China and India account for more than one-third of the world’s population with India predicted to exceed China as the most populated country by 2024. Its already large economy is also expected to surpass the United States as the second-largest global economy by 2030.

However, India is just the fifth-largest paper producing country in the world and accounts for only 4 percent of global paper production. Why?

Using FisherSolve Next™ data and intelligence, we’ve pinpointed three factors to help explain why India hasn’t become a predominant power in the pulp and paper industry.

1. Lagging GDP, production capacity

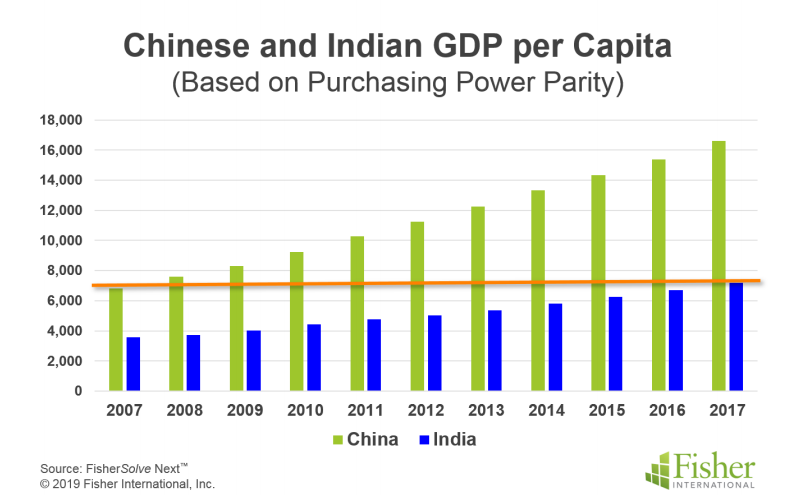

India’s population may be creeping closer to China’s, but both its gross domestic product (GDP) and paper production capacity are decades behind.

In 2017, India reached a GDP per capita that mirrors China’s GDP per capita of 2007 – just prior to China’s explosive growth period. However, China’s 2007 total paper capacity dramatically dwarfs that of India currently, with India more resembling China’s market from 20 years ago.

.png?width=795&name=India_blog_Slide_2%20(1).png)

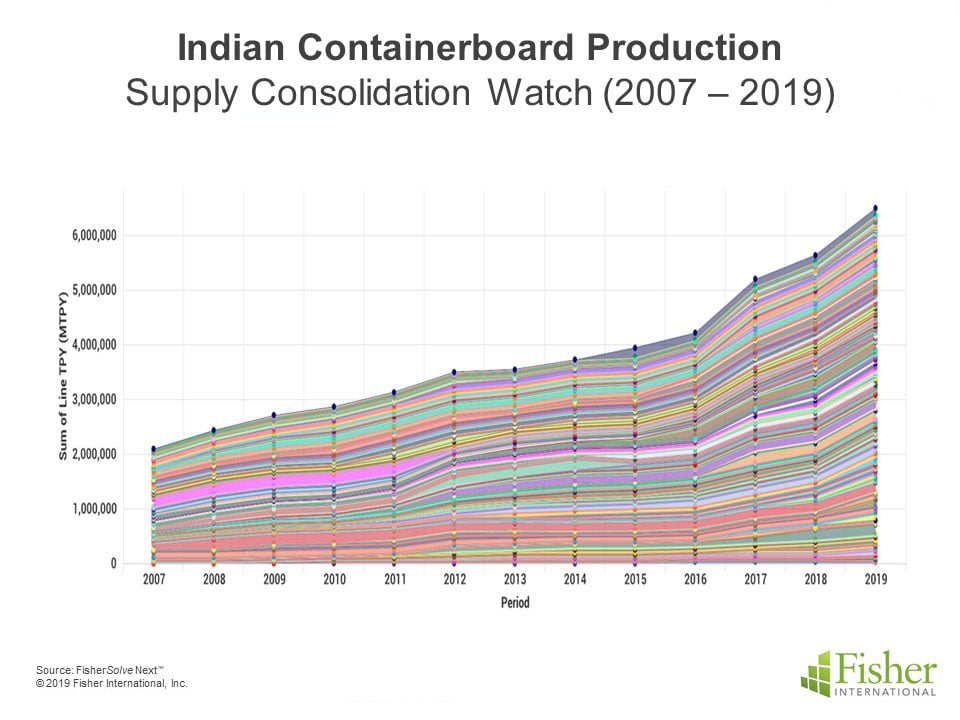

2. Market fragmentation

India is the most fragmented major global market in the world. Capacity share of the top three paper producers is only 10 percent. Looking at containerboard, the number of producers has more than doubled since 2007.

Fragmentation is in part due to the fact the Indian market hasn’t matured. Once growth begins to slow and there is no new capacity built, it’s expected that consolidation by mergers and acquisitions will start.

Moreover, larger and competitive manufacturers will likely force smaller and inefficient producers out of business. While consolidation in China has been driven as of late by government-imposed environmental legislation, this is not something seen on a large scale in India – yet.

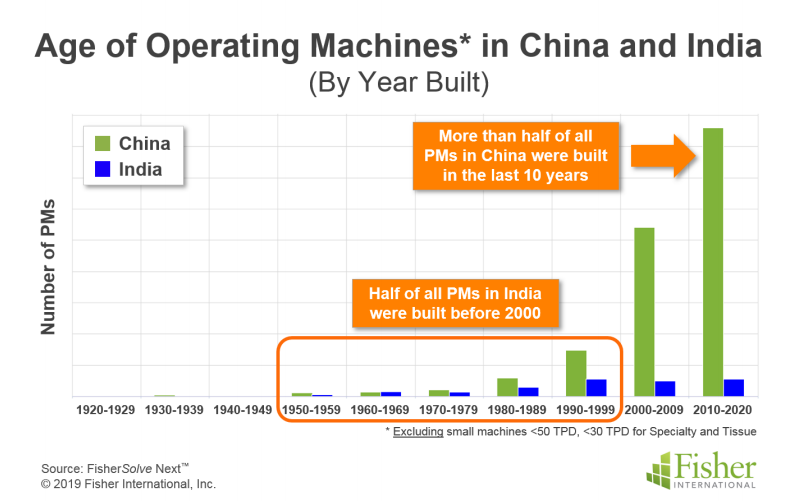

3. Small mills, old machines

Ownership in India is still predominantly small, privately owned (over 80 percent) and in clusters, driven by water and availability of raw materials. This is in sharp contrast to China, where most mills were state-owned until shifting to private and public ownership at the turn of the century.

Assuming demand growth would be met by local production instead of imports, and an ongoing robust GDP and population growth, it’s anticipated there will be a need for approximately 500 additional machines (an average machine size of 30,000 MT) to meet this growth by domestic production. This is double the country’s current number of large machines – and still far behind China’s 3,250 machines.

India’s machines are also much older than China’s, highlighting the need for modernization. While domestic paper machine suppliers dominate in both China and India, Western paper machine suppliers appear to be more successful in India than China.

So, could India enjoy supercharged growth in the industry similar to China over the last two decades? The short answer is no.

China’s economic and political structure enabled it to make a strongly managed top-down shift and redirection of its national economy, including heavy investments in infrastructure in a short amount of time.

India’s non-centralized economic and political structure makes a similar change initiative challenging and requiring much more time to implement. Nonetheless, India will still offer attractive although smaller opportunities for fiber imports, new and larger machines, and greenfield investments.