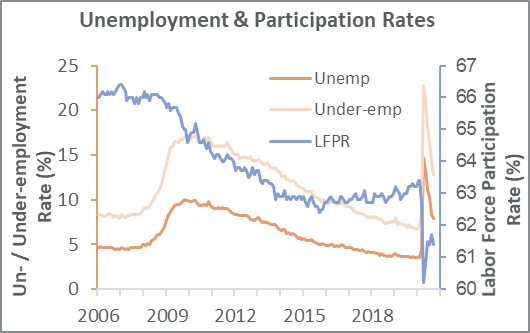

The Bureau of Labor Statistics’ (BLS) establishment survey showed non-farm employers added 661,000 jobs in September (well below the +894,000 expected). Also, July and August employment changes were revised up by a combined 145,000. Meanwhile, the unemployment rate (based upon the BLS’s household survey) receded (-0.5PP) to 7.9 percent under a combination of rising employment (+275,000) and shrinking labor force (-695,000); concurrently, the labor force participation rate retreated (-0.3PP) to 61.4 percent.

Since it is election season, context around the current virus-induced unemployment rate could be useful. September’s 7.9 percent is lower than the average unemployment rate during President Obama’s first four-year term (Feb 2009-Jan 2013: 9.0 percent) but greater than the average of his second term (Feb 2013-Jan 2017: 6.0 percent). Through September 2020, President Trump’s average unemployment rate has been 5.4 percent; the pre-pandemic average was 5.0 percent. Interestingly, the unemployment rates at this point in both President Obama’s and Trump’s reelection campaigns were nearly identical: 7.8 percent (Sep 2012) and 7.9 percent (Sep 2020), respectively.

President Trump’s executive order deferring certain payroll obligations through December 31, 2020 thwarted our use of withholding-tax data to “sanity test” the employment report. However, continuing jobless claims dropped by about 1 million during September, which lends credence to the reported jobs gain. For context, roughly 11.4 million of the 22.2 million jobs lost to the pandemic’s aftermath have been recovered.

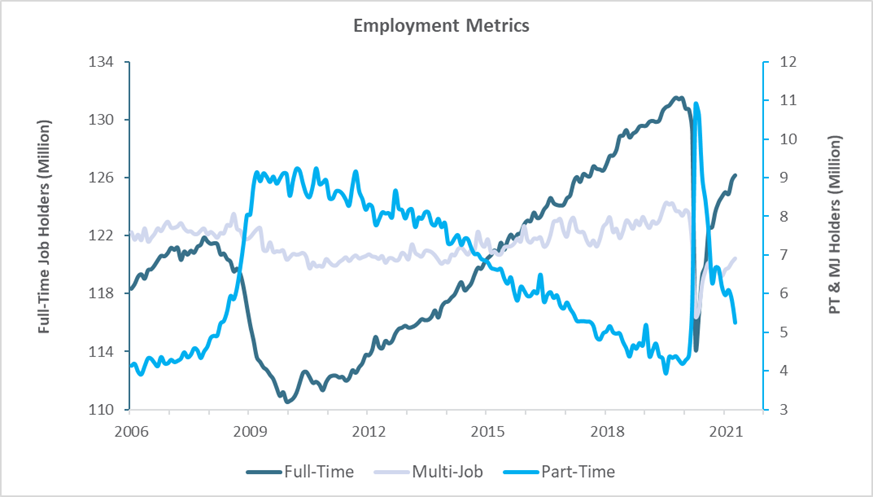

Full-time jobs in September crept higher (+54,000) to 122.4 million. Workers employed part time for economic reasons fell by 1.272 million, whereas those working part time for non-economic reasons rose by 288,000; multiple-job holders declined by 339,000. Once again, the shrinkage in the number of temporarily unemployed (-1.523 million, to 4.637 million) could explain most/all of September’s job gains.

Goods-producing industries gained 93,000 jobs, while service providers added a more robust 568,000 jobs—especially leisure and hospitality (+318,000), retail trade (+142,000), health care and social assistance (+107,000), and professional and business services (+89,000). Public-sector employment declined, mainly in state and local government education (-231,100).

Manufacturing expanded by 66,000 jobs. That result is perhaps somewhat consistent the ISM’s manufacturing employment sub-index, which nearly ceased contracting in September. Wood Products employment advanced by 3,900 (ISM was unchanged); Paper and Paper Products: +3,000 (ISM increased); Construction: +26,000 (ISM increased).

Average hourly earnings of all private employees inched up by $0.02 to $29.47 (+4.7 percent YoY); since the average workweek lengthened (+0.1 hour) to 34.7 hours, average weekly earnings increased by $3.64, to $1,022.61 (+3.1 percent YoY). That compares favorably with the CPI’s August advance of +1.3 percent YoY, although some argue the modest CPI increase is tempered by items (e.g., airfares and energy) consumers are purchasing in much smaller quantities than before, whereas prices for “the goods people are actually buying are way up.”

Data from Homebase show stalling improvement in small-business locations open, employees working and hours worked since June. Moreover, job cuts announced by US-based employers jumped to 118,804 in September (+2.6 percent MoM). Announcements were concentrated among entertainment/leisure and aerospace/defense companies. Retailers were split, with terminations offset by announcements of intentions for holiday hiring; not surprisingly, the mix of jobs for which retailers are advertising is shifting away from traditional sales work.

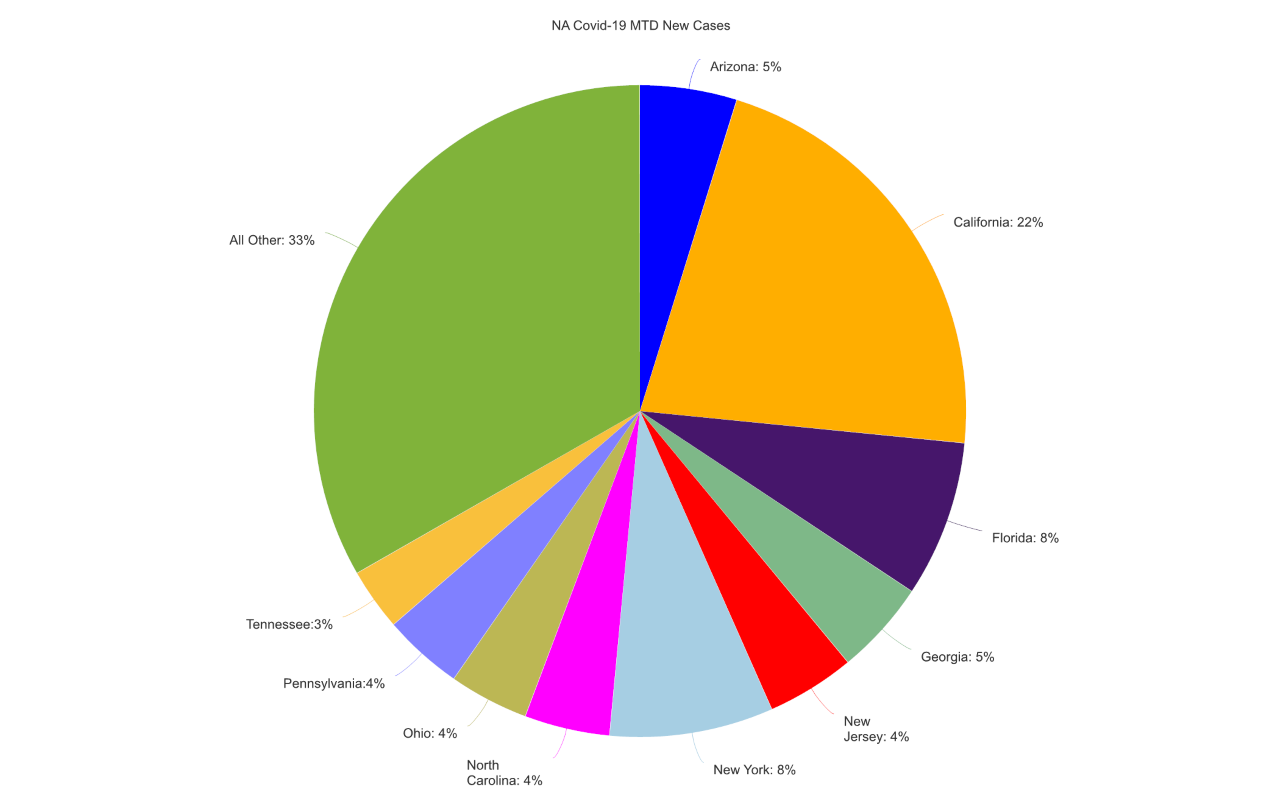

“We are setting new records for job cuts even though things have improved since the earliest days of the pandemic,” said Challenger, Gray & Christmas’ Andrew Challenger. “These are uncertain times for everyone, as many states are experiencing an uptick in the number of COVID-19 cases. It is clear we still have a long way to go before many industries can return to normal.”