We recently discussed 10 interesting facts surrounding the current global tissue market. Today, however, we’re going to narrow it down a bit and look specifically at the North American tissue market and some of the trends that will shape this market in the future.

Overview

The current North American tissue market is at about a 10 million short ton value with net imports (excluding the US and Canada) at about 480,000 short tons (st). When looking towards the future, we expect the market to grow by roughly 1% over the next year.

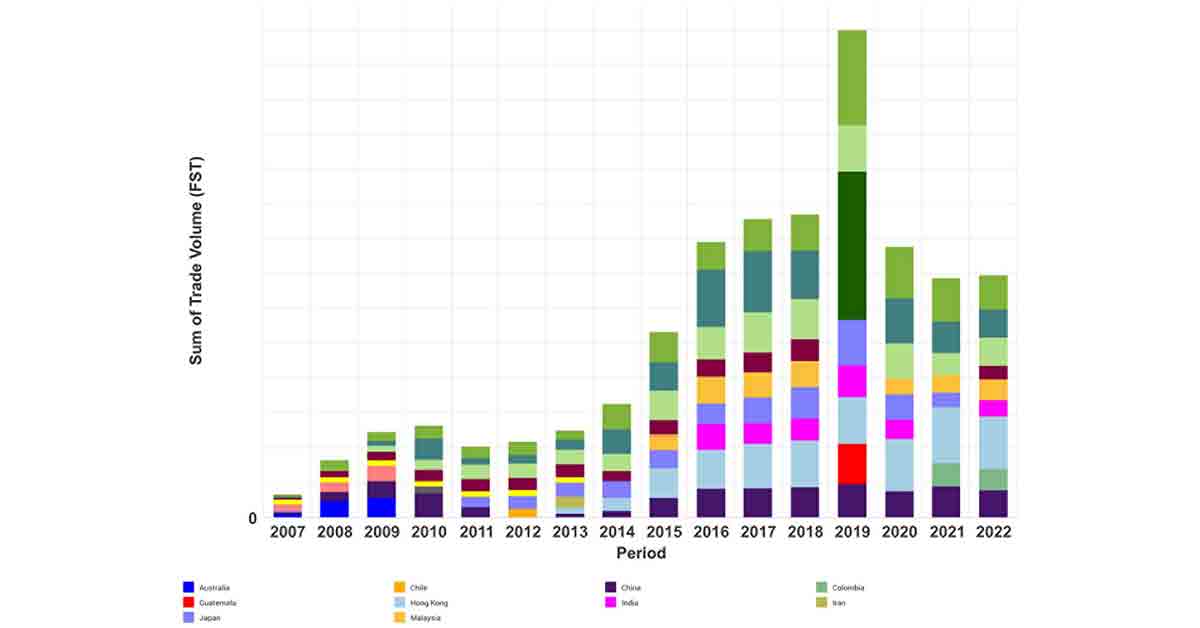

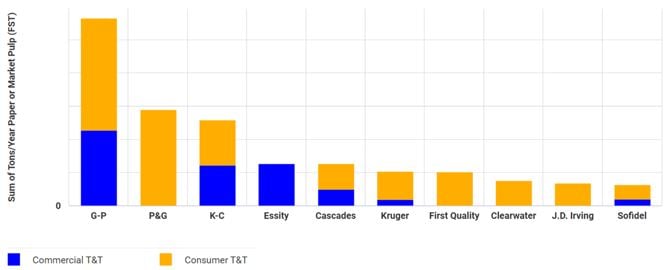

Within the North American tissue segment, ~1/3 of the market is made up of private label share. The image below illustrates the top 10 North American producers by capacity, and it’s interesting to note that the top 3 companies account for about 50% of total capacity.

Top 10 North American Tissue Producers by Capacity

Source: FisherSolve

Trends to Watch

Trend prediction is risky business today, as uncertainty may be higher now than it has been in several decades. Between the unexpected global pandemic we experienced over the last two years and the first “major” European land war in 70 years, trend predicting isn’t as reliable as it once was. However, the antidote to uncertainty is scenario planning – identifying risks and addressing them, and finding the underlying truths that are likely in most scenarios.

In order to scenario plan, we must identify the risks by asking critical questions such as:

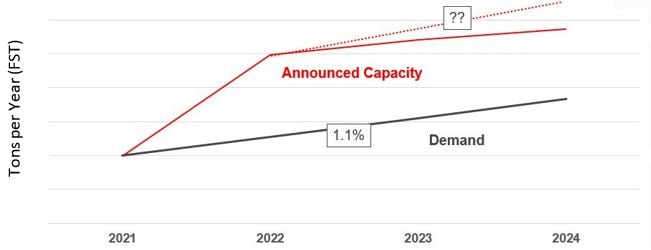

- Will capacity (especially in private label) create a bubble? The chart below illustrates North American announced Tissue and Towel capacity and the expected demand. Assuming North America as a whole grows at about 1%, we can compare the expected demand with the announced capacity, and what we see is the likelihood of an expanding gap between capacity and demand as announced capacity is exceeding gross demand. Of course, as the chart below reflects announced capacity, it is altogether possible that we will see additional announcements 2-3 years from now.

North American Announced T&T Capacity and Expected Demand

Source: FisherSolve

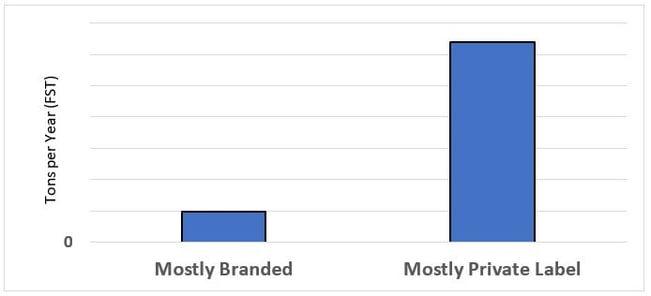

When we dive deeper and look a bit closer at the details, we can see that a significant amount of new capacity over the 5-year period will come from companies that focus largely on the private label market.

North American Tissue Capacity Change 2021-2025

Source: FisherSolve

- Will private label market demand grow enough to absorb all of the new capacity? Let’s examine three factors that will impact the direction of this growth:

-

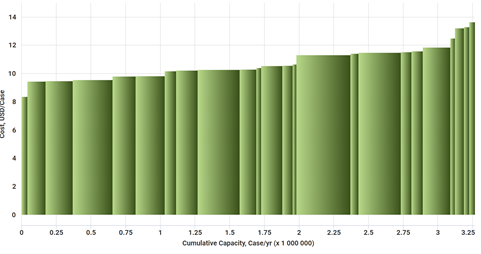

- Costs: The chart below illustrates a cost curve (supply curve) at the case level. Using data from FisherSolve, we can adjust for differences in advanced and conventional pressing. When applied, we can see that private labels can be low cost and cost competitive as half of 1st and 2nd quartile consumer advanced non-integrated mills are private label.

FisherSolve Tissue Costs of Manufacture (Case Basis)

North American Advanced Consumer Mills, Non-Integrated (Q4 2021)

Source: FisherSolve

-

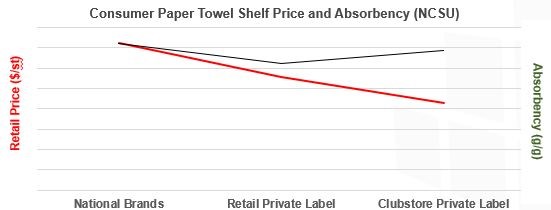

- Quality: When looking at the results from the North Carolina State University (NCSU) published tissue study comparing the shelf price and absorbency of towel, private labels can compete on the shelf in terms of quality compared to national brands. However, the question remains: will towel consumers pay 60-80% more for 10-20% more absorbency?

- Quality: When looking at the results from the North Carolina State University (NCSU) published tissue study comparing the shelf price and absorbency of towel, private labels can compete on the shelf in terms of quality compared to national brands. However, the question remains: will towel consumers pay 60-80% more for 10-20% more absorbency?

-

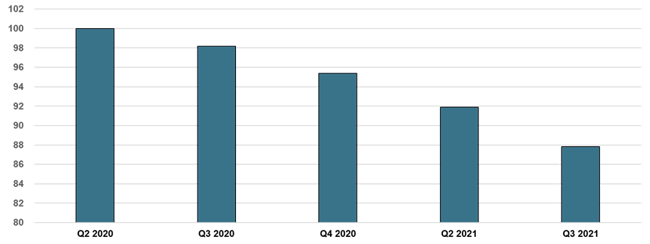

- Inflation: Inflation is eroding consumer spending power, which has historically been a tailwind for private label brands. As we can see in the image below, US real wages for all wage earners dropped 12% in 3Q2021 compared to 2Q2020.

US Real Wages for All Wage Earners

However, this all just a small part of the story. Private label capacity is growing fast and fragmenting – another trend to keep an eye on.

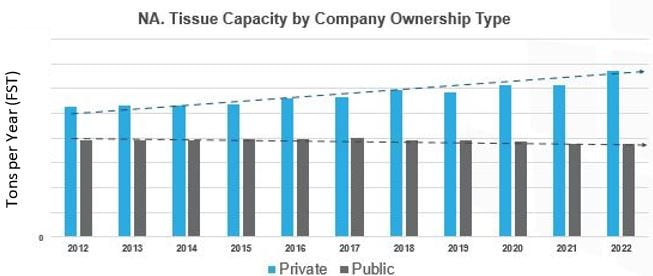

Another important dynamic that is just as critical, and something that is oftentimes overlooked, is the share of private and public ownership. Looking at the decline in public company ownership and what that tells us about capital return expectations has extremely important strategic implications. When investing, public companies tend to want a shorter ROI, whereas private companies, such as Pratt and Georgia Pacific, don’t mind a longer ROI. This is a major factor into why recent, new tissue growth is occurring within private companies.

What Role Does Carbon Play in All of This?

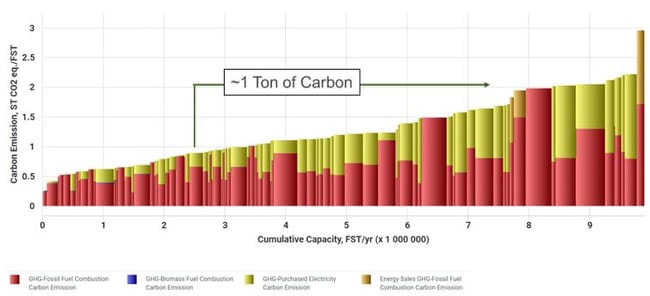

Whether voluntary or mandatory, carbon will increasingly be a cost for producers. We’ve already seen big brands set net-zero goals which are being backed with big investments and demands that their suppliers help them meet reduction targets. We’ve also seen carbon legislation in various forms that has been introduced in several regions – which is creating new opportunities for the industry to take advantage of the significant shift in views on the environment.

The image below illustrates North American tissue greenhouse gas (GHG) emissions by mill, and there are significant differences in the amount of carbon emitted between various US tissue producers. Those mills that are emitting the least amount of GHG are advantaged within the industry, whereas those towards the right side of the curve face a serious risk.

North American Tissue Greenhouse Gas Emissions by Mill (Scope 1 and 2)

Source: FisherSolve

Overall, the North American tissue market is very likely to see a cycle of surplus capacity in the coming years, however, pressure will vary by tissue segment and channel. Even though exogenous factors such as Covid-19, the Russia-Ukraine war, and inflation are creating more uncertainty, there are some things we are fairly certain about: low-cost producers in private labels who can compete will gain share; the prospect of reduced consumer spending power will be a tailwind; and carbon costs will become more widespread in the next 5 years, creating a major opportunity for owners who can proactively articulate their story.

For further insight, contact us today to find out how Fisher International can help you with strategy development and implementation through the use of our proprietary data and business intelligence platform FisherSolve. With access to detailed information on virtually every mill in the world, our consulting services help provide answers to important questions by explaining market movements in verifiable, fact-based and common-sense terms that industry professionals find useful.