Tissue Conference 2021 was recently held virtually and included a presentation from Fisher’s Matt Elhardt, Vice President, Global Sales. The conference was hosted by Tissue Analytica in collaboration with NC State University and TAPPI.

The theme of this year’s Conference is “Sustainability, Performance, Risks & Opportunities in Times of Pandemic,” which included presentations and attendants from around the world. Presentations focused on the outlook for the industry in 2021, advances in fiber and furnish development and performance, efforts toward fiber reduction, scientific discussion on the true sustainability of hygiene tissue products, and sustainability metrics.

Matt’s presentation titled “Will a New US Administration Bring New Carbon Costs to Tissue? What Could be the Impacts?” covered topics and addressed questions related to the administration change in Washington, including:

- How has California’s ETS regime impacted tissue?

- What if a California-styled ETS system applied to the entire USA?

- How large is the GhG variance among US tissue mills?

- Will climate regulation create trade-offs at the consumer level?

- Will US tissue really be threatened by a carbon legislation?

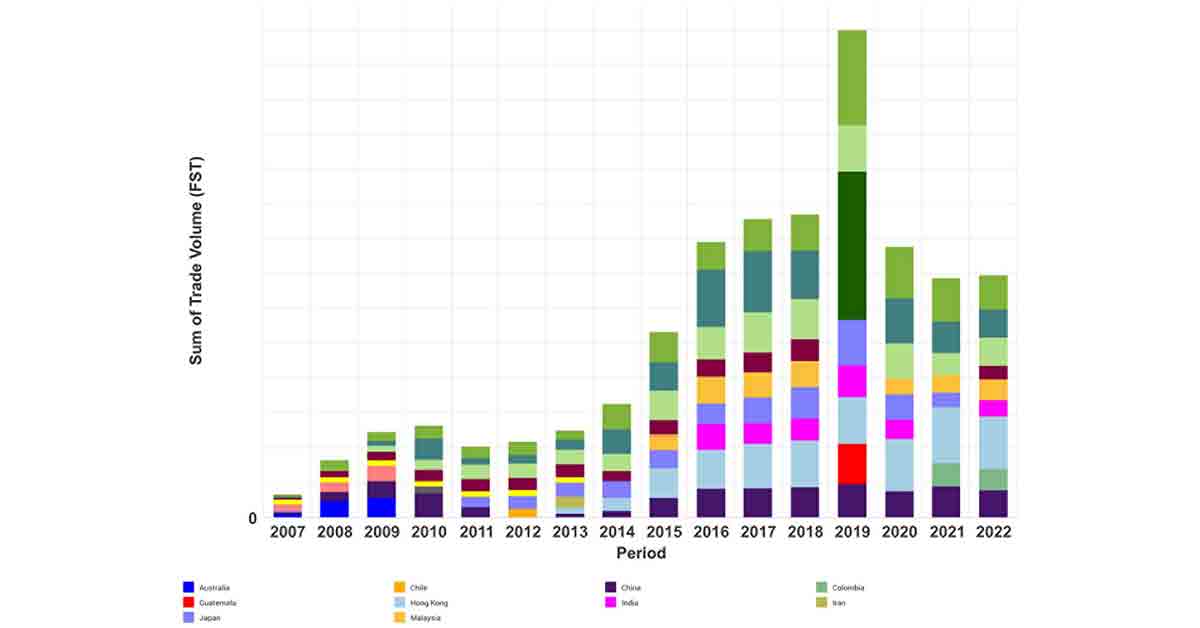

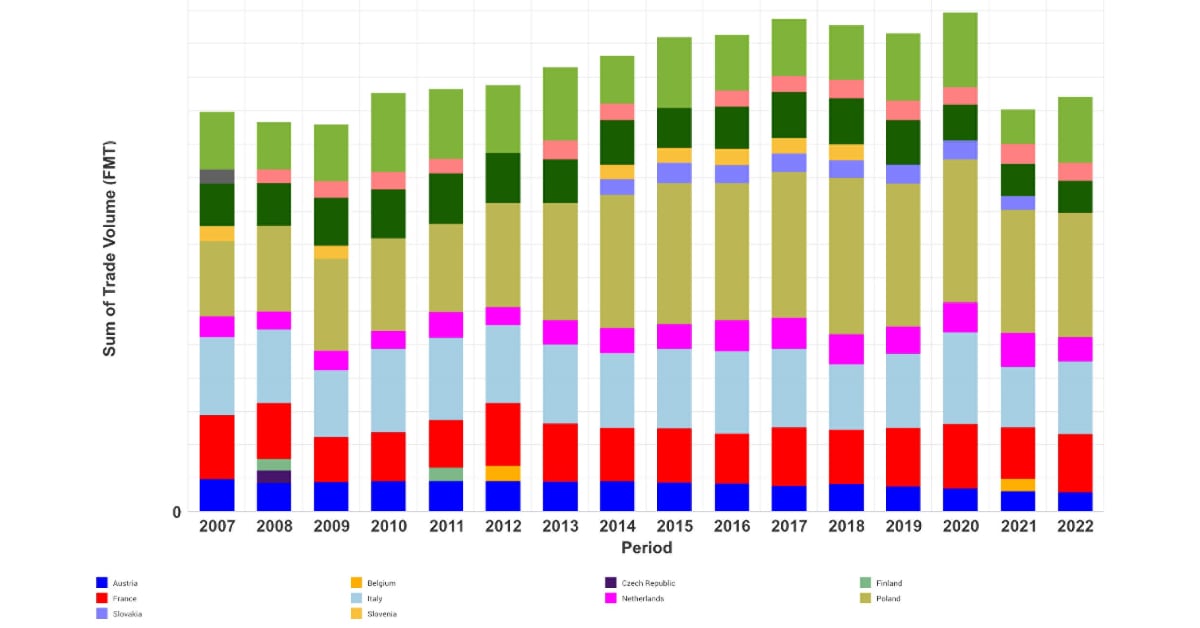

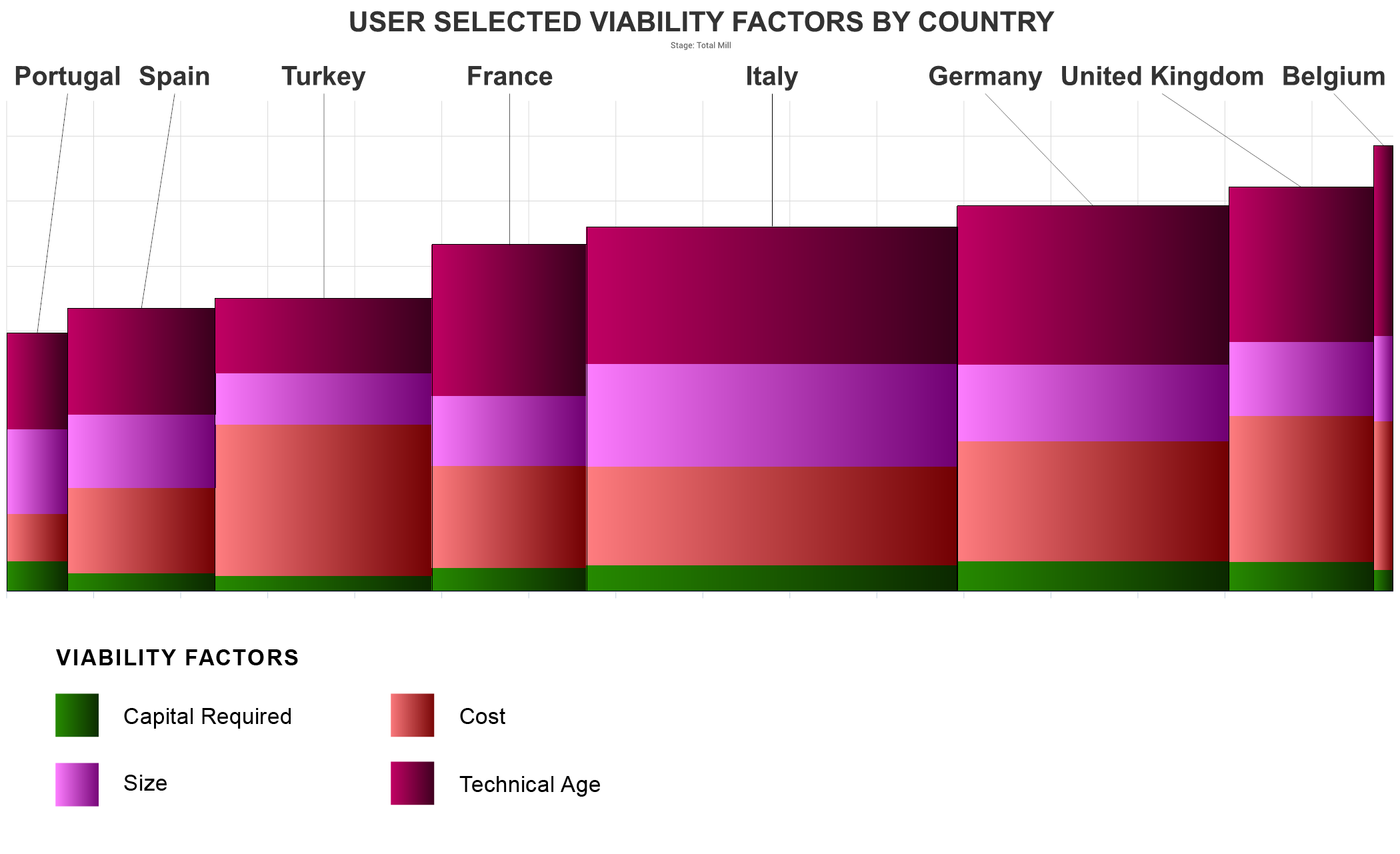

Interested in learning more about how the FisherSolve business intelligence platform can help you analyze and address these topics in a changing global market that will be increasingly impacted by ESG initiatives? FisherSolve contains highly detailed and complete information on every pulp and paper mill in the world. It describes the assets, production, operations, environmental flows, costs-of-production, long-term viability, carbon footprint and more for all pulp and paper mills producing 50+ TPD.

Unique and interactive data surrounding environmental flows include:

- Water Supply & Treatment

The Water Module in FisherSolve shows water and wastewater flows for each mill with data about volume, source, application, destination, and treatment methods for each site’s incoming water, outgoing wastewater, and sludge. We use it to measure water consumption per ton and compare it to the mill’s water risk.

- Carbon Emissions

The Carbon Module in FisherSolve shows the carbon output of every pulp line and paper machine for each of the products they produce. Based on uniform international standards, the tool makes FisherSolve uniquely capable of measuring and benchmarking the carbon footprint of all players against their peers.

The tool shows carbon emission of various scopes, all the way from cradle to destination. Emissions from purchased electricity, biomass combustion, fossil fuel combustion, raw materials, and transportation from gate to destination are calculated and can be analyzed in any combination. As with all FisherSolve data modules, drill-down and roll-up capabilities allow for strategic analysis at any level you choose to examine for whatever combination of factors that are important to you.