As the biggest containerboard producer in China, Nine Dragons has always been an industry leader when it comes to strategic decision making that will help secure competitive advantages. From supplying raw materials to nationwide mill developments, Nine Dragons is oftentimes faster and more precise in its expansion plans compared to its peers.

For example, when facing the drastic change of China’s recent policy on overseas recycled paper imports, Nine Dragons was the first producer to act with a swift, strategic acquisition of recycled pulp assets in the US – other producers have followed suit over the years. We thought it would be of value to look closely at some of Nine Dragons’ innovative business moves over the years to see how they positioned themselves as one of the top industry leaders.

Within the past year, besides securing it’s recycle-based raw material supply through overseas investments, Nine Dragons announced its investment plan in two chemi-thermomechanical pulping systems for its planned mill in Beihai, China. According to news releases, the fiber lines will have a capacity of 1,000 admt/d and 670 admt/d, respectively, and will process a mixture of eucalyptus, acacia and poplar wood chips for the production of folding boxboard (FBB). The Beihai mill is planned to be an integrated pulp and paper facility with over 7 million metric tons of capacity of packaging paper, including 1.2 million tons of FBB. As noted in its annual report, Nine Dragons’ Chair, Ms. Cheung Yan, pointed out Nine Dragons’ interest in expansion into high-end packaging products. Ultimately, the FBB market is one of its key-focuses for future developments in China.

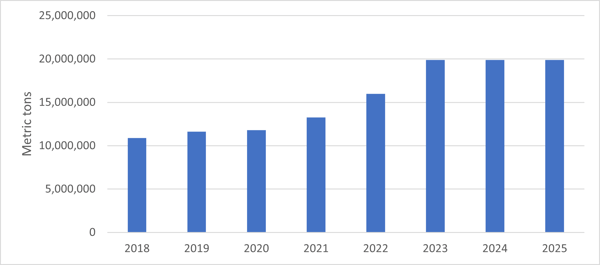

According to FisherSolve, Nine Dragons has a current capacity of 16 million TPY (not including US assets), which is mainly comprised of containerboard and recycled board with no FBB production yet. While it’s a brand-new product for Nine Dragons, it has been a hot investment within recent years as anti-plastic policies released in China and around the world have driven strong demand growth expectations. Together with FBB prices that skyrocketed last year, driven largely by industry consolidation (the number one producer APP’s acquisition of number three producer Bohui), FBB has been attracting huge capital investments in China as seen in the image below.

Figure 1. FBB Capacity Trends in China

Source: FisherSolve Next

Based on current announced projects, over 6 million tons of new capacity will come online between 2021-2025, which would almost double FBB capacity in China compared to 2018. If we look further into the new projects, they are mostly stemming from top FBB producers such as APP, Bohui and Sun Paper. Interestingly, traditional containerboard producers such as Lee & Man, Nine Dragons and Fujian Liansheng are joining this competitive market by announcing capacity investments of over 1 million metric tons respectively. Given the current market size at around 1.1 million metric tons of FBB/SBS in China, it looks like new investments could soon make the domestic market too crowded. Can these new containerboard giants be competitive in such a market?

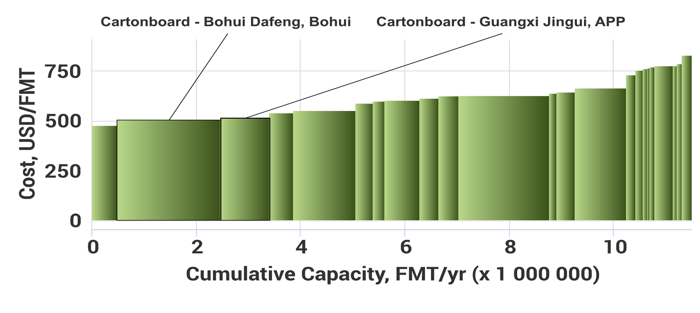

The value chain of FBB is different from containerboard, as it is heavily dependent on imported wood pulp to fuel the paper machines in China. Investing in local BCTMP/APMP lines is a solid and essential choice to compete in the market as it can significantly lower pulp costs compared to using only imported wood pulp. We can see from Figure 2 that the lowest cost FBB producers in China are those with their own pulp mills. With more FBB capacity being planned in China, it is expected that more BCTMP/APMP pulp lines will come online as well.

Figure 2. Manufacturing Costs of FBB in China, FOB Mill Site 4Q2021

Source: FisherSolve Next