Anyone who reads or prepares financial reports or literature knows how important ESG (Environmental, Social & Corporate Governance) is currently, but the truth is, it was a key investment concern long before there was a catchy acronym. The term ESG was coined around 2005 (as an offshoot of Socially Responsible or Ethical Investing), although it was another full decade before it became a standard part of the Wall Street lexicon. Today, communicating the ESG message is so paramount that it is often intertwined with a company’s strategy or mission statement, which is paradoxical since strategy should conceivably evolve more than a company’s commitment to doing the “right things” all the time.

Given that ESG is a term primarily targeted toward the investment community, this discussion will focus on financial and quantifiable themes. We believe that the “E” (Environmental) in ESG comes first and is the most important from an investor standpoint because carbon intensity (does it emit or sequester carbon?), water use and quality, climate impacts, and sustainability are top of mind in a world buffeted by extreme weather events, pandemic responses and supply chain constraints.

The Social and Governance components of ESG are important too, as a company’s relationship with its community and management’s ability to develop strategy, allocate capital, establish a culture and draw and retain talent are intertwined. The last point — attracting and retaining talent — could possibly be the most underestimated element of ESG, as the current cohort of new workforce entrants place more importance on ESG & DEI (Diversity, Equity & Inclusion) metrics and workplace satisfaction than their predecessors. Taking this full circle, a company that can’t attract and retain the best talent won’t be able to maximize shareholder returns or contribute to other causes for the benefit of society, and the ESG story breaks down.

ESG in practice is about much more than just optics and good PR; it’s important for a company not only to walk the walk, but to also talk the talk in a fashion nearly as concise as the three-letter acronym. Corporations must articulate their ESG strategy as part of their license to operate, maintain their reputations with the public, and nurture relationships with consumers in order access capital markets. Those that do it well will participate in a virtuous feedback loop with their communities, customers and shareholders, and those that don’t will destroy value – a breach of their primary fiduciary duty.

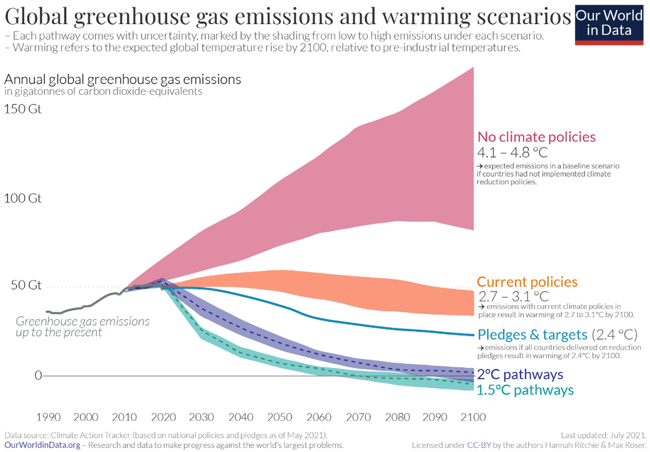

If a feedback loop is an accurate description of ESG in action, then understanding the importance of the factors in the circuit requires isolating each of the three. Since the Social and Governance components of ESG are extremely subjective, the most quantitative elements of the disclosures generally surround the demographics of a company’s workforce or board composition and management compensation, and then describe policies associated with data, privacy, human rights, lobbying, etc. We believe carbon is the lightning rod, where energy and eyeballs will be continually focused because the detrimental impacts can be seen almost in real time, while things that go right take decades to play out.

Sticking with carbon and water, these two elements will likely be the key to any environmental scorecard moving forward, as they already have a slew of targets (Carbon Neutrality by 2050 and the Clean Water Act) and because impacts on these fronts can be seen and smelled (airborne smog, polluted or unsafe water, etc.) and aren’t tolerated in their immediate communities. While addressing long-term issues takes a generational investment approach, identifying and sanctioning breaches of standards or unacceptable behavior can be done in real time.

CLICK BELOW TO READ THE FULL REPORT