An Overview of Starch in the P&P Industry

Starch is the primary adhesive used in bags and containerboard. In North America, the starch used in the Pulp and Paper industry comes from corn, potatoes and tapioca – wheat and rice were once used but have been dropped for economic reasons – however, most starch producers in NA now use corn. Europe, on the other hand, mainly uses potato starch products whereas far Eastern Asia uses tapioca starch-based products. These various starches have variable costs and applications as they all perform differently due to their respective solids, viscosities, temperatures, strength and quantity needed.

The largest starch producers in North America include Tate & Lyle, ADM, and Ingredion. These types of companies contract with farmers to plant a certain amount of acreage of corn to ensure their supply a year in advance. Typically, farmers will order the seed corn from November through January from the seed companies for planting in the upcoming spring months.

It's important to note that the corn that is used for human consumption (frozen, canned, corn-on-the-cob) is sweet corn, which is classified as anywhere from 45–60-day corn. Whereas the corn used for ethanol, livestock feed, starch, fructose, cooking oil, and other industrial uses is 120-day corn. They are completely different varieties and for practical purposes are not interchangeable for their different end-uses.

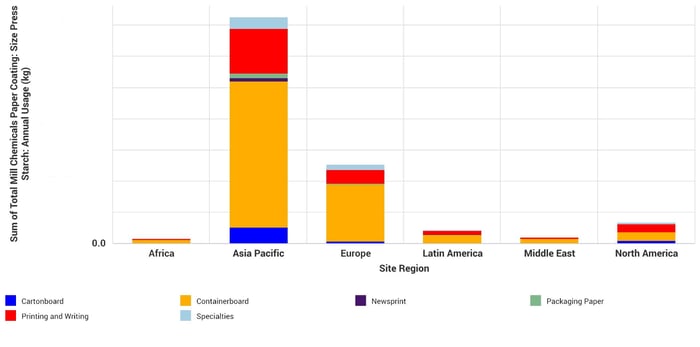

To get a better understanding of the use of starch in the P&P industry, the image below illustrates the estimated consumption of size press starch products for 2Q2022 by region and paper grade.

Consumption of Size Press Starch by Region and Major Grade

Source: FisherSolve

Factors Impacting the Starch Shortage

The corn starch market is projected to witness a CAGR of 6.35% during the forecast period of 2022-2027. Currently, demand is higher than market supply. One factor contributing to this is that due to its binding and disintegrant properties, cornstarch is often used in medication manufacturing, and since the onset of the pandemic, demand for medications has increased drastically.

In addition to increased demand, transportation disruptions have also played a major role in the starch shortage. Corn mills operate 24 hours/day to churn out corn, but supply chain delays have caused major interruptions at the mill level where inventories may stockpile due to transportation shortages.

All in all, the starch shortage appears to be supply/demand driven as opposed to some of the global food shortages that are arising. However, this is a serious situation that may cause cascading impacts considering there is about 300 MM lbs. of additional starch demand coming online from the P&P industry over the next 12 months. This demand will be coming from increased production of containerboard grades due to paper machine conversions, as well as new recycled fiber paper production. The increased containerboard production should also result in increased containerboard converting activities. A secondary demand source will be the bag converting industry as the demand for paper-based packaging is expected to increase due to plastic substitutions for a more environmentally friendly packaging option.

Questions to Consider

As we enter this period of uncertainty in the starch market, it’s important to keep these critical thinking questions in the back of your mind:

- What options, besides chemical resins, if any, are there to replace starch in the short-term?

- In what ways can producers reduce their starch usage?

- Which grades will be impacted the greatest?

In such a volatile global economy, it’s important to access robust datasets and practical insights to anticipate market shifts. For further insight into these questions and others, Fisher International offers unparalleled business intelligence and consulting services that allow innovative and forward-looking companies to identify new opportunities that drive business success. Talk with one of our experts today.