Coronavirus outbreaks have developed across the globe. Countries like Italy and China have instituted blockades and quarantines to prevent the spread of the disease, while United States health officials are preparing the country for its likely bout with the newly dubbed COVID-19 strain.

Anxiety levels have risen along with the confirmed number of COVID-19 cases in China and beyond. American markets are nervous as the Dow Jones Industrial Index dropped nearly 2,000 points in a two-day span from Feb. 24-25, marking the measurement’s largest two-day slide ever (in terms of points).

According to Reuters, European shares recorded their worst one-day loss since June 2016 on Monday, Feb. 24.

“There is no question financial markets are coming round to the realization that this particular crisis is likely to have a slightly longer shelf life than many thought was the case a couple of weeks ago,” said Michael Hewson, chief markets analyst at CMC Markets in London.

“For now, there appears little prospect that financial markets look likely to settle down in the short term, which means investors will have to get used to an extended period of uncertainty and volatility."

Currently there are very few cases of #COVID19 in the US & no reported community spread. But as more countries see community spread, successful containment becomes harder and CDC is preparing for community spread in the US. pic.twitter.com/MBJftVsR0H

— CDC (@CDCgov) February 25, 2020

As the world rallies to contain COVID-19, the potential impacts for individual industries are vast and varied. Fisher International has taken the time to analyze how this mysterious disease could impact demand for pulp and paper products.

Potential Negative Demand Impacts:

Slowdown in Fast-Moving Consumer Goods

Concerns over the virus will, likely, affect consumer spending patterns, which will cascade across the entire economy. From a pulp and paper perspective, such a trend will most directly impact packaging demand.

For example, Apple and Microsoft both warned investors their revenue for the March quarter would be lower than anticipated amid the COVID-19 outbreak. This indicates reduced demand for product packaging from two of the largest and most influential companies in the world.

“Demand for our products within China has been affected,” Apple said in a statement. “All of our stores in China and many of our partner stores have been closed. Additionally, stores that are open have been operating at reduced hours and with very low customer traffic.”

(Read more: Coronavirus’ Impact on China’s Paper Industry Still Unknown)

With the virus moving into other major countries, it’s likely consumers will display similar behavior. Business Insider noted Apple didn’t provide a new revenue estimate as the disease outbreak is still in an early, unpredictable stage.

Reduced Imports of Fiber, Domestic Oversupply

With reduced packaging demands comes reduced demand for pulp to make those products.

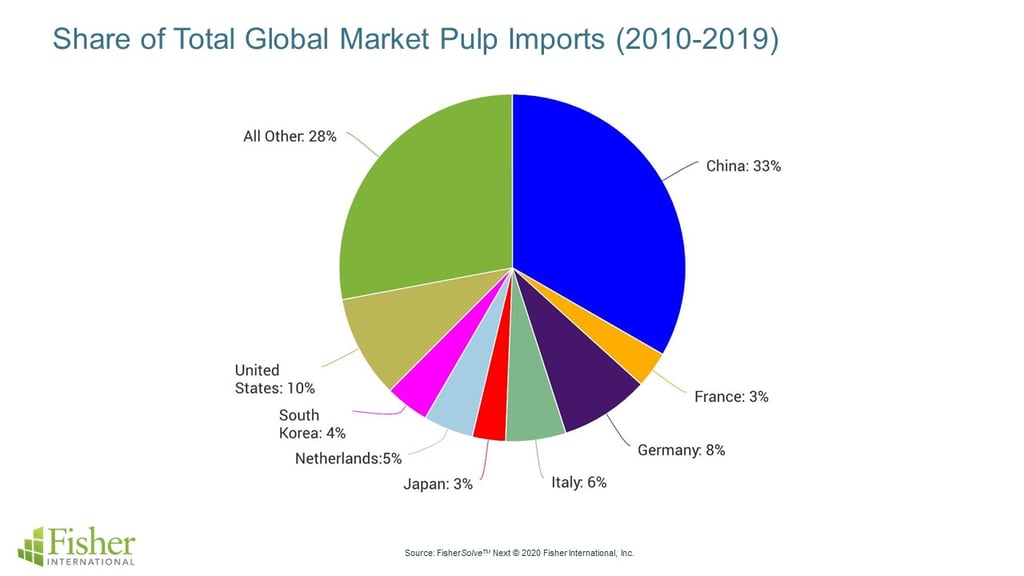

China is the key buyer of pulp, paper, wood, and chips. According to FisherSolve Next, China accounted for one-third of the world’s market pulp imports last decade.

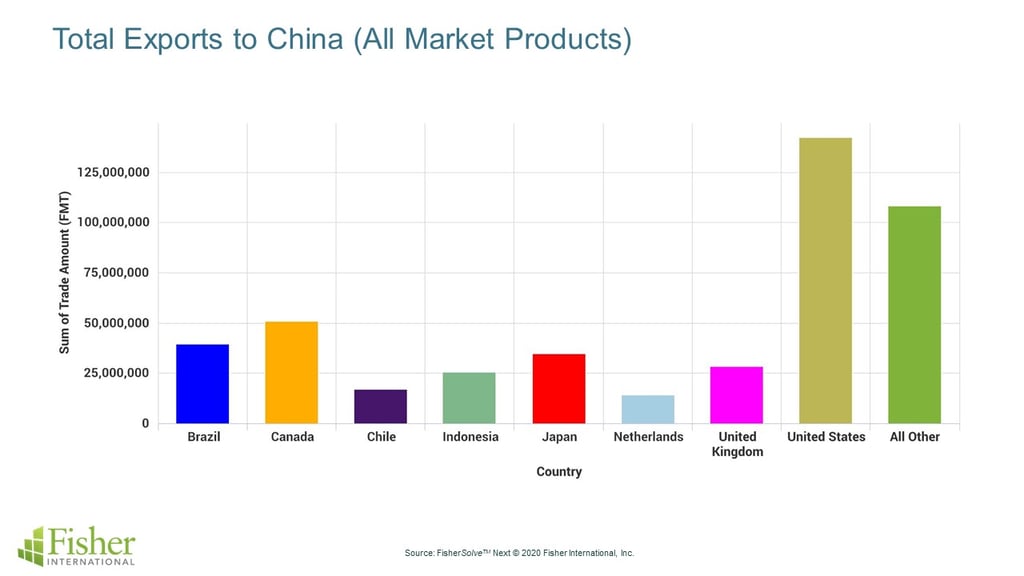

If China stops importing as much product, countries reliant on exporting goods to China will have to look to domestic markets to mitigate oversupply issues. This especially concerns the US, which was by far the largest exporter of paper and pulp products to China from 2010-19.

Oversupply presents another problem for US exporters as unease in the global market has encouraged investment in the US dollar (USD), which is largely considered to be a safe haven asset in times of increased uncertainty. This drives up the USD value, makes American goods a tougher (and more expensive) sell to potential importers, and reduces profits for US sellers.

Both the USD Index (DXY), which rose from 96.39 at the end of 2019 to 99.86 on Feb. 20, and US 10-Year Treasury Yield, down from 1.92 percent at the close of 2019 to 1.27 percent on Feb. 27, illustrate this race out of a volatile stock market and toward more stable investments in recent months.

Potential Positive Demand Impacts:

Towel and Tissue Consumption Could Increase

Health officials worldwide have stressed the importance of hygiene and disinfecting as efforts to contain COIVD-19 intensify. Arguably the simplest measure to avoid spreading the disease – washing your hands – could have the biggest impact for pulp and paper demand.

Disposable hand towels should be the preferred method for hand drying in public/shared bathrooms as a 2018 study by the American Society for Microbiology found hot-air hand dryers “can disperse bacteria from hands or deposit bacteria on surfaces, including recently washed hands.”

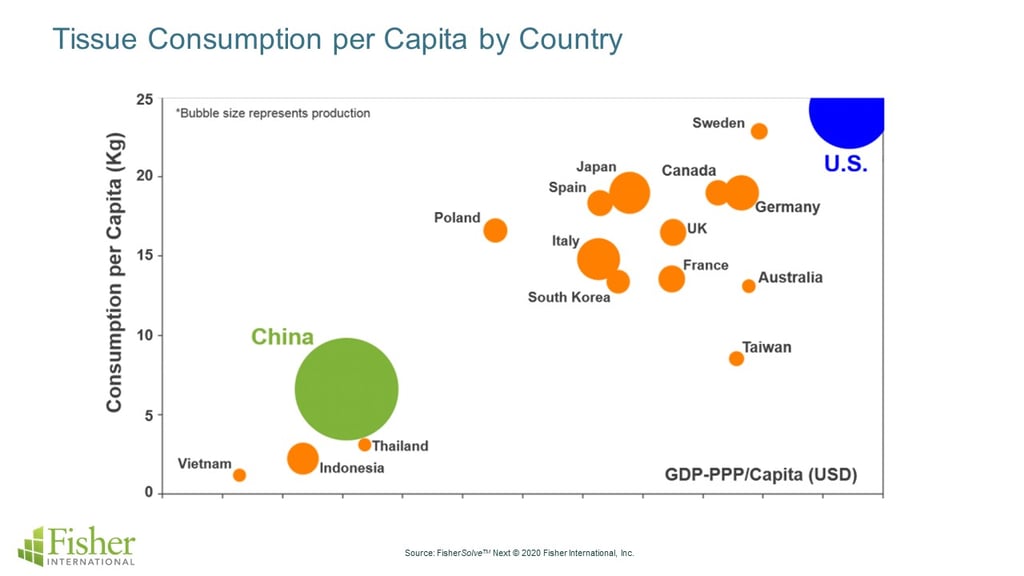

It’s easy to see the US, which is already the largest consumer of tissue products by far, running to stores to stock up on throwaway products like toilet paper and paper towels as cautious citizens go above and beyond when disinfecting their homes — a trend we saw in China.

According to Digiday, online sales of the disinfectant Dettol rose 643 percent year-on-year between Feb. 10-13 on the Chinese e-commerce website Suning.com.

That brings us to our next topic.

Increased e-commerce

The public needs much more than disinfectant to make it through a potential pandemic, and much of what it needs will be bought online and delivered to homes.

PracticalEcommerce.com reported earlier this month that “Chinese e-commerce platforms such as Alibaba and JD.com are hiring thousands of temporary workers, as government-imposed travel restrictions have increased consumer demand for online grocery delivery services.”

And while some governments have mandated people stay in their homes, many will voluntarily shelter themselves and rely on delivery services for food and goods. This creates a serious need for packaging, which could drive an increase in demand for corrugated materials.

It’s still too early to determine the impact of the coronavirus on the corrugated sector, but considering China is now delivering everything from toilet paper to margaritas, we can imagine American consumers will turn to Amazon and others to avoid human-to-human contact if anxiety over the disease continues to rise.

Pulp and paper producers use Fisher’s business intelligence resources for both market and competitive analysis. From strategic decisions about products and assets to tactical decisions like where to spend sales time, we support the entire decision chain with the FisherSolve™ platform.