On January 20, 2021 Joe Biden was sworn in as the 46th President of the United States, which capped off an especially contentious election season. The Biden administration has widely publicized that a key component of its vision for the country is pursuing clean energy to help mitigate the impacts of climate change; he even wrote one of the first climate bills in the US Senate.

How could this new administration and its push for clean energy affect the tissue industry?

Watch Matt Elhardt’s Recent Presentation on this Topic

What We Already Know

President Biden has rejoined the Paris Treaty on Climate Change and has promised an enforcement mechanism to limit carbon emissions in an attempt to curb climate change. He has also selected Janet Yellen as the new Secretary of the Treasury, who has been open about her support for a price on carbon as a means to drive reductions. While Biden has also said that he supports a carbon tax, his team seems to favor an Emission Trading System (ETS).

California currently operates the largest carbon regulatory regime in the United States through its own ETS system, which is also known as “cap and trade.” This means that benchmarks for carbon trade emissions are established by an individual industry; each unique manufacturing sector essentially has different carbon targets. If a single manufacturing facility exceeds its allotted benchmark, a penalty is administered in the form of a fee.

Broad adjustments are factored in as a way to prevent job losses so that regulation doesn’t completely stifle profitability, which could result in curtailments or closures. But high performing facilities are able to sell or exchange their surplus “credits.”

What if an ETS System Was Established for the US Tissue Industry?

There has already been at least one public lawsuit by a major tissue producer regarding California’s ETS system, which means we know that it does, in fact, affect the tissue industry. If an ETS system like California’s were to be established on a national scale, what would that look like for the entire US tissue industry?

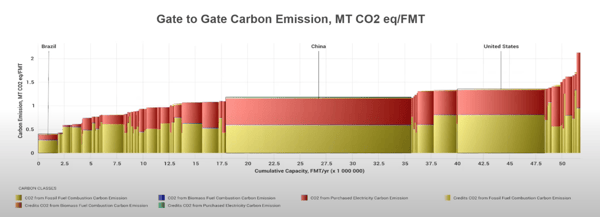

Using the Carbon Benchmarking Model from FisherSolve ™, we can see that the United States is a fairly high emitter of carbon compared to the rest of the world, averaging around 1.3 metric tons of CO2 per metric ton of finished product. Brazil, on the other hand, is on the lower end below 0.5 / ton of carbon per ton of finished product. We can also see that a significant amount of the CO2 being emitted is from mills that are still using fossil fuel combustion to create energy and power the mill.

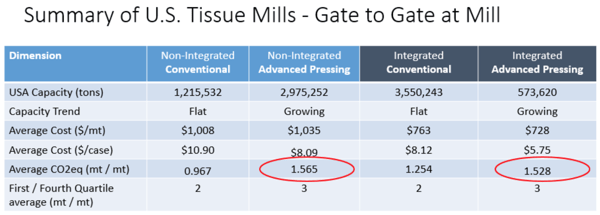

When we narrow our view from a global perspective to just the United States, we can see from the chart above that machines and mills that are creating higher quality products also have a larger carbon footprint, as measured on a CO2 equivalent per ton of finished product basis. This means we can assume that if a regulation were to be placed on carbon, it would raise the cost of manufacturing for these producers, making their lower-carbon competitors potentially more competitive in the marketplace.

Interested in learning more about how the FisherSolve Water Supply & Treatment and Carbon Emissions modules can help you analyze and address these topics in a changing global market that will be increasingly impacted by ESG initiatives? Carbon benchmarking in FisherSolve includes the CO2 footprint analysis of every machine, mill, company, country, and world region. This unique resource supports analysis of carbon emissions at both mill and macro levels with standardized measures and consistent methodology for the industry worldwide.

Tissue products drive strong consumer emotional reactions, and carbon content could join growing sustainability concerns and public perceptions. An increase in consumer awareness around this topic is already driving changes in the market, as consumers are demanding products that are more in tune with ESG initiatives and the circular economy. Could NGO and consumer advocates also report carbon content that would cause sustainability concerns against the advanced technology or ultra-premium products that dominate the American consumer space? Ultra-performance tissue producers may want to have a sound understanding of the metrics and their individual performance in order to address such concerns.

While a national ETS system has not yet impacted the tissue industry, the possibility is not far-fetched given what we know about the Biden administration’s intentions to tackle climate-related policy concerns.