When uncovering the foundational elements that ensure success for your company, it is important to keep in mind that knowledge is always power. Continuously staying informed of the various factors that impact your business is crucial to maintaining success within your industry. Especially within the global paper and pulp trade, where small changes along the supply chain can have cumulative impacts. Therefore, it is important to have access to reliable insights at the local, national and global levels that can help you confidently plan ahead for optimal success despite the potential for volatile market conditions.

Sustainable profits comes from the value gained through constant refinement of utilized assets. In commodity businesses like pulp and paper, that effectiveness is driven by a wide range of decisions which, when made marginally better, result in higher prices, higher operating rates, lower costs, and lower volatility than in less well-run firms. So, while capital investment is the cost of entry, profitability comes from superior decision making.

Market Trends

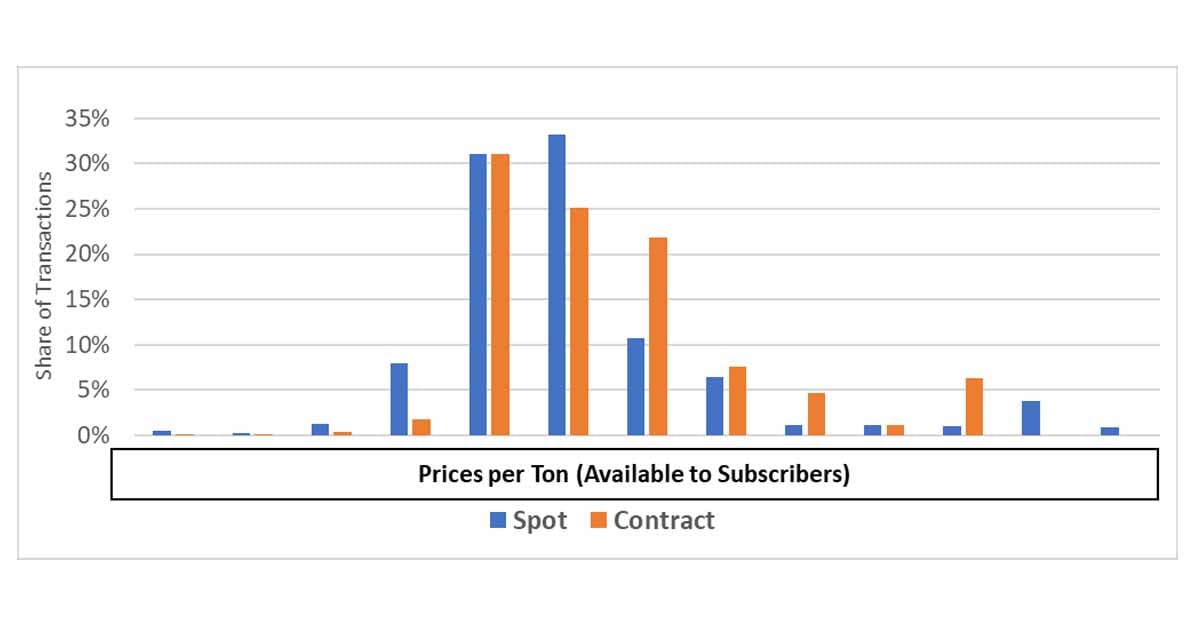

Analyzing data-driven market trends plays a critical role in understanding these insights because they allow you to evaluate the underlying drivers that affect your business. The Market Trends module in FisherSolve Next allows you to evaluate growth trends by paper grade and region, enhance budgets, identify economic threats to plans, prepare for market capacity fluctuations, and analyze cost and price sensitivity to macro-economic factors. This platform offers companies a competitive advantage by providing continuously reviewed and updated information that creates readily available data and insights that matter to you most.

Purposeful data-driven decision making isn’t just a way to become a better business; it’s a competitive advantage that businesses cannot afford to bypass. Business owners and managers today need intelligence resources that can both aggregate massive amounts of data and refine it to address the specific goals at hand. Fisher’s Market Trends module offers distinct data from Fisher International and trusted third-party sources all within an easy-to-navigate, singular platform.

|

Producers· Evaluate investment opportunities · Analyze cost and price sensitivity to macro-economic factors · Better anticipate the impact of global supply-demand on your product mix

|

Suppliers· Capitalize on changing supply and demand conditions · Plan for market capacity fluctuations · Track macro-economic factors for pricing impacts |

Buyers/Financial Services· Evaluate growth trends by identifying macro-economic threats to investments · Plan for market capacity fluctuations |

Associations· Plan industry events to match changing industry dynamics · Analyze key member-specific market factors |

Successful long-term business strategies rely heavily on the knowledge and data derived from analyzing market trends, and FisherSolve Next offers the ability to readily surface the valuable insights needed to uncover the best opportunities for success.

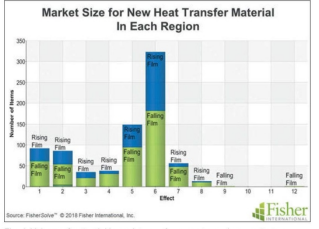

Case Study: New Product Development Analysis

A large supplier to the paper industry developed a new material with advanced heat-transfer properties. The pulp industry represented a potential market. To decide whether or not to invest further in application development, the supplier wanted certainty that the market would be attractive, i.e., not just in terms of the total potential, but also of the value it could potentially deliver to each customer.

Business intelligence defined the size of the potential market using detail on the capacity and design of every evaporator worldwide. Interviews with a sampling of people, also pulled from the business intelligence system, defined the value of this material compared to conventional materials. Then the business intelligence system extrapolated the value to all other mills based on the system’s cost-of-production model for every mill.

Planning & Forecasting

Uncovering new, viable market trends is just the first step. Formulating an actionable plan with a high degree of accuracy is the second step. Business planning is a complex procedure, but a reliable planning/forecasting model must take global, national and local events—and the interplay between them—into consideration. Fisher’s Market Trends module allows you to analyze economic and demographic indicators, apparent consumption, capacity, trade value and other related criteria to inform your decision-making process.

This allows you to uncover the market trends that matter most to you, including statistically significant correlations between the data, the economic indicators that affect demand (GDP, population, exchange rates, etc.) and the events that affect supply.

Global market uncertainty is the highest it has been since the Great Recession that began over 12 years ago. To alleviate some of the pressures that have impacted your business over the last several months, you need a collection of enhanced business tools that enable you to make better decisions with a high degree of confidence. Fisher’s products are designed to be the most relevant, data-intensive tools available to your management team.

For more information on how Fisher’s Market Trends data can add power to your business intelligence and improve your decision-making, or to add it to your FisherSolve Next subscription, contact us today.