Other developments include the addition of hemp fibers to the mix to make “Lyohemp”. This is being researched by TITK in Germany. Cellulose sources from green protein crops (grass) is being investigated by Aarhus University in Denmark. Other initiatives contributing to a less CO2-intensive economy include dope dying techniques (researched by Aditya Birla).

Rayon fibers are being examined for use, as an example, for reinforcement of auto-interior panels as an alternative to petro-based fibers.

The term ‘nanocellulose’ is used to broadly refer to cellulose nanocrystals (CNC) which are created by the acid hydrolysis of cellulose fibers. In the US, Cotton Incorporated is a not-for-profit organisation funded by cotton growers with the objective of creating increased value in the cotton value chain. It is looking at ways to use CNC from scrap recycled cotton in composites. The aim is to generate materials with improved properties. Research institutes including Research Institutes of Sweden (RISE) are investigating fibers with nanocellulose.

It is inconceivable that cellulose fibers will come anywhere close to being able to substitute for synthetic fibers in the foreseeable future given that demand for polyester, polyamide, etc. will continue to grow as the world’s population grows and world GDP increases. As with sustainable chemicals and polymers in general, cellulose fibers are one tool at our disposal to tackle CO2 output reduction targets and global warming targets. But more needs to be done in support – textile recycling and the willingness of brand owners and consumers to pay higher prices for recycled material rather than the use of more forest resources. As regards synthetic fibers and overall, without reduction in demand, much greater reliance on recycling is then essential if we are to come close to sustainability goals.

However, cellulosics are growing (at a projected CAGR or 2.8% to 2025) faster than some mature fibers like acrylic or polyamide, at least at present, due to softness and water absorption -- cotton-like qualities.

Gillian Tweddle is Business Manager – Individual Project Studies at Tecnon OrbiChem Ltd.