Like most, I’m reading the daily updates about the coronavirus (COVID-19) crisis, and if anything is certain, it’s the uncertainty of the overall impact of the virus – how deep, and how long.

Over the span of five days, Goldman Sachs adjusted its U.S. GDP forecast by nearly 20 percent, for example. It subsequently revised it – downward, again just a few days ago. It seems most experts agree that we’ll have a dark cloud over ourselves – and our economy - until a vaccine is developed, or until our populations develop so-called “herd immunity”.

The first vaccine trial in the US began this month in my home city of Seattle, a “world record.”

Even given the rapid time from gene sequencing to the first vaccine, the consensus view among experts seems to be we might not have a vaccine for the population until Q1 2021.

Adding to this uncertainty is the programs used by government to contain or control the virus spread – ranging from extreme social distancing (USA) to complete quarantines (China in February, India, and now Italy).

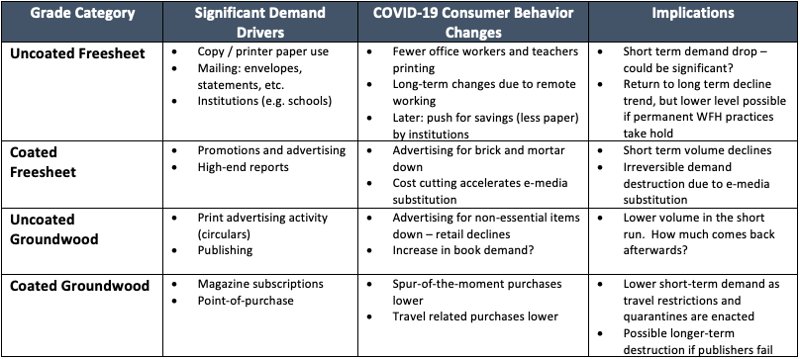

How might this impact printing and writing paper? At a high level, we can imagine at least the following:

Printing and Writing: Already a Stressed Segment

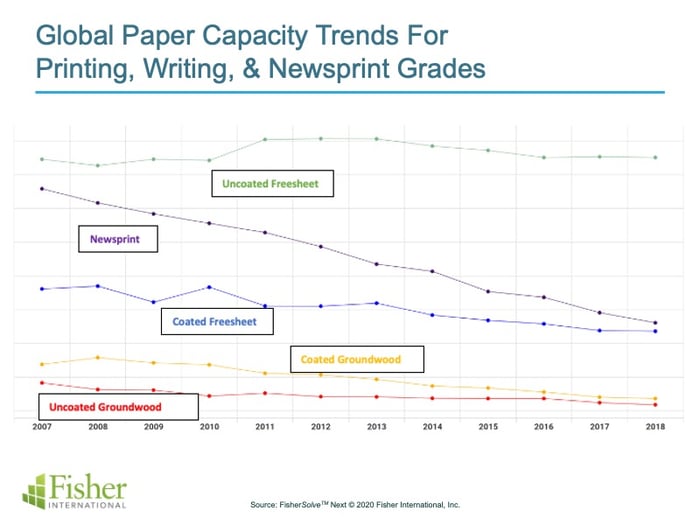

It's well known that printing, writing, and newsprint paper demand has been under pressure for some time. While the rates of change by country are different, since 2012, global capacity has been declining from -1 percent for uncoated freesheet (used in copy paper, envelopes, etc.) to -4 percent the coated groundwood grades (used in magazines, weekly circulars), to -6 percent for newsprint. This is shown in the following chart from FisherSolve™:

Unequal declines, coupled with poor timing of capacity additions, have created persistent oversupply issues globally, which can be seen in export/import trends (mills looking for volume seek new customers continuously), and also, overall pricing trends.

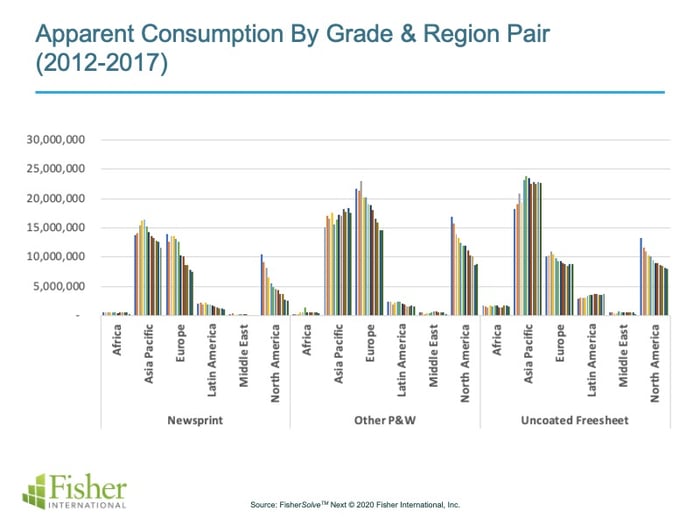

From FisherSolve™, we can evaluate consumption by grade, as well as capacity. Analyzing the data, we see uncoated freesheet, for example, has declined in the developed world, while remaining flat in Asia.

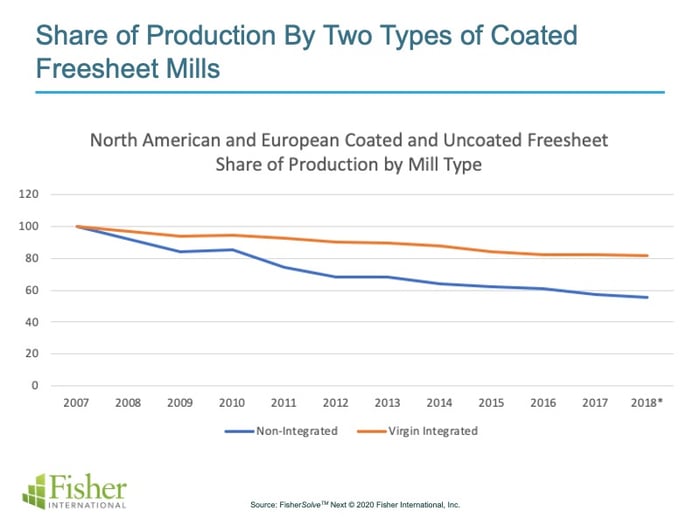

These impacts have spilled into other markets, particularly pulp, due to reductions in demand from non-integrated mills, which have closed at a higher rate than integrated mills. The result is lower purchases of market pulp. And, since non-integrated mills tend to close at faster rates than integrated mills, this results in lower demand on pulp than would've been calculated from the end market’s demand alone.

So, What Should You Do?

Already, management consultants are out with playbooks defining how organizations should react to the crisis. Most share a common theme consisting of forming work-teams of your resources to tackle the various aspects of the issue, from supply chain resilience, to cash collections, to developing strategies to work from home. Whether it’s “create a nerve center” or “establishing a senior team in a war room setting,” at this point with the situation changing quickly, I believe it is better to get started than to get right.

Already, management consultants are out with playbooks defining how organizations should react to the crisis. Most share a common theme consisting of forming work-teams of your resources to tackle the various aspects of the issue, from supply chain resilience, to cash collections, to developing strategies to work from home. Whether it’s “create a nerve center” or “establishing a senior team in a war room setting,” at this point with the situation changing quickly, I believe it is better to get started than to get right.

If you haven’t sketched out a plan to deal with the impacts of the virus, do so now.

At Fisher, we've already instituted travel restrictions, work from home (WFH) policies, and proactive outreach to customers. Most of our employees already work remotely, so fortunately, we are more prepared than many companies to transition to WFH.

Big Problems Call for Big Data

What about your markets? Once you have addressed the “must-do” actions to keep your business going, how are you going to navigate the coming changes to the markets?

At Fisher and Forest2Market, we think about this a lot – it’s the foundation of our business and mantra. In a capital-intensive industry, the cost of good data is insignificant, so much so that it almost always pays to have the best possible information.

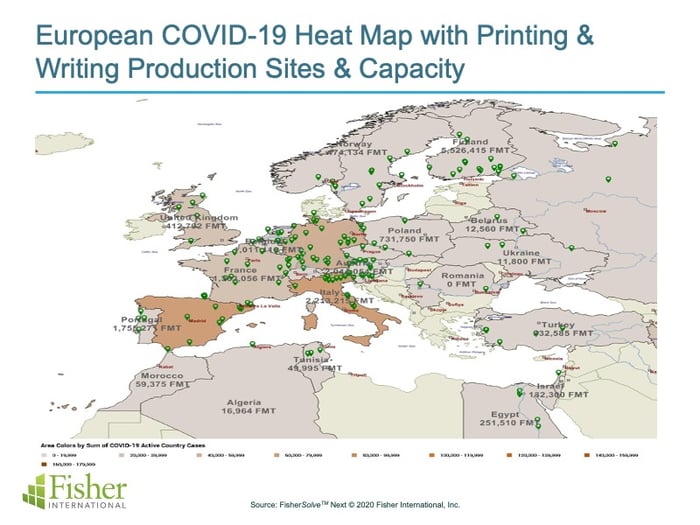

With that in mind, we are providing two new tools at no cost to analyze this impact: a forecast tool for global pulp and paper demand by country/region and COVID-19 data in FisherSolve ™ Next.

With these new features you can gather necessary market data quickly, then run scenarios in order to develop strategies for each.

I know – I’m biased – but I’ll ask you to take a moment to think about it. What kind of information about your customers, markets, competitive environment do you need to navigate the next 12 months? How important is this to you? How much would it cost compared to:

- A new headbox ($5,000,000)?

- The money you’ve avoided spending on industry conferences that are canceled ($100,000)

- To avoid shutting down a mill (at least $20,000,000)?

- To avoid customers who default on AR (several million for large suppliers?)

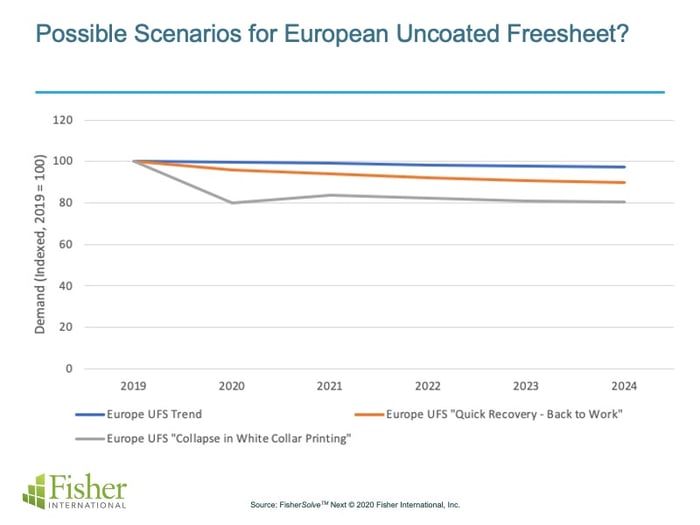

The first step is to define future scenarios, given the uncertainty of the upcoming year. For example, European uncoated freesheet:

In this chart, we’ve shown the trend (in blue), along with two possible future scenarios, one that reflects a quick recovery, and one whereby some demand is permanently destroyed due to changing consumer preferences and lower wealth, accelerating adoption of lower cost e-media.

In the more bearish case, we assume not only a significant impact to printing and copying – due to work from home, quarantines, and institutional alternatives (like my kids now submitting homework online versus on paper worksheets), but also, that companies see some of those options are preferred, which results in permanent demand destruction before reverting to the longer term trend.

As a mill owner, or supplier mills, your strategy to navigate the next year could vary dramatically for each strategy. And although we can say for sure there is uncertainty (perhaps great uncertainty) in what might happen, this shouldn’t stop business owners from being prepared.

How will COVID-19 and resulting economic scenarios impact your business? What are the likely range of outcomes? For each, do you have a playbook in place defining what you will do?

In order to develop strategies, these are some of the fundamental questions management teams could be asking themselves:

- If demand does fall dramatically, how are your assets on the cost curve? Will they survive?

- For export businesses, are your mills more at risk than those in other countries? Is there an inventory strategy to execute?

- What will future prices do by scenario? What’s our cash flow scenario in each?

- Does our customer mix put us at risk? If we supply to the industry, what is the viability of mills versus our revenues? See chart at left.

- If company valuations fall, who should we buy? Which are most attractive for our business?

- What new products can we develop to support the industry?

Free Resources From Fisher International

Over the last few weeks we've developed the following two new tools for use by our customers, and will be offering them free to subscribing clients with the requisite scope of data:

- An econometric model to convert forecasts for the virus’ impact into paper and pulp demand, for every major grade in every country and region in the world.

- COVID-19 related data integrated into FisherSolve™

Please contact us here at Fisher International to learn more about FisherSolve™ Next and how it can help you navigate these uncertain times.

Matt Elhardt is a Strategic Planning professional with 20 years of pulp and paper industry experience in sales, marketing, product development, and operations. His area of expertise is identifying growth potential and achieving performance end-goals through strategic management, pricing and margin optimization, and anticipating marketplace dynamics.