In December, Swedish pulp and paper manufacturer BillerudKorsnäs AB announced its acquisition of North American coated papers producer Verso Corporation. The acquisition of all of Verso’s outstanding shares for a purchase price of $825 million dollars is fully in line with BillerudKorsnäs’s strategy to drive profitable growth in paperboard, along with its ambition to expand into North America.

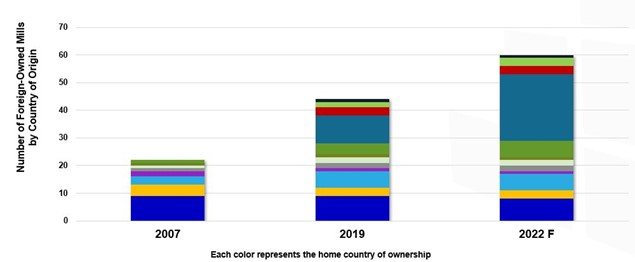

BillerudKorsnäs is one of many foreign companies establishing roots by investing in North America. Some other recent examples include Paper Excellence and its acquisition of Domtar, as well as SAICA’s corrugated box plant that is currently under construction (SAICA has also promised to invest $800mm in the US market). Other foreign companies such as Sofidel, Nine Dragons, DS Smith, Smurfit Kappa and Ahlstrom-Munksjö have also invested and enhanced its position in the North American market with local production. In fact, by the end 2022, the number of foreign-owned mills operating in North America will have tripled since 2007 to 60 mills.

Foreign-Owned Mills in NA

Source: FisherSolve Next

So why are so many foreign companies actively investing in North America? Some drivers include:

- A search for material supply and global expansion

- The desire to follow their customers

- A search for new markets that are sizable, mature and stable that allow margin growth

- Established business practices and economic/political stability

- The desire to diversify risk

- Abundance of fiber supply (virgin and recycled)

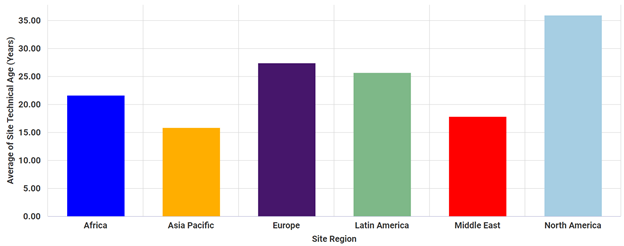

As seen in the chart below, foreign mills typically have a lower technical age, as they are newer, than North American mills. There is some nuance but generally, our experience is that foreign firms are willing to accept lower average returns than North American publicly traded companies. Ultimately, this could alter the competitive landscape/dynamics.

Average Technical Age by Region

Source: FisherSolve Next

In addition, it is also possible that there will be new capital investment as a result. Foreign investments have a wide range of possible impacts. Newcomers entering the market could possibly have lower margin expectations and therefore influence prices or they could introduce new products to the market – thereby increasing competition or maintaining different operational behavior when it comes to sourcing, which might require suppliers to reevaluate their sales and service practices.

As companies continue their search for new opportunities, North America will most likely remain a top destination for investors. RBC analyst Paul Quinn has already predicted that Clearwater Paper could become the next acquisition target for BillerudKorsnäs as the company plans to further expand in North America.

As global companies continue to search for inexpensive, high-quality fiber, North America is likely to remain a top destination. The companies that conduct thorough due diligence prior to investing, and have a clear understanding of opportunities, risks, and market variables will be more likely to succeed.

Pulp and paper producers use Fisher’s business intelligence resources for both market and competitive analysis. From strategic decisions about products and assets to tactical decisions like where to spend sales time, we support the entire decision chain with the FisherSolve platform.