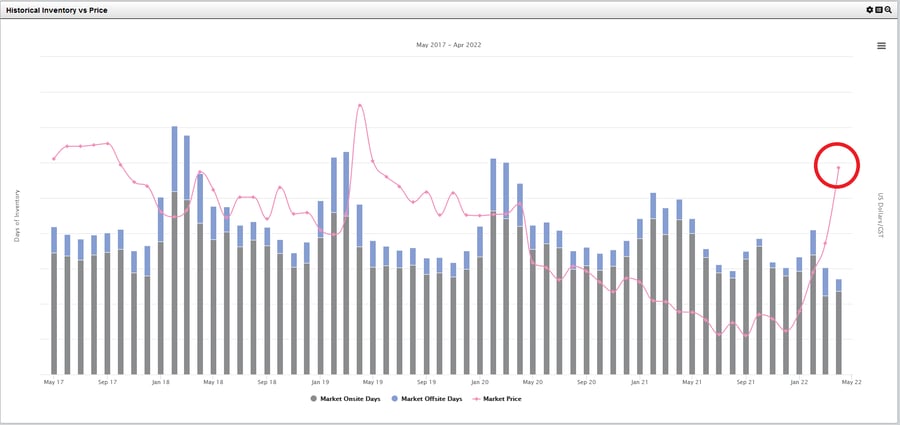

After spending the better part of two years in the doldrums – a period which saw a significant dropofff in demand due to the closure of two large regional paper mills – delivered wood fiber prices in the Lake States have turned significantly higher in 2022. Prices are up 10% since the beginning of 1Q2022 and are now at their highest point in more than three years, and the trend shows no signs of abating.

The Lake States normally experiences an increase in total delivered price in April/May as woodyards are emptied and a secondary freight charge is realized on wood deliveries. However, Forest2Market data indicates that mills in the Lake States have been holding noticeably less offsite inventory over the last two winters compared to historical trends. This suggests that the recent increase in price is driven less by seasonal factors, i.e., emptying of regional woodyards, and more by market supply issues driven by increasing costs.

As we reported in the wake of the devastating economic impacts caused by COVID-induced lockdowns in 2020, wood fiber consumption dropped off significantly in every wood basket across North America. But as the economy picked up steam in 3Q and 4Q2020, some regions experienced structural changes in fiber demand that continue to impact their respective wood supply chains.

Despite decreasing prices over the last two years, the regional forest industry has been testing the limits of the wood production system over the last two quarters. The Lake States market is now close to experiencing a repeat of a supply/demand scenario in 2014 that saw wood fiber prices skyrocket.

What Happened in 2014?

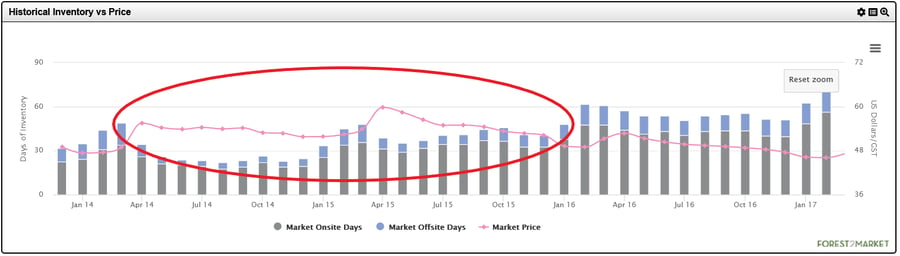

The seasonality of timber harvesting is a significant driver of price in the Lake States. Deliveries typically peak from January through March and, depending on when the cold weather hits, can sometimes include December of the prior year. As a result, regional mills fill their log inventories during 1Q to include as much as 80 days’ worth of system-wide inventory designed to last through the spring season. It is equally important for the system to maintain a minimum of 30 days’ worth of hardwood inventory during the rest of the year so that winter surge capacity is not stressed beyond its capabilities.

There is little flexibility in these numbers, as spring “break up” is traditionally the low point for wood deliveries because the rainy climate from March - May results in difficult forest and road conditions. It is far better to carry excess inventory during break up than it is to risk running out of wood or paying exorbitant spot prices in an effort to play catch-up. When inventories dipped below 30 days in 2Q2014, prices spiked over 20% during the following year before finally leveling off in late 2016, as noted in the chart below.

What’s Driving Prices Higher Now?

When analyzing days of inventory and price over the last several months, a trend is developing that is similar to what occurred in 2014: market onsite days of inventory have been in the low 30s or below since 3Q2021. Market offsite days of inventory have been equally thin. We’re now beginning to see a price increase in combination with low inventory levels, which is a situation that is only exacerbated by rising supply chain costs.

There are a few drivers applying upward price pressure in the current market:

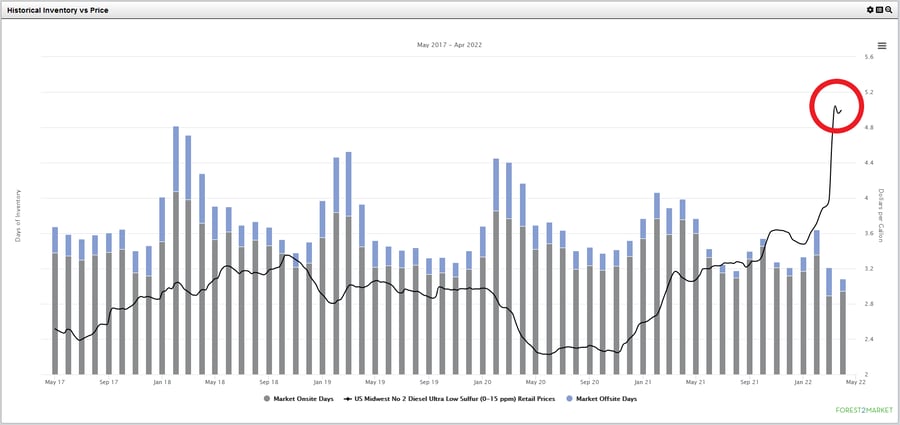

- Oil/Diesel Price: As we have demonstrated in the past, the supply and demand of logs and wood fiber is ultimately what drives the price of these products on the market, which is independent of fuel price. However, the cost of producing logs and fiber is not independent of fuel price, or the price of any other input that goes into generating these products; steel, labor, tires, oil, etc. all affect the cost of producing forest products.

Average diesel price in the Lake States is now over $5.00/gallon, a 58% year-over-year increase. This added cost is compounded by the fact that the average haul distance in the region is over 80 miles.

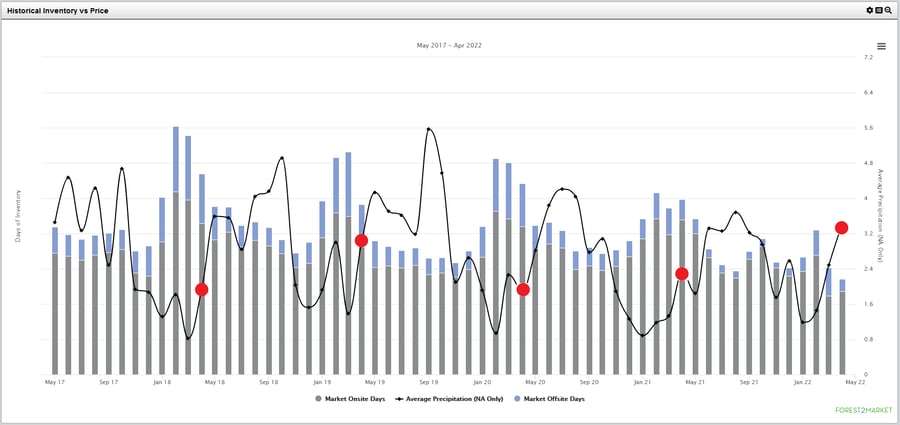

- Weather: There is oftentimes discussion about limited logging and trucking capacity due to the seasonality of harvests in the Lake States, but this is really more a need of managing “surge” capacity at the right times of the year. A December freeze-up allows for winter logging, and a normal cold winter ensures harvesting crews can access enough timber to account for surge capacity. However, a warm and wet spring impedes harvesting operations and can spell disaster for wood-consuming facilities — especially for those mills who are already running on lean inventories.

In the chart below, we overlaid monthly precipitation data with historical on- and off-site days of inventory (each red dot represents April precipitation data for the previous five years). Notice how low inventories were in April 2022 while total monthly precipitation was higher than it has been over the last five years. This dynamic can cause some degree of panic buying, which drives consumers to spot price purchases that are significantly higher than typical delivered costs.

As we enter 2H2022, will the Lake States find itself in another cycle of rising prices amid a sustained fiber supply squeeze like the region experienced in 2014/15?

Since inventories are now low by historical norms, regional mill facilities must plan accordingly in order to avoid a scramble to secure fiber at significantly higher prices. This presents an excellent opportunity for regional mills to utilize Forest2Market’s Delivered Price Forecast tool, which is available to subscribers to Forest2Market’s Delivered Price Benchmark service in the SilvaStat360 platform.

The new Delivered Price Forecast tool incorporates forecasting scenarios based on the highest-quality transactional data in the forest products industry. By starting the process with a precise starting price based on actual mill and market transactions, the forecast scenarios deliver a greater level of accuracy that result in less variability over time.

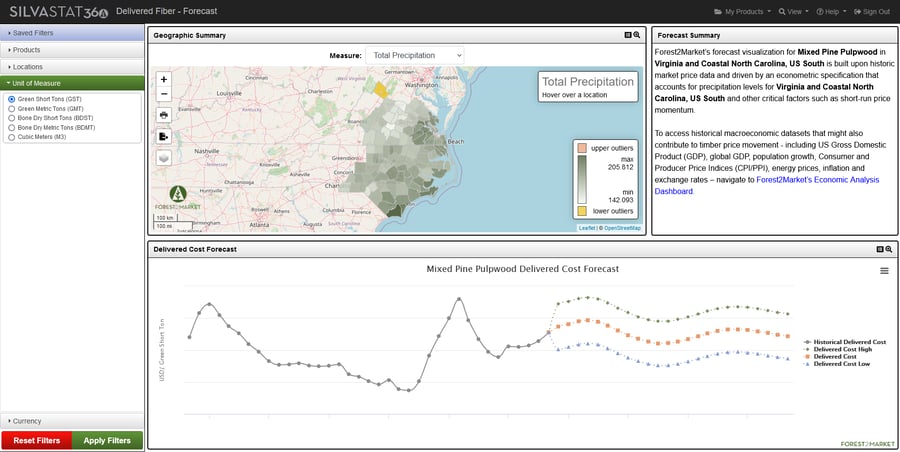

The SilvaStat360 Delivered Price Forecast dashboard provides interactive charts that help users visualize the data that correspond to their mill facilities and the larger market. Users can sort by product, location and mill, unit of measure, and currency. The data and visualizations can also be downloaded and exported as images to be used in presentation formats.

In the screenshot below, the map at the top illustrates precipitation data for a particular NC and VA wood basket and the bottom chart displays the delivered cost forecast for pine pulpwood that includes:

- Historical Delivered Cost

- Delivered Cost High Scenario

- Delivered Cost Scenario

- Delivered Cost Low Scenario

Users can also zoom in to further interact with the data, and hover over each point in the chart to get instant forecast costs in each scenario for seamless price comparisons.

With the new Delivered Price Forecast tool, Forest2Market subscribers have even deeper insights into their historic, current, and future delivered wood costs. While supply and demand will always dictate market price direction, improving supply chain efficiencies is the single most effective method to boost profitability and Forest2Market’s proprietary data allows for an unrivaled, comprehensive look at the supply chain costs impacting fiber and log markets.