When the term inflation is in the news, panic, confusion and speculation tend to fill the air. While most people understand that inflation means rising prices, they tend to stop there and assume they need to cut costs immediately. However, according to Fritz Nelson at Oracle NetSuite, “The way inflation affects an individual business depends on its unique economic circumstances: what industry it’s in, how its particular costs are rising (or falling), the productivity of its workforce, the nature of its supply, etc.”

Knowing how to prepare and adapt your business to inflationary trends can help you not only weather inflation but come out the other end stronger. That being said, the only way to hedge against uncertainty with any degree of confidence is with reliable historical data, transaction-based raw material price forecasts, and the industry experience to connect the relevant dots and provide meaningful insights.

With the Pulp and Paper industry already being an incredibly volatile industry, it’s imperative now more than ever to assess where your business stands and make a strategic, actionable plan as we enter another year that is bound to bring more unexpected turbulence.

Producing valuable, bankable resource assessments and forecasts requires a deep understanding of the Pulp and Paper industry. Therefore, the onus is on project developers to achieve a comprehensive knowledge of supply chain and other operational issues that affect project viability and, ultimately, project success.

Whether you are financing a project or acquisition, constructing a new facility or expanding an existing one, or transitioning lines, a long-term cost and sustainability resource assessment from Fisher International can help you answer these critical business questions:

- What will the price of raw materials be over the life of the asset?

- Will demand from other new or expanded facilities affect market price?

- What is the long-term outlook for the sustainability of supply and capacity?

- Is there sufficient available supply to support this facility over the life of the asset?

Fisher International regularly performs due diligence assignments and custom resource assessments on behalf of producers, suppliers and investors operating within the global Pulp and Paper industry. We use our powerful proprietary database, FisherSolve, combined with the considerable industry experience of our consulting team to bring pulp and paper professionals worldwide the ability to make informed and precise decisions faster, broadly and more efficiently.

Fisher International is an independent third-party source of assessments and advice. We do not buy, sell, manufacture or manage pulp, paper, energy or carbon. As a result, our advice is objective and free from conflicts of interest.

Our industry leading FisherSolve platform, integrated services, and focused, personalized solutions can help customers uncover untapped opportunities and mitigate vulnerabilities, while revealing the best path for sustainable, profitable growth. Some of our business intelligence tools we offer include:

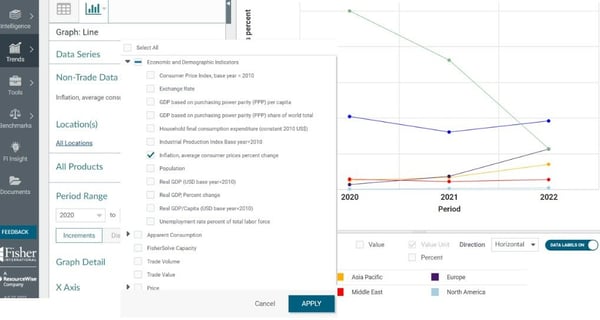

- Market Trends Module: Our Market Trends module allows you to evaluate growth trends by paper grade and region, identify economic threats, prepare for market capacity fluctuations, and analyze cost and price sensitivity to macro-economic factors. Below is an example of the numerous situations you can analyze using this module.

- Quality and Viability Index: Our Quality and Viability indexes predict the long-term future of pulp lines and paper machines by considering cost-of-production, size, technical age, grade risk, position in company fleet, capital required, transportation, and other factors—all of which can be considered under various economic scenarios.

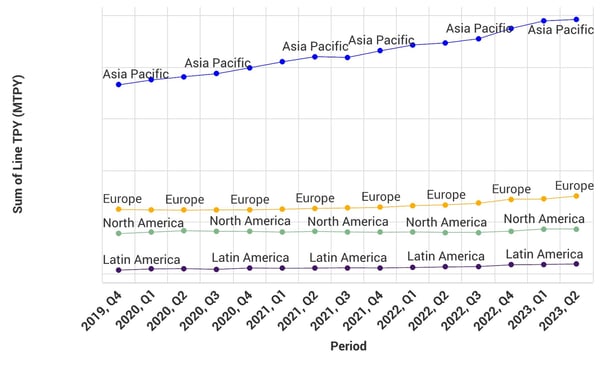

- Capacity Trends Module: Our Capacity Trends module provides insight into the status of the industry’s past (apart from the latest quarter) and announced future capacity changes. This data can be aggregated in tables and graphs at different levels by company, geography, and product detail, among others. Below is an example of a graph that can be pulled using this module to analyze the growth or decline of capacity.

- Carbon Benchmark: Our Carbon Benchmark shows the carbon output of every pulp line and paper machine for each of the products they produce, all the way from cradle to destination.

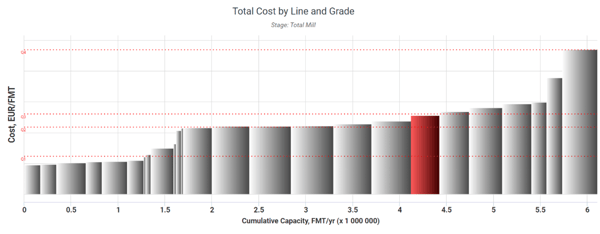

- Virtual Mills: The Virtual Mills tool allows you to create a confidential, user-defined mill that can represent any greenfield, brownfield, rebuild or grade change project, with the inputs defined by the client and/or with Fisher consultants’ expertise. The virtual mills are modeled with the same rigor of existing sites and the results – such as cash costs, energy consumption or carbon emissions – can be visualized and benchmarked against existing sites and other virtual mills in FisherSolve. Below is an example a benchmark cost curve illustrating the manufacturing cost of the new machine (virtual mill) against other European machines producing the same product grade.

Sustainable profits come from the value gained through constant refinement of utilized assets. In commodity businesses like pulp and paper, that effectiveness is driven by a wide range of decisions which, when made marginally better, result in higher prices, higher operating rates, lower costs, and lower volatility than in less well-run firms.

These custom studies enable participants in the P&P industry to respond confidently to market changes while assuming a comfortable level of risk. Using a forecast model that can maximize return and minimize risk is simply smart business, especially during times of market stress and uncertainty. Before you move forward with a new facility, expansion or purchase, talk to us about custom resource assessment options that will inform the kind of confident decision-making needed to ensure your next project is a success.