If you were to interview any well-experienced paper maker in the field, you would likely find many have a similar mindset when it comes to producing paper: A mix of fiber will contribute to better machine runnability and improved paper characteristics. However, this is not always the case once fiber availability, price and commercial terms interfere in the pulp mix choice.

From a fiber perspective, Chemical-Thermal Mechanical Pulp (CTMP) and alike are the ideal types of material pulp producers want to use. This is because the yield wood versus pulp is huge when compared with kraft pulp.

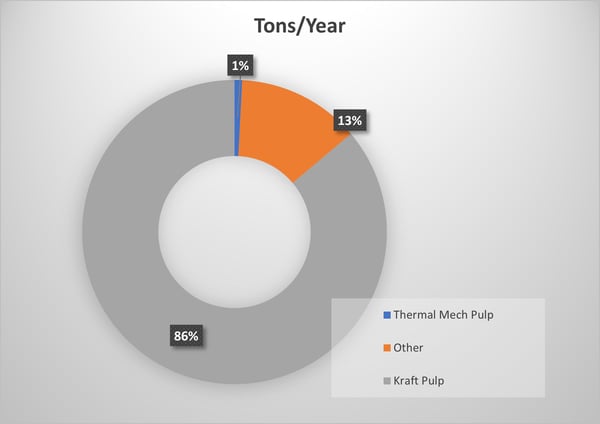

Looking at the marketplace in Figure 1, the global use of CTMP is almost zero. This piques curiosity because the market would very well accept this type of fiber. So, why is this? Because of its price.

Figure 1: Use of Pulp in the Global Marketplace

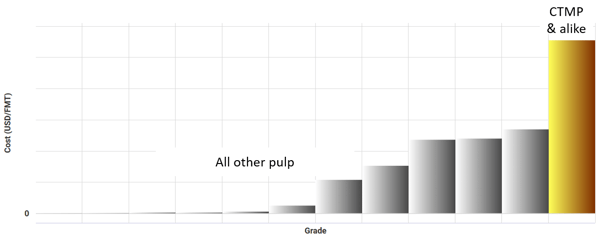

CTMP is an energy intensive fiber. With increased regulations being placed on energy usage, there is a significant difference between the cost of CTMP versus other pulps (as seen in Figure 2). Therefore, many feel it’s not worth the hefty bill.

Figure 2: Energy Cost by Market Pulp Grade

Source: FisherSolve

However, after understanding the benefits that could come with using CTMP, a few integrated paper producers have announced new projects to expand its CTMP capacity. These new projects come despite the higher energy cost. For example, SCA made the decision to increase its production of CTMP from 90,000 tons to 300,000 tons in its new pulp mill at its Ortviken site.

Companies’ decision to now produce CTMP is also due to the large surplus of energy these new kraft lines now possess thanks to new technologies and improved processes. With CTMP being an energy intensive grade, these advancements make producing it much easier and attractive.

However, from a strategy standpoint, this means each mill must weigh a few options:

- Sell the energy surplus in the market?

- Invest in new integrated paper machines on site to consume energy?

- Produce CTMP, increase the yield and save wood?

- Sell the tall oil instead of burning it?

Are You Passing Up Major Opportunities?

If you are a market pulp producer, it’s important to analyze and consider the advantages of all your options. Dismissing a chance to pivot to produce a desirable and advantageous grade within your mill due to a lack of insight of what the big picture would actually look like could end up being a missed opportunity.

Before immediately crossing an option off your list, it’s important to make sure you have the right data. That way, you can better understand which direction would fit your mill the best.

Fisher International’s Virtual Mills module can provide market pulp producers exactly what they need. A Virtual Mill is a confidential, user-defined mill that passes through Fisher's proprietary mass and energy balance model and delivered to the client via our business intelligence platform FisherSolve. Virtual mills can represent any greenfield, brownfield, rebuild or grade change project.

The virtual mills are modeled with the same rigor as existing sites. The results — such as cash costs, energy consumption, or carbon emissions — can be visualized and benchmarked against existing sites and other virtual mills in FisherSolve. Analysis of virtual mill results can provide significant insights for decision-making as multiple scenarios can be evaluated.

With this tool, market pulp producers can assess the aforementioned variables and questions. This will help determine what options are available to make a new investment in a different grade such as CTMP. This is a critical tool, as in many countries this must be revisited every other year or so, given the constant changes in market variables such as energy policies.

Interested in learning more about how our Virtual Mills module and other Fisher Solve functions can help you better prepare for the future? Schedule a free demo today.