Much like 2020, the global forest products industry has undergone significant changes this year – some expected, and some unexpected. However, the industry as a whole remains solidly profitable and structurally sound despite changing demand patterns and supply chain strains that continue to be a source of frustration across the entire economy.

Most importantly, the forest value chain is well-positioned for a future that is eager to embrace natural, sustainable, and renewable solutions that help mitigate the effects of climate change.

This is what we do best, and this is the story we must continue to tell in 2022.

In light of all that has transpired in 2021, we wanted to take an opportunity to look back and see which topics resonated the most with visitors to Forest2Market’s MarketWatch blog throughout the year.

It’s also a great opportunity to offer our sincere gratitude to the contributors and regular readers of our blog and newsletters. We are delighted that you find continued value in our content. We wish you a safe, warm, and joyous holiday season and we look forward to providing you with fresh industry insights and meaningful content in 2022.

The Top 10 Most Popular Blog Posts of 2021

Southern yellow pine (SYP) lumber prices are at record highs, by huge margins. Forest2Market’s composite SYP lumber price for the week ending March 5 was $979/MBF, which represents an astounding 171% increase over the same week in 2020. While this trend benefits southern sawmills, many timberland owners in the US South are asking the obvious question: Why are log prices in local markets not reflective of a record lumber market? The answer to this question is not as straightforward as it may seem.

Southern yellow pine (SYP) lumber prices are at record highs, by huge margins. Forest2Market’s composite SYP lumber price for the week ending March 5 was $979/MBF, which represents an astounding 171% increase over the same week in 2020. While this trend benefits southern sawmills, many timberland owners in the US South are asking the obvious question: Why are log prices in local markets not reflective of a record lumber market? The answer to this question is not as straightforward as it may seem.

Timber and the land timber occupy are economic assets. As in any market, when there is strong demand, owners actively manage their assets to maximize economic return. In this case, timberland owners manage their forests to maximize tree growth, especially the growth of the highest valued product – sawtimber. This management structure increases their return on investment. In turn, forest products manufacturers use the raw materials that they purchase to the fullest extent possible, including the utilization of low-value trees and residuals for energy purposes where markets exist.

Market pulp prices have always been volatile and kraft market pulp, in particular, saw some of its lowest prices in the last 10 years in 2020. However, 2021 has brought price increases with skyrocketing spot prices in February and early March. Between December 1, 2020 and late February 2021, bleached softwood kraft futures were up 48% on the Shanghai Futures Exchange (SHFI), and additional price increases have been announced, leaving buyers wondering what has happened and when it will end.

For those unfamiliar with the forest products industry as a whole—and lumber manufacturing specifically—it’s important to understand the delicate relationship that exists between demand for forest products and the capacity to manufacture them. Raw material costs (timber) can comprise upwards of 75% of total operating costs for forest products manufacturers, so meticulous procurement strategies and management of those resources ultimately defines success.

As population in the region steadily grows, rural forest landowners who were once many miles from anyone are increasingly impacted by the perpetual sprawl that is bringing new housing developments, schools, and shopping centers to their backyards. The US South continues to transition from a rural to a more urban/suburban region as small to medium sized towns are expanding rapidly, mimicking larger cities such as Atlanta, Charlotte, Nashville, Birmingham, Jacksonville, New Orleans and Houston. Rural land is converted daily from forestland and small farms to retiree residences and businesses.

With the benefit of hindsight, modern Americans often look back in horror at the way many of the rapidly expanding industries of the late 19th and early 20th centuries managed our natural resources. This includes some of the forest industry practices of the time, which were oftentimes a blight on the larger forest sector in many regions. Of course, hindsight is 20/20 and can never fully account for the complexities of the day.

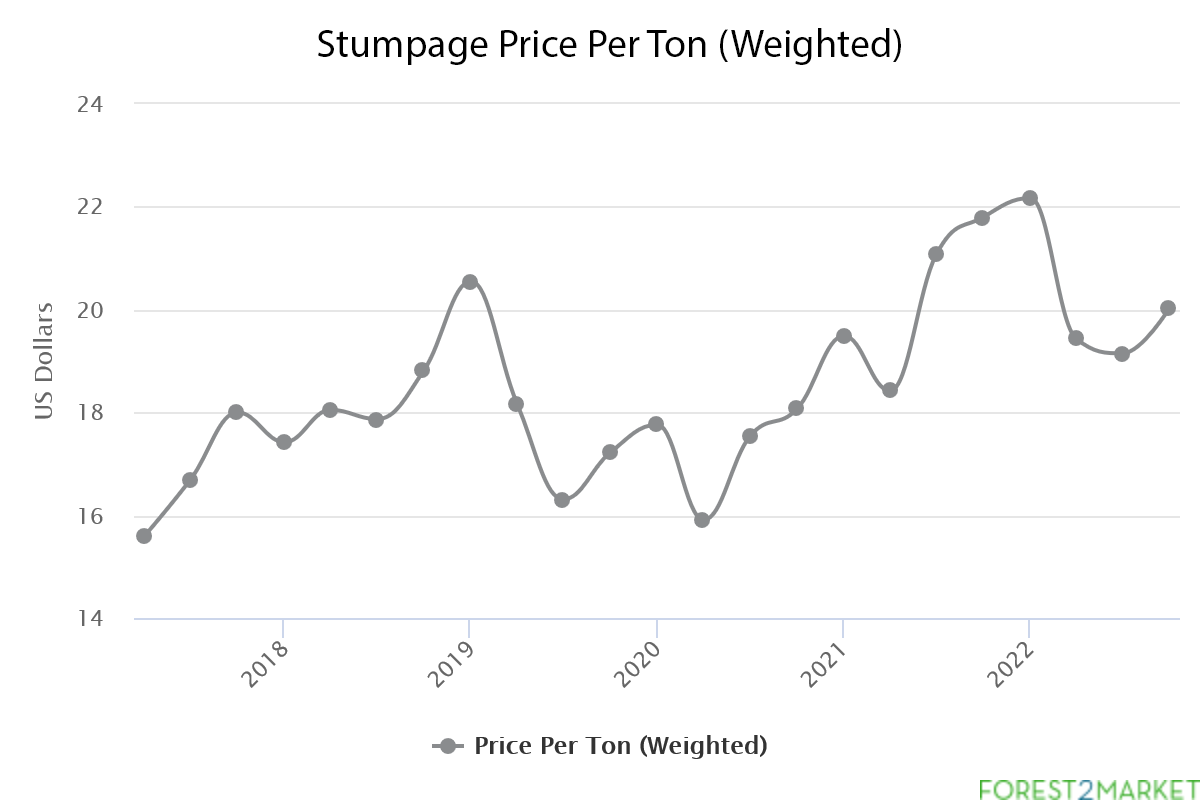

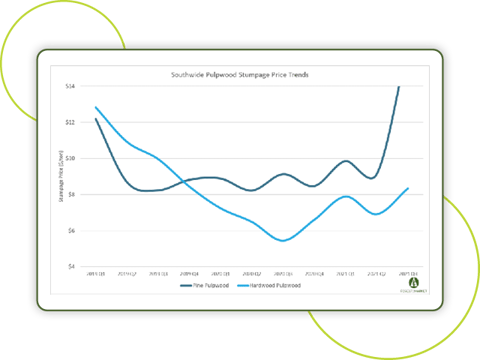

Led by insatiable demand for small pine and hardwood logs, the weighted average price for southern timber surged to a 14-year high in 3Q2021. Stumpage prices were up +16 percent quarter-over-quarter (QoQ) and +22 percent year-over-year (YoY). The last time Forest2Market’s Southwide weighted average stumpage price was this high was in 4Q2007, just before the onset of the Great Recession.

Led by insatiable demand for small pine and hardwood logs, the weighted average price for southern timber surged to a 14-year high in 3Q2021. Stumpage prices were up +16 percent quarter-over-quarter (QoQ) and +22 percent year-over-year (YoY). The last time Forest2Market’s Southwide weighted average stumpage price was this high was in 4Q2007, just before the onset of the Great Recession.

Understanding the complex relationships that exist between carbon emissions and environmental carbon sequestration is no small task. As ecological science goes, this is a relatively new field of study that is made more complex by the fact that the study area is global, and the time period is essentially infinite. Like all science, our understanding about this relationship continues to evolve.

Delivered wood fiber prices in the Lake States are at their lowest point since Forest2Market began collecting transactional pricing data from the region over eight years ago. As we reported last year in the wake of the devastating economic impacts caused by the COVID-19 pandemic, wood fiber consumption dropped off significantly in every wood basket across North America. But as the economy picked up steam in 3Q and 4Q2020, some regions experienced structural changes in fiber demand that continue to impact their respective wood supply chains.

The broad topic of climate change is now top-of-mind across the legislative, corporate and consumer landscapes. While all channels continue to develop viable and innovative methods to mitigate the risks of climate change, forests are quietly doing much of the heavy lifting in the background. In fact, forest ecosystems make up the largest terrestrial carbon sink on Earth.