There are four main coated paperboard products produced in North America and Europe:

- Folding Boxboard (FBB)

- Coated Recycled Board (CRB)

- Solid Bleached Sulphate (SBS)

- Solid Unbleached Kraft (SUK)

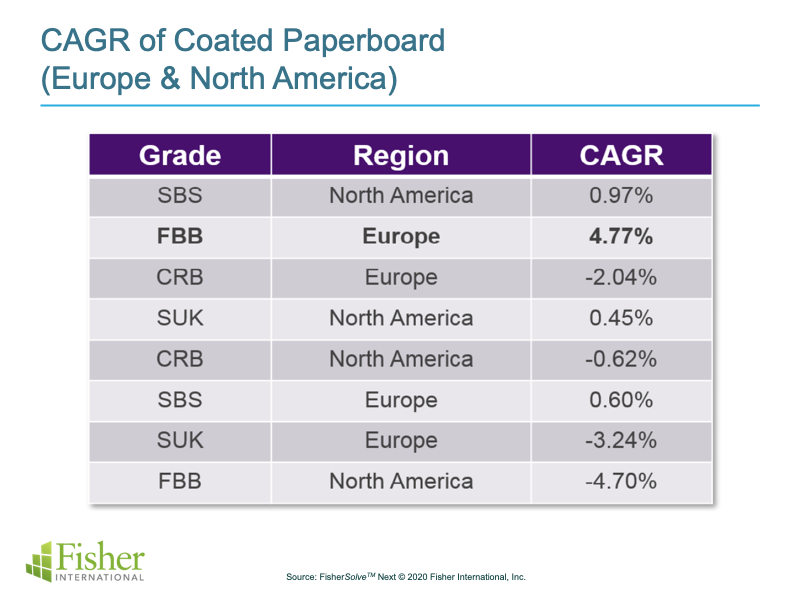

Production of coated paperboard has increased 0.9 million tonnes (8.8 percent) in Europe and 0.3 million tonnes (3 percent) in North America over the last seven years.

FBB is the most common paperboard produced in Europe with almost 50 percent share. In North America, SBS is the most common with around 55 percent share.

The chart below shows a compound annual growth rate (CAGR) in North America and Europe of each grade between 2011 and 2018, and what stands out is the rapid growth of FBB in Europe against the very different trajectories of the other grades.

So, let’s ask ourselves, what is behind the growth of FBB in Europe?

Three Reasons Why Folding Boxboard is Growing Rapidly in Europe

1. Mineral Oil Migration

The mineral oil migration issue in packaging popped-up around nine years ago. Swiss studies showed paperboard boxes like CRB made from environmentally friendly recycled fibers can contain significant portions of mineral oil originated from printing ink.

If food had direct contact with such paperboard boxes, it was possible increased amounts of mineral oils could migrate from the paperboard to the foodstuff and present health risks.

It was recommended that recycled paperboard should be replaced with virgin fiber-based paperboard such as FBB. This caused a lot substitution of FBB for CRB, for example in cereal packages, like muesli and corn flakes, where food is in direct contact with the paperboard.

Today, there are no regulations on the minimum accepted amount of migrated mineral oil in packaging in Europe. There has been debate, studies, and a draft mineral oil ordinance by the German Federal Ministry of Food and Agriculture which recommended the use of a barrier in order to protect the food.

Some European CRB producers, especially Mayr-Melnhof, have developed functional barrier coatings to get renewed food industry product safety acceptance. But the perception of many food packaging paperboard users is that FBB offers better product safety and purity than CRB.

2. Fiber-Based Packages as Substitute for Plastic

FBB, as well as all paperboard products, is an environmentally sustainable alternative for plastic packaging. Unlike plastic, paperboard is renewable, recyclable and, in some cases, even biodegradable and industrially compostable. The growing desire, especially in Europe, to reduce plastic pollution in the oceans has awakened demand for paperboard packaging.

There are already a few plastic packaging bans in Europe. France was the first country in the world to ban disposable plastic cups and plates in 2016. The European Parliament decided in 2018 on a complete ban on a range of single-use plastic products across the union. Many companies have announced changes from plastic to paperboard, for example in vegetable packaging.

FBB producers have managed to develop lighter FBB without sacrificing strength properties to save on raw material costs. There is a trend to move from 100 percent plastic packaging to combined paperboard and plastic packaging like yogurt jars.

There are new innovations like single-use coffee cups without any plastic which Kotkamills is producing. Normally the cup must include a barrier layer made from plastic, which prevents absorption of liquids and greases, but this new innovation contains coating instead of plastic.

3. Export from Europe to North America

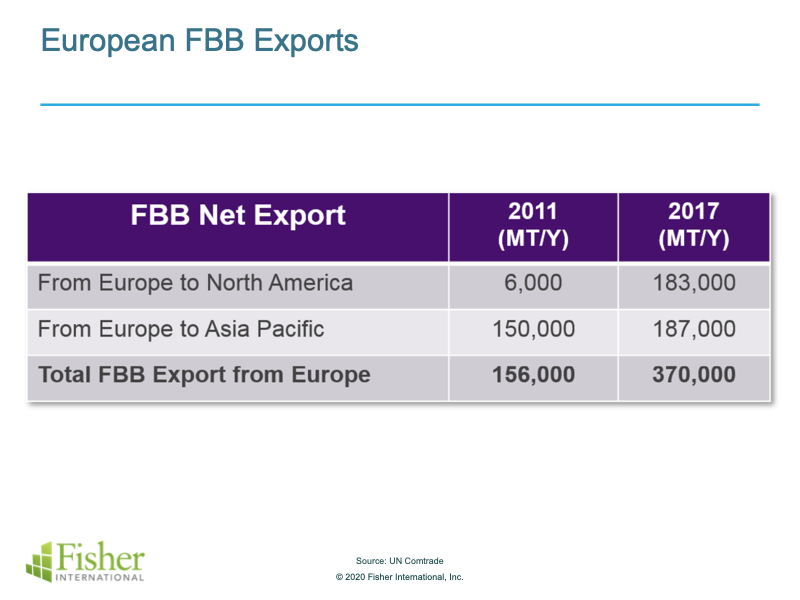

FBB exports from Europe to North America and Asia Pacific have grown almost 215,000 tonnes from 2011 to 2017 (Figure 4). This represents about 15% of the total growth between 2011 and 2017. FBB exports represent about 7% of total FBB production in Europe.

Export data also shows that North America has become a new market area for European FBB. It has succeeded in meeting the rising trend of lighter packaging materials with the same stiffness of North American SBS. Non- integrated converters in North America have also increased the FBB demand while searching for alternatives to SBS.

For more insight into the growth of FBB in Europe, download the Fisher analysis titled “Why Did Folding Boxboard Production Grow So Quickly in Europe?” by clicking here.