Chlor-alkali is an industrial process widely used to produce chlorine, caustic soda, and other chlorine and sodium derived/based products. The pulp and paper industry, which accounts for 15% of the global caustic soda consumption, is the third-largest market for the chlor-alkali industry. Principal uses of caustic soda in pulp and paper production include the cooking/processing of Kraft pulps, the extraction of lignin during the pulp bleaching sequences, and the on-site manufacture of sodium hypochlorite.

Prior to the COVID-19 outbreak, caustic soda demand was firm with most sectors showing steady growth over the past few years. However, when the COVID-19 pandemic hit the US in March 2020, the market shifted very quickly, going from plentiful supply and higher inventories to a considerably tighter market as operating rates were cut due to poor chlorine demand.

Many industries were impacted by the COVID-19 pandemic, particularly in 2Q2020 when demand destruction was significant in the construction industry and when PVC became particularly weak, pushing down chlor-alkali operating rates. Demand is now beginning to rebound back to normal pre-COVID-19 levels and while the pulp & paper market is slowly recovering, organic and inorganic chemical demand is strong.

Due to some manufacturing units being offline in the past couple of months, supply is tightening, and export volumes have been lower. The offline units have offset reduced US export demand in the past few month, and Alunorte has reduced its alumina plant operating rate to between 35% and 45% for the next two months due to operational and maintenance issues at its pipeline.

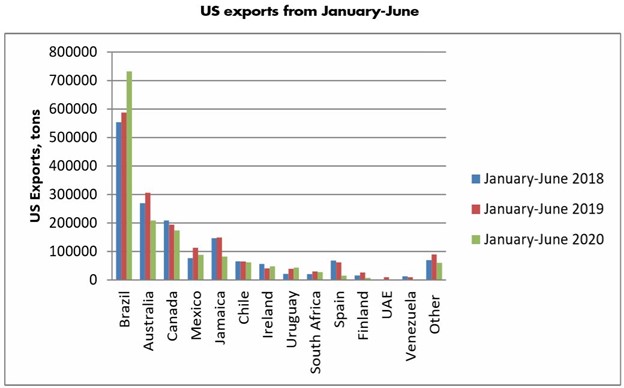

There has also been a change in trade flows since the beginning of the pandemic; the primary change has been a notable increase in exports to Brazil compared to previous years. In the past two years, demand from Brazil has decreased due to lower operating rates at Alunorte but in May 2019, Alunorte was permitted to ramp up production to normal levels after running at half capacity for over a year. The increase in caustic soda demand for Alunorte has offset the decline in demand caused by South America’s wider economic challenges.

US exports to Australia have also decreased in 2020 due to competitive prices in Asia making exports from the US less favorable. While alumina is a minor end-use in the US domestic market, high volumes of caustic soda are shipped from the US gulf to the global alumina market, particular in South America. However, US production volumes of caustic soda in August were still over 20% lower than August 2019.

What’s Next for the Chlor-Alkali Sector?

As we enter the final quarter of 2020, the chlor-alkali industry remains under pressure, driven by weak demand and sluggish growth. This landscape has created new challenges for market players, making it even more challenging to prepare short and long-term strategies.

In an exclusive interview with Tecnon OrbiChem’s experts Charles Fryer and Angel Fernandez, ICIS’s Cameron Roberts ask business-critical questions regarding the impact of COVID-19 from the implications on global supply and demand to application markets, such as automotive, construction and pulp and paper.

World Chlor-Alkali Virtual Conference

Neo Wu from Fisher International, together with Charles Fryer and Angel Fernandez from Tecnon OrbiChem will be presenting at the World Chlor-alkali Virtual Conference organized by ICIS and Tecnon OrbiChem on October 21 & 22. Join the conference and take advantage of the limited-time free registration.