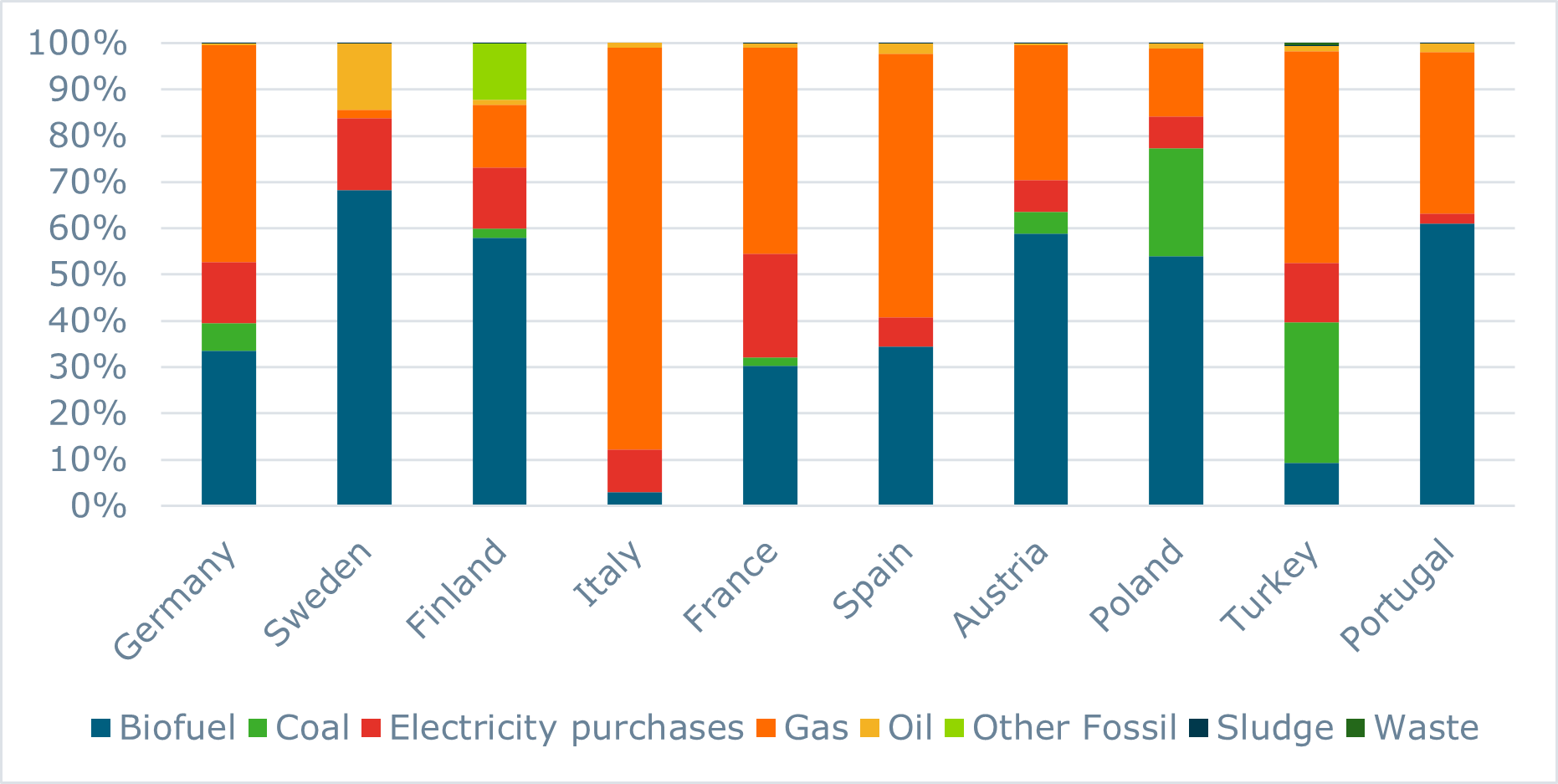

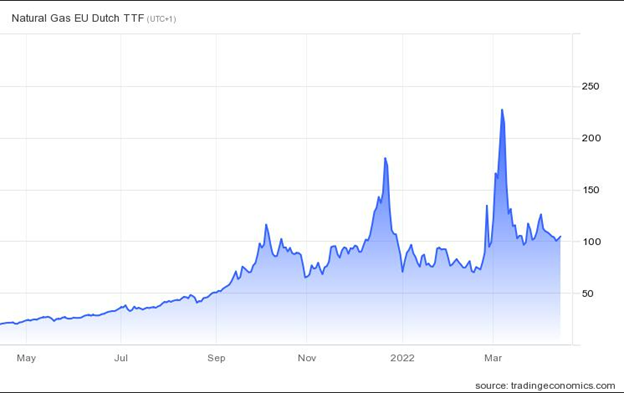

CEPI announced in late April that European mills must begin to make difficult decisions regarding a temporary halt of production across Europe due to the extreme energy price surge following the Russian invasion of Ukraine. However, they did suggest one possible option to maintain operations despite energy shortages: temporarily switch from natural gas to less environmentally friendly energy sources such as oil or coal. But would oil or coal be a proper (and feasible) substitute for natural gas in European mills? And would this go over well now that sustainability has become a significant priority amongst consumers?

Russia is the world’s third largest oil producer behind the United States and Saudi Arabia, and the world’s largest exporter of oil to global markets along with the second largest crude oil exporter behind Saudi Arabia.

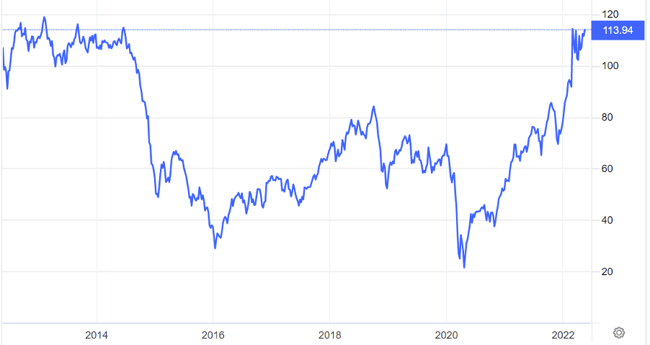

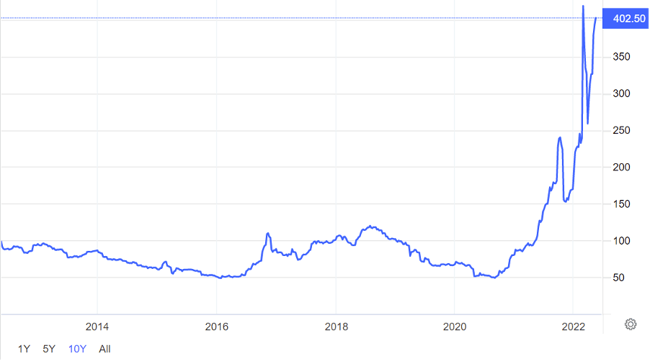

In 2021, 49% of Russia’s oil was exported to OECD Europe, and while we’re not sure when or if Europe will put sanctions on Russian oil imports, brent crude oil prices are already hitting 10-year record levels, almost reaching the same level as in 2012 and increasing six times the price in 2020.

Crude Oil Price Trends -- Brent (USD/Bbl)

Source: Trading Economics

Poland is the biggest coal producer in OECD Europe, occupying 96% of 57.2 MT of total coal production in 2021 – which represents a 50% capacity reduction in Europe since 2010. And while coal is not a favorable energy source in Europe, the price also soared four times since earlier this year.

Coal Price Trends – New Castle (USD/MT)

Source: Trading Economics

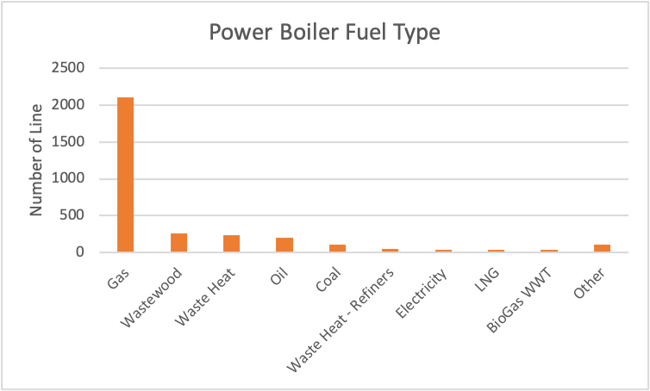

According to FisherSolve, there are more than 2,000 gas fueled power boilers in Europe, only around 200 oil-fueled power boilers, and 100 coal-fueled power boilers. Ignoring the price increase and supply of both oil and coal, it also takes a significant amount of time to switch fuels for the boilers, which seems like a long-term solution for a short-term necessity.

Source: FisherSolve

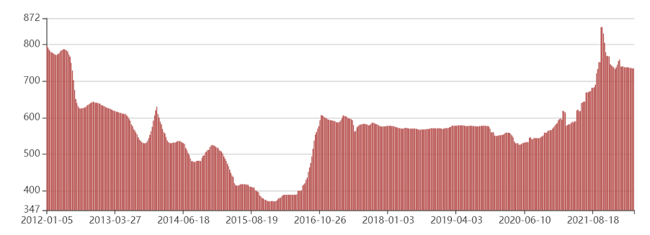

Are soaring fuel prices unique to Europe? If we focus on Asia, we see similar price trends in both China and India – the top coal producers. China’s coal price levels reached a 10-year high at end of 2021 and remain on the historically higher side, which has forced many paper mills in China to cease production.

China Coal Price Trends, MT/RMB

Source: CQCOAL

In India, we not only see a price increase, but also some shortages as well. It was reported that since late last year, 70% of Indian coal plants maintained less than 7 days of inventory and 30% maintained less than 4 days, which has caused ongoing power cuts.

Demand for electricity and fuel has been expanding in India as its economy has grown, although as 20-30% of its coal is imported, the devaluation of the Rupee has also pushed coal prices higher.

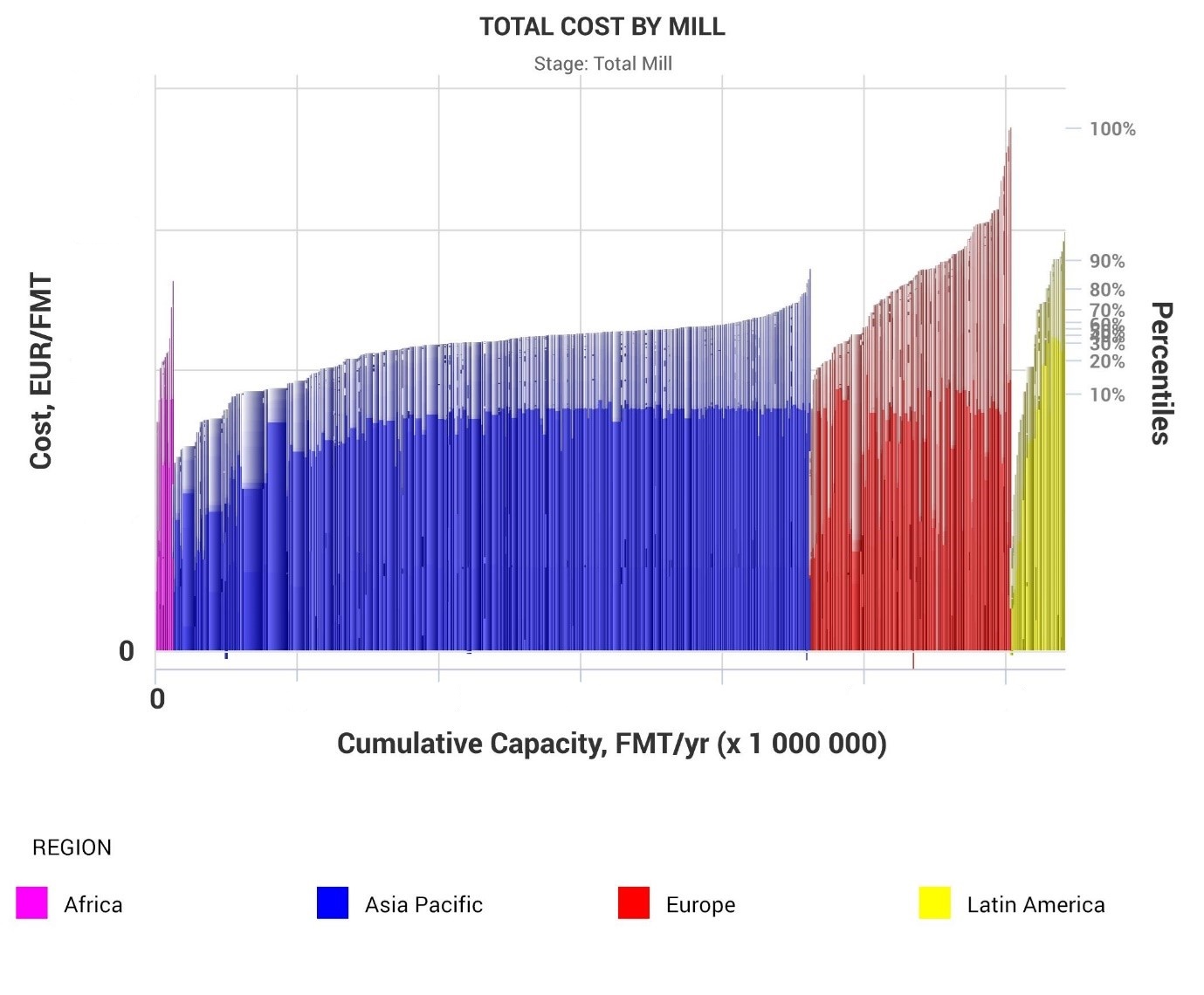

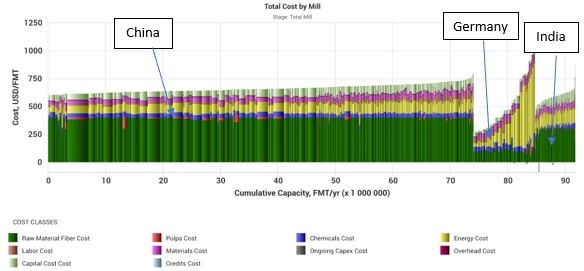

While it’s not a feasible short-term solution for the paper industry to switch fuels, energy costs have become a significant factor of manufacturing costs. Taking containerboard manufacturing cost for example, in 2020, the average energy cost in China, India, and Germany was below 75 USD/FMT, while in 2022, the energy cost has been as high as 230+ USD/FMT, as seen below.

2020Q1 vs 2022Q1 Containerboard Manufacturing Energy Cost, USD/FMT

.png?width=700&name=Containerboard%20Manufacturing%20Energy%20Cost%20(002).png)

Source: FisherSolve

2022Q1 Containerboard Manufacturing Cost—Country Average, USD/FMT

Source: FisherSolve

Taking all of these factors into consideration, some important questions to consider include:

- With fuel prices increasing, which companies will maintain their cost advantage and which will take a margin hit?

- Will diverging manufacturing costs reshape global trade?

- While companies who have stable access to raw materials and can hedge price increases may take this opportunity to build their brands and expand in the market, will there be more M&A opportunities?

For a deeper look into answering the questions, talk with an expert at Fisher International who can help your business formulate an actionable plan with a high degree of accuracy. Fisher customers also have access to Fisher International’s business intelligence platform, FisherSolve Next, which provides detailed information on every paper and pulp mill in the world.