Panic buying, hoarding or establishing a “personal inventory,” however you want to describe it, the buying of tissue – especially toilet paper – has been a strange feature of the 2020 pandemic. In most countries – Australia and New Zealand are good examples – the only reason there were shortages of these products was because of the panic buying. Normal patterns of consumer behavior would easily have been met by local producers and importers.

It may be a comfort (or maybe not) that panic buying is not a peculiarly antipodean pursuit. Latest information tells us that across the world, where people have the means, they have built personal inventories of toilet paper and other tissue products.

The pandemic has sharpened some already clear trends in consumer behavior, as we heard earlier this month. A recent Tissue World conference (held online) heard from a number of tissue companies about the future trends that can be discerned from this period of peculiar consumer behavior. Here are some take outs:

Retail

- E-commerce deliveries of tissue products have increased five times compared to a year ago

- Online and discount club channels will deliver fastest growth in developed countries

- Manufacturers are pursuing “direct to consumer” or business to consumer (B2C) brands

- Supply chain costs may define competitive advantage in the future

- Supply chain cost is moving beyond “freight” and is now focused more on “post”

- By 2025, expectations are that 25% of retail will be “same day delivery”

Supply Chain

- It is essential to have a multi-channel, end-to-end strategy.

- Scale considerations are changing to meet emerging and rapidly changing supply channels.

- Consumers less concerned about the “where” and more concerned about the “how”. That is, suppliers need to focus on how they do business, more than where their products come from.

Sustainability and Innovation

- Successful producers are innovating and adding value through their emphasis on supply chain sustainability.

- Value in tissue goes beyond the product level, including into service models (like B2C delivery channels).

- A significantly higher spend is required on service in the new market.

- Consumers expect the shopping experience to be “click and its done” with less and less interaction required as time passes.

(The Managing Director of IndustryEdge, Tim Woods, was a panelist in the opening session of Tissue World’s Digital Days.)

There is a lot for a business engaged in providing consumer products/services to consider, but essentially it boils down to this: expect to deal more directly with consumers, who will require better service and faster delivery than ever before and will not tolerate failures in the supply chain – right from the fiber source all the way to the smile on the face of the delivery driver dropping off their personal inventory.

Local Experience Continues to be Patchy

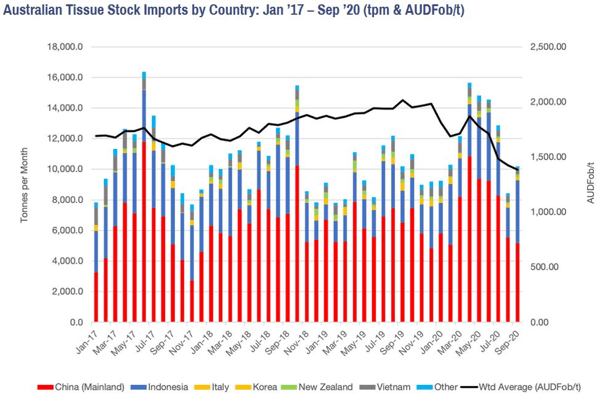

Meantime, back in the day-to-day realities of balancing surges in demand, the latest data shows tissue imports are at best, difficult to predict right now. As the chart below shows, imports of tissue stock leaped to near record monthly levels in April, reaching 15,650 tons, before correcting to 10,040 tons in September.

It is difficult to escape the importance of supply from China into the Australian market across all time periods, but in particular, its role as the main supplier of the “flex” volume required to supplement local supply when households went about building those personal inventories. The other supplier of significance is nearby Indonesia.

Source: Australian Bureau of Statistics (ABS)

On an annualized basis, year-ended September, tissue imports lifted 15.1% to 137,356 tons, only marginally (1.3%) lower than the record set year-ended June 2020.

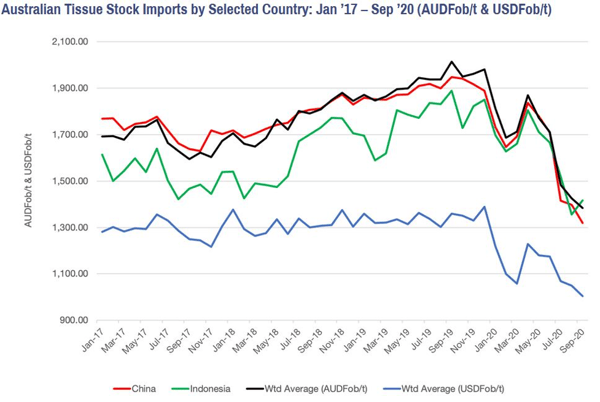

In some respects, the real interest lies in the average import price. In a period of sustained over-demand and some rapid actions being taken to ensure supply chains were replenished, prices would go up, right? Not on this occasion. As the chart below shows, there was genuine price restraint on imports.

IndustryEdge asked an importer why this was the case, and though it isn’t universally the norm, they suggested that some of the volume was perhaps not of the normal high standard of material that is imported. They added that one importer had brought in larger volumes they had acquired on the disrupted spot market, which accounted for some of the average price reduction.

But ultimately, as the chart shows, prices have declined steeply because the total global market is disrupted and there are supply imbalances that at least some buyers are able to leverage. Take into account the sustained low price of bleached pulp in China and throughout Asia, which has created a recipe for serious price reductions.

Source: ABS, derived, Reserve Bank of Australia (RBA) and IndustryEdge

In September 2020, Australia’s average tissue import price was AUDFob1,384/t, more than 31% lower than a year earlier. In US dollar terms, the average price was 26% lower over the same period.

The challenge for maintaining local production of tissue should not be underestimated. These imports are of tissue stock – for local conversion, including by the companies that also make tissue in Australia. Costs of production have not reduced significantly, if at all, over recent months. Local producers are in some cases being forced to import stock and convert it, in addition to manufacturing locally.

The real risk now is this: As local producers take these measures to sustain local supply, the increased imports could further reduce the capacity of the local manufacturers to continue production at current levels.

This analysis was first published in the Pulp & Paper Edge Data and Information Service in November 2020. Subscriptions include access to a wide range of data for Australia and New Zealand and the region’s only ongoing analysis of the fiber supplies, pulp, paper, paperboard and paper products industry.