The sense of uncertainty that gripped the entire globe over the last year is unprecedented in modern history. While many businesses were forced to close during the peak of the COVID-19 crisis, those considered by the U.S. Department of Homeland Security to be part of the “essential critical infrastructure workforce” were invaluable in bolstering the nation’s response.

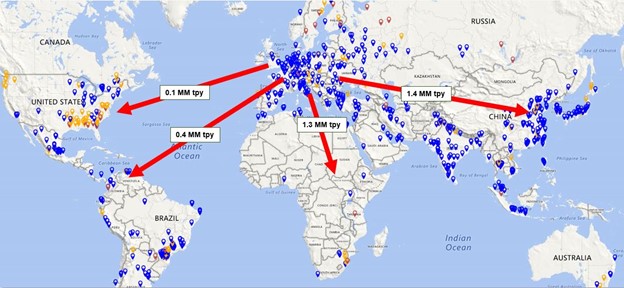

The Pulp & Paper industry is one of these essential workforces, which means paper and paper products manufacturers were forced to navigate the extreme uncertainty of 2020 by paying very close attention to rapidly changing market signals. While some segments are still playing catch-up due to the incredible spike in demand stretching back to last April, the global supply chain is finding its footing. With a watchful eye on market demand, inventories and fluctuating capacities, paper products manufacturers must sharpen their focus on supply chain management strategies to maintain profitability moving forward. In particular, there are three areas of chain management that are especially applicable right now:

- An optimized supply chain produces competitively priced end products.

- When a mill sources its fiber from an optimized supply chain, it gets better quality material and lowers its total procurement costs.

- Companies considered leaders in supply chain management in industrial products markets have Earnings before Interest and Taxes (EBIT) margins that are 114% higher than other companies in their peer groups.

How can paper products manufacturers maximize efficiencies, optimize their supply chains and better prepare for significant market uncertainty like we have experienced over the last year?

Incorporate flexibility

A nimble supply chain can scale to handle large volumes of wood raw materials, but it can also operate cost effectively with lower volumes when demand withers, or at full capacity when demand is strong. The key to being able to achieve this level of flexibility lies in actively managing individual cost components within the supply chain, then optimizing the divide between fixed and variable operating costs. For example, most fiber procurement managers and their teams have already taken advantage of obvious cost savings opportunities by eliminating:

- High cost sources of fiber

- Low quality sources of fiber

- Sources with high freight or difficult logistical challenges

Once this low-hanging fruit has been picked, however, there are always additional methods for improving supply chain efficiencies. Some of the more difficult questions to answer when it comes to extracting additional value from the wood fiber supply chain include:

- How does my raw material procurement system differ from the best performers in my peer group?

- Am I focusing my procurement targets in the lowest cost areas of my procurement zone?

- Are there areas where I outperform the market? Underperform the market?

- Can I avoid spot market purchases and lower my costs in an up market?

- Can I reduce capacity and maintain margins in a down market?

In order to answer these questions, organizations need to maintain a solid understanding of their own data, as well as the transactional data that is reflective of the actual market in which they operate. In stressed markets—like the one we currently find ourselves navigating—access to real market data becomes increasingly valuable.

Transactional data allows you to identify inefficiencies and develop fact-based solutions for optimizing your supply chain. This data becomes a powerful decision-making tool, one that can help you plan strategically, develop operational blueprints and proceed tactically even amid extreme levels of uncertainty.

In a manufacturing process where upwards of 70% of the finished product cost can be attributed to raw material costs, constant attention to the details involved in procuring those raw materials is imperative. We believe that business intelligence is the best investment you can make in capital intensive industries, particularly as we continue to navigate these uncertain times.