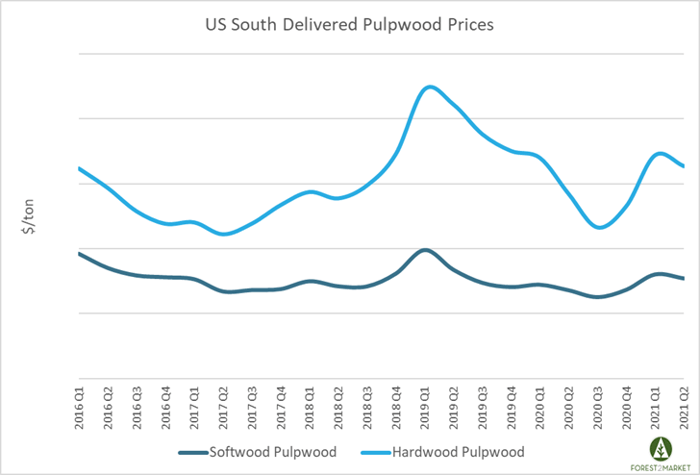

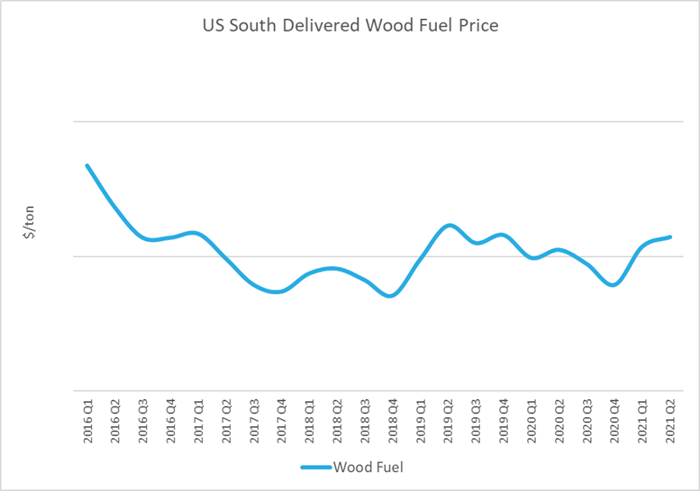

The 5-year delivered price trends for pine and hardwood pulpwood, as well as wood fuel in the US South have demonstrated a fair amount of volatility; hardwood pulpwood tends to be the most unstable. After bottoming last year in the wake of the COVID-19 pandemic, however, all three products have trended higher.

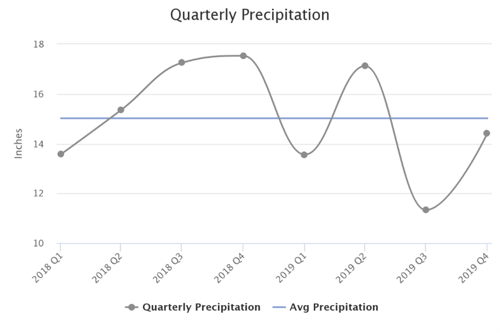

For softwood/hardwood pulpwood and wood fuel, 2019 represented a point of peak volatility over the 5-year period that was driven in part by the significant amount of precipitation that the South experienced from 3Q2018-2Q2019. With a major swing in rainfall over the 3-quarter period came an equally sizable swing in wood raw material prices as harvesting operations were constrained by the weather.

Then came the unimaginable, cascading events of 2020’s pandemic, which caused a disruption to the forest supply chain in every way imaginable. What can we learn from recent price performance?

Pulpwood Products

Year-over-year (YoY), delivered prices for both pine pulpwood and hardwood pulpwood in the US South increased (2Q2020 to 2Q2021).

- Delivered pine pulpwood prices were up 3% YoY at the end of 2Q2021.

- Delivered hardwood pulpwood prices were up 5% YoY at the end of 2Q2021.

Quarter-over-quarter (QoQ), delivered prices for pine pulpwood and hardwood pulpwood in the US South decreased (1Q2021 to 2Q2021).

- Delivered pine pulpwood prices were down 0.9% QoQ at the end of 2Q2021.

- Delivered hardwood pulpwood prices were down 2.0% QoQ at the end of 2Q2021.

2H2021 Outlook

Despite a fourth month of wet weather (areas surrounding the Gulf Coast are at 157% of normal rainfall), delivered pine pulpwood price movement should be minimal as the market settles into typical seasonality patterns through the remainder of 3Q. As we approach the dog days of summer, most of the South is drying out, although tropical storm/hurricane activity has the potential to impact availability in certain areas. Any near-term upward price pressure will likely come via some combination of rising fuel prices and increased freight rates caused by trucking shortages.

Hardwood pulpwood will follow a similar trend and will be impacted by the same market dynamics. However, HPW could demonstrate more volatility through 3Q and 4Q should housing starts fall off significantly, which would impact pine sawtimber demand, clearcut harvests, and HPW supply.

Wood Fuel

Year-over-year (YoY), delivered prices for wood fuel in the US South also increased (2Q2020 to 2Q2021) to their highest level since 4Q2019.

- Delivered wood fuel prices were up 0.9% YoY at the end of 2Q2021.

- Delivered wood fuel prices were up 0.7% QoQ at the end of 2Q2021.

2H2021 Outlook

As long as housing starts and general economic conditions remain stable, wood fuel prices should demonstrate minimal volatility in the second half of the year. Under these circumstances, southern sawmills will continue to run at near maximum capacity, which would generate constant flow of wood fuel. This steady production will help keep supply and demand in equilibrium, allowing prices to remain fairly stable.