The coronavirus has spread from the Chinese city of Wuhan around the world. Hundreds of people are dead, thousands have fallen ill, and millions are on city-wide lockdowns. Chinese markets have dropped and hospitals are clamoring for supplies to slow the spread of the mysterious sickness.

And though the focus of the entire world revolves around stopping the coronavirus, ripple effects will be felt throughout industries that rely heavily on the Chinese market.

To slow further spreading, the Chinese government postponed the off-holiday working days to Feb. 3 nationwide, and some provinces lengthened the holiday to Feb. 9. Local public transportation, services, schools and other fields that consolidate crowds of people temporarily closed operations.

Tech giant Apple has closed all of its stores and corporate offices in mainland China through Feb. 9.

Low industrial consumption and production caused by the virus have already caused significant harm to China’s economy. The tertiary industry (the segment of the economy that provides services to consumers) has taken the brunt of early economic effects as residents are required to stay at home and avoid public gatherings.

It’s estimated China missed out on $150 billion in restaurant, tourism, retail sales, and catering services during the week-long Chinese lunar new year holiday (Jan. 25-30). The figure equals 4.6 percent of the Chinese economy in the first quarter of 2019.

The Economist Intelligence Unit and S&P Global Ratings both estimated a 1 percent cut to China’s 2020 real GDP growth due to the virus.

Chinese paper manufacturers responded quickly to fight the disease and support Wuhan, a city of 11 million people, with cash and material donations. Some tissue companies provided facial tissues, diapers and surgical masks to mitigate medical material shortage.

The global situation is eerily similar to the SARS outbreak in 2002 that killed nearly 800 people in 17 countries. SARS took two full percentage points off China’s economic growth in the first quarter of 2003 (11.1 percent to 9.1 percent) and caused an estimated global economic loss of nearly $40 billion, according to the National Academy of Sciences.

And while the coronavirus (roughly 2 percent mortality rate) appears much less lethal than SARS (9.6 percent mortality rate) on a global level, China’s importance to the global economy is far greater today than it was 17 years ago.

Citing Oxford Economics, The New York Times reported China’s share of global trade has more than doubled, to 12.8 percent last year from 5.3 percent in 2003. According to the World Bank, the nation’s annual economic output has multiplied even faster in the last 17 years, from $1.7 trillion to nearly $14 trillion.

It might be too early to talk about the impacts of the outbreak on China’s paper-making industry considering the uncertainty of how the virus will develop, but the sector won’t go unscathed.

According to FisherSolve Next, a temporary shutdown of 10-21 days could result in a loss of 4.7 million tons of production in paper and packaging grade products or 4 percent of China’s estimated total paper and packaging production in 2020.

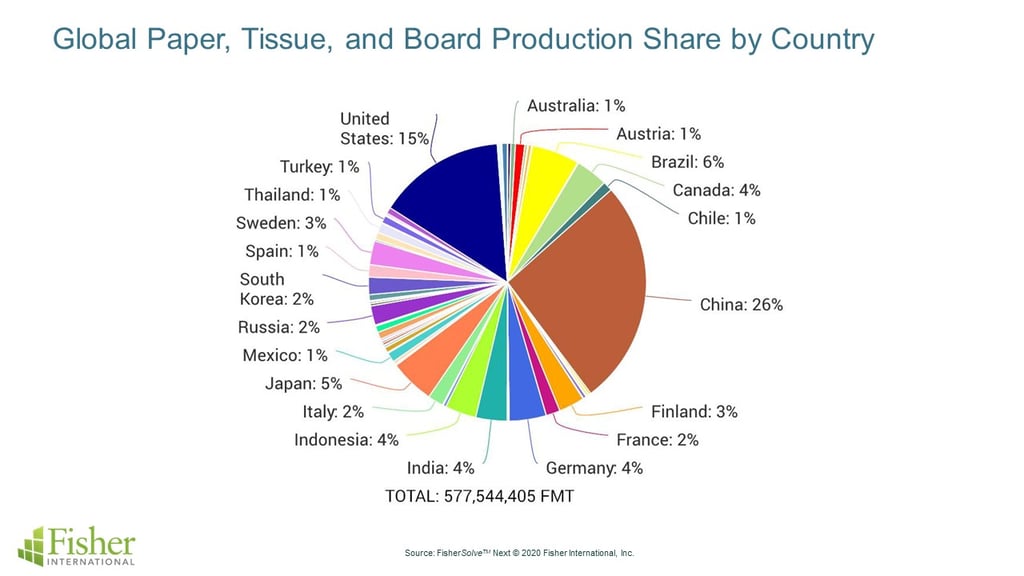

And 4 percent of China’s production is disproportionality important as the nation accounts for more than a quarter of the world’s paper, tissue and board production.

Going forward, there’s potential for an increase in demand in some tissue types, but Chinese manufacturers are treating the outbreak as a social health issue rather than a commercial opportunity.

However, the coronavirus outbreak will likely boost online consumption in the near term as people minimize contact with the public, which will benefit the packaging industry.

As for the impact on other nations, any drop in Chinese paper production will result in a decrease in exports from countries that ship pulp or recovered papers to China, which relies heavily on raw material imports. In the interim, this could create opportunities for countries that sell finished paper products to China directly.

For now, the world is forced to wait and see not only how the coronavirus will develop globally, but also how the economy and paper industry will respond.