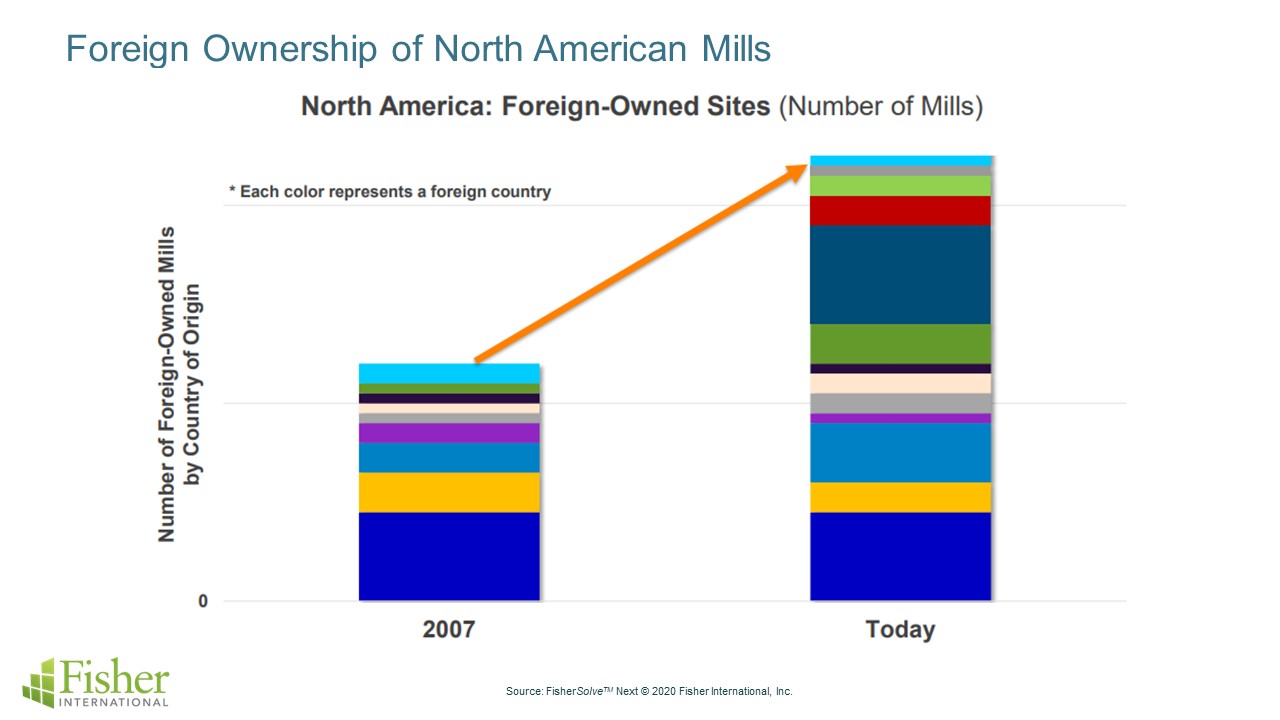

Foreign ownership of North American pulp and paper mills has more than doubled since 2007. While the biggest share in ownership in 2007 was held by Swedish and South African parent companies, today Indonesia is the largest investor in North America, followed by Sweden.

With the exception of Brazil and Chile, investments in production sites in North America are held by companies from all major pulp and paper supply hubs around the world, and these investments have been growing well-aligned with market growth patterns across all grades, from specialties and packaging to tissue and market pulp.

Foreign-owned mills enjoy over 15 percent capacity share in the market pulp supply in North America, 10 percent in tissue, and more than 20 percent in specialties, for an average of about 10 percent of total North American pulp and paper production overall. While there is also a meaningful share of foreign-owned production in the declining printing and writing segment, some of these machines are already committed to be converted to produce more attractive grades like containerboard.

Today, 10 of the top 15 global pulp and paper producers have a mill presence in North America—including APP, Nine Dragons, UPM, Smurfit Kappa, and Nippon Paper—and in the last two years alone, foreign companies acquired 15 mills. Chinese and Indonesian companies have bought printing and writing assets for conversion into market pulp and packaging grades, DS Smith entered the US manufacturing market, and Ahlstrom-Munksjö acquired the Expera Specialty Solutions assets in the Midwest.

Motivating Factors

Differentiated market dynamics is what motivates companies to branch out to different geographies. In the case of the pulp and paper industry, some of the reasons producers are investing in North America include:

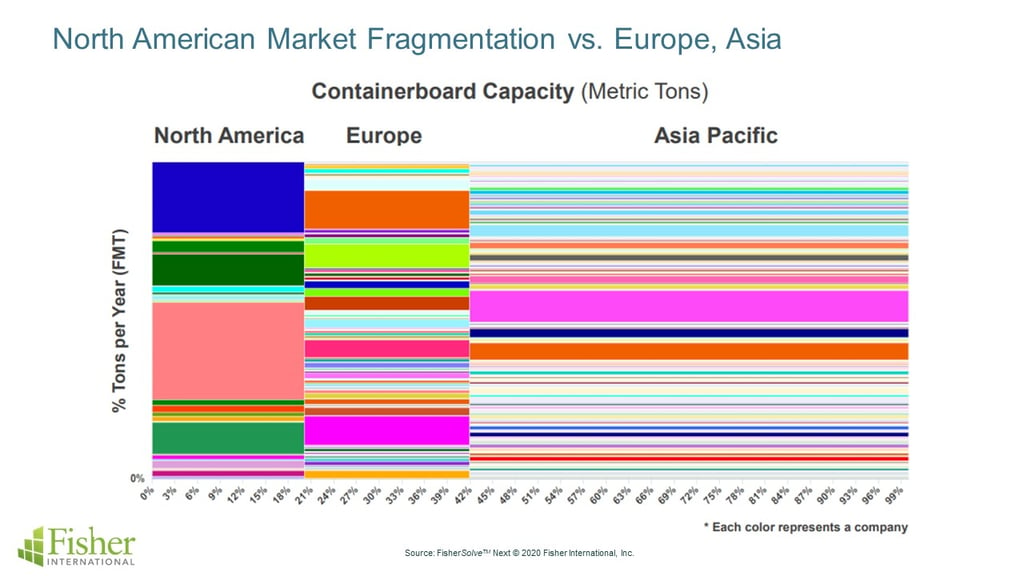

• A sizable, mature, and stable market with attractive margins and low fragmentation in major segments

• Printing and Writing and Newsprint asset availability for conversion (distressed assets)

• Abundance of fiber supply (virgin and recycled)

• The desire to diversify risk

• Established business practices and economic/political stability

For example, looking at the containerboard segment, we notice that, based on the supply structure and on today’s price levels, there are opportunities for margin realization even for the higher cost producers, which makes it very attractive for foreign investments.

In terms of availability of potential assets for conversion, most of the printing and writing and newsprint capacity in North America comes from integrated sites. Considering that fiber is one of the biggest costs in pulp and paper production, access to onsite fiber is very valuable, making these sites attractive for conversion.

Potential Market Impact

Foreign investments could impact the marketplace in different ways. For example, a newcomer could come to the market with lower margin expectations and influence prices. New investments could also bring new products and influence the market, increasing competition—for instance, lightweight high-performance innovative products in packaging grades, higher and better usage of mechanical furnish, and differentiated barrier materials.

Suppliers to the paper industry could also be impacted as foreign buyers can have different expectations and behavior when it comes to sourcing and might require suppliers to rethink their sales and service practices.

So far, foreign investments have not affected industry consolidation. However, as markets continue to consolidate around the world and leaders must diversify their geographic risk, we could expect more comers to North America.

As global companies continue to search for inexpensive, good quality fiber, North America is likely to be among the top destinations. The companies that conduct thorough due diligence prior to investing, and have a clear understanding of opportunities, risks, and market variables, will be more likely to succeed.

Pulp and paper producers use Fisher’s business intelligence resources for both market and competitive analysis. From strategic decisions about products and assets to tactical decisions like where to spend sales time, we support the entire decision chain with the FisherSolve™ platform.