71% of global fund managers representing $12.9 trillion in assets recently stated that they believed the pandemic would lead to an increase in actions designed to tackle climate change and bio-diversity losses. Some major brands who have committed to ambitious zero carbon targets (and the year by which they intend to achieve them) include Apple by 2030, Amazon by 2040, Unilever by 2039, Starbucks by 2050 and Nike by 2050.

As the momentum behind this movement continues to gain traction, the question is no longer a matter of if carbon will hit your bottom line, but when it will hit. Carbon costs are coming, and it is now evident that optimized sourcing in the future will require consideration of both traditional and environmental costs.

As we’ve discussed in previous posts, President Biden has promised an ‘enforcement mechanism’ to limit carbon emissions in order to achieve his pledge to cut US greenhouse emissions (GhG) in half by 2030. While no policy has been formally established, the administration has said that a system targeting sector-specific standards, similar to California’s ETS “cap and trade” scheme, is preferred. However, this initiative is an effort to catch up with many other countries who have already established systems to reduce GhG emissions.

With an ETS in place, benchmarks for carbon trade emissions would be established by a governing agency for each individual industry, with each unique manufacturing sector setting a different carbon target. However, if a single manufacturing facility exceeds its allotted benchmark, a penalty is administered in the form of a fee.

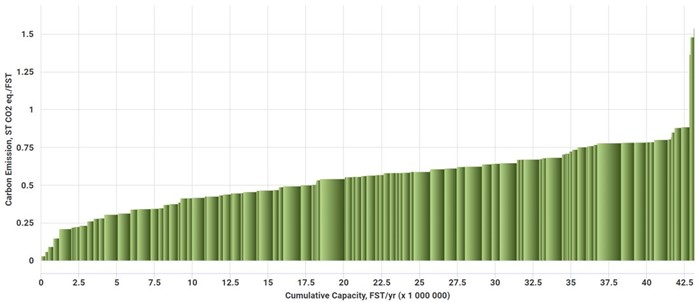

If carbon fees, or their equivalent, are established, it could create wide differences in costs for North American pulp & paper mills. As illustrated in the image below, some of the highest emitting mills are producing 4x as much carbon compared to other mills.

North American Containerboard Greenhouse Gas Emissions by Mill

Source: FisherSolve™ Next

While we don’t yet know which individual segments and companies will be impacted the most, how much current emissions could cost, etc., we do know that carbon taxes will definitely increase the cost of doing business for many manufacturers.

The United States is a fairly high emitter of carbon compared to the rest of the world, averaging around 1.3 metric tons of CO2 per metric ton of finished product. Many mills are still using fossil fuels to create energy and power their facilities, which are emitting a considerable amount of CO2. Interestingly, many of the high-emitting mills are also creating higher quality products.

Since the onset of the pandemic, demand in the tissue and towel segment has skyrocketed, driven in part by demand for high-quality at-home tissue. North American consumers continue to favor ultra-premium products at home. When looking at previous economic recessions, consumers usually step down to value or economy brands. But during the Great Recession in 2008, consumers continued to buy the highest performance tissue available despite tough economic circumstances— a trend we’ve seen continue through the pandemic.

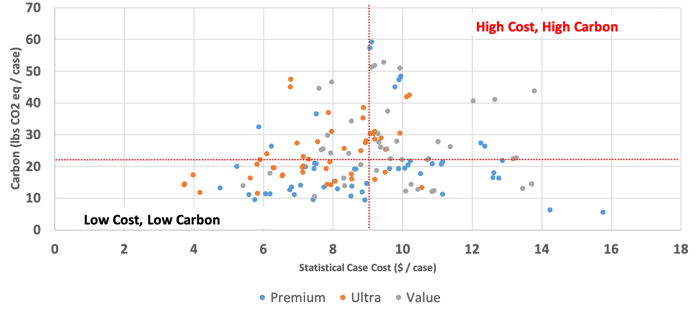

In the graph below, the horizontal axis shows the average statistical case cost for every tissue machine in North America categorized by premium, ultra and value product capability; the Y-axis illustrates carbon emission. As the data show, the lower cost machines are mainly premium and there is a 20lbs/case difference between the highest and lowest cost machines, which is critical to understand because these are two extremely valuable criteria for consumers.

Cost and Carbon of NA Consumer Tissue Machines by Quality Tier

Source: FisherSolve™ Next

The Future Needn’t be Frightening

Whether your facility has been in operation for decades or you’re currently expanding and adding capacity amid new demand, FisherSolve can help you make better operational decisions during periods of high uncertainty in the market. Organizations that use the power of benchmarking with unique, reliable datasets remain agile and are able to quickly adapt to changing market signals because they are constantly setting goals, analyzing performance, measuring results and making necessary changes.

To help prepare for a more ecologically-conscious future, FisherSolve’s Carbon Module shows the carbon output of every pulp line and paper machine for each of the products they produce. Based on uniform international standards, the tool makes FisherSolve uniquely capable of measuring and benchmarking the carbon footprint of all players against their peers. The tool shows carbon emission of various scopes, all the way from cradle to destination. As with all FisherSolve data modules, it allows for strategic analysis at any level you choose to examine for whatever combination of factors that are most important to you.