In its continuing efforts to assist clients during this unique time in global history, Fisher International has fully integrated COVID-19 data into its business intelligence platform FisherSolve™ Next.

Every account holder can use FisherSolve™ Next filters, tools, and market trends to access COVID-19 statistics by country and state/province and correlate their findings with applicable FisherSolve™ data.

This newest addition to the platform can help users trace the impact of the COVID-19 pandemic on paper, pulp, tissue, and packaging production by geography and grade. Using that insight, customers can formulate strategies to respond to the dynamics of the pandemic and identify at-risk segments and assets.

Fisher consultants can help users formulate business-outcome scenarios, project the competitive landscape by geography and competitor, identify M&A opportunities based on projected economic position, and plan human resource and other operations.

Among the features used to highlight COVID-19 data are heat maps that can be filtered by region, country, state and indicate potential impacts on grade capacities. Users can also build charts and tables matching COVID-19 data with economic and demographic indicators including GDP, population, inflation, exchange rates, and unemployment.

After utilizing these new features, clients will be able to understand which regions and operations have been hit hardest by the pandemic and where future shifts in production and demand are likely.

To help illustrate how these new datasets can be used to inform decisions and strategy for the pulp and paper industry, we’ve highlighted the following three questions FisherSolve™ can help answer:

1. Which mills are most likely to be impacted by COVID-19?

We know the COVID-19 pandemic will impact demand for certain products, but how will the virus affect a mill’s workforce?

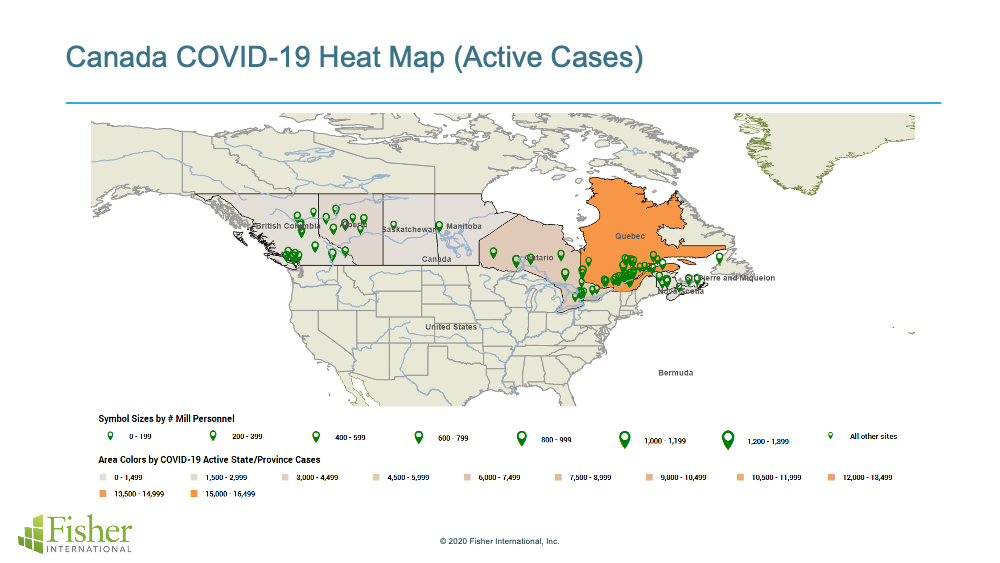

Using FisherSolve™ heat maps and mill locators, you can pinpoint which mills are in regions most affected by COVID-19. The chart below shows the location of all mills in Canada and indicates the size of the mill by number of employees and correlates that with provinces with the most active cases of COVID-19.

This information can be crucial for suppliers who do business with smaller mills in highly impacted areas. Smaller workforces are at more risk of being crippled when a handful of employees are infected. On the other hand, larger mills in provinces with a limited number of active cases should be able to continue production without interruption.

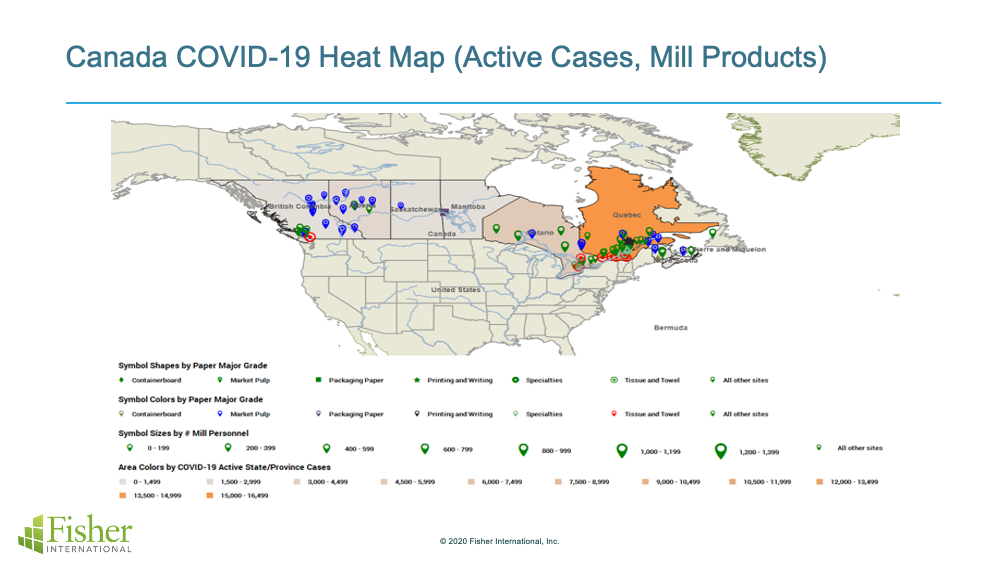

FisherSolve™ can also label these mills by paper grades produced.

2. Which production lines may not make it to the other side of COVID-19?

In our last example we discussed mills that could see a change in production due to in-house COVID-19 infection rates, but what about those mills and lines that could take the biggest hit from changing consumer behavior?

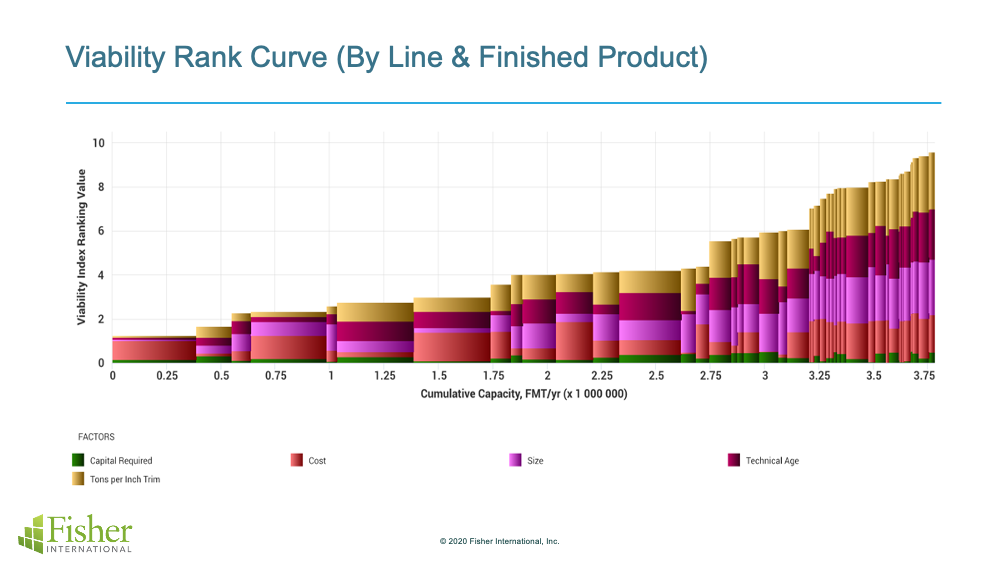

Printing and writing paper have taken blow after blow in recent years, and the COVID-19 pandemic could be the potential knockout punch for at-risk producers of uncoated freesheet.

Using the viability benchmarking tool in FisherSolve™ Next, we can rank the viability of a mill against its peers based on operating costs, capital required, size, technical age and tons per inch trim.

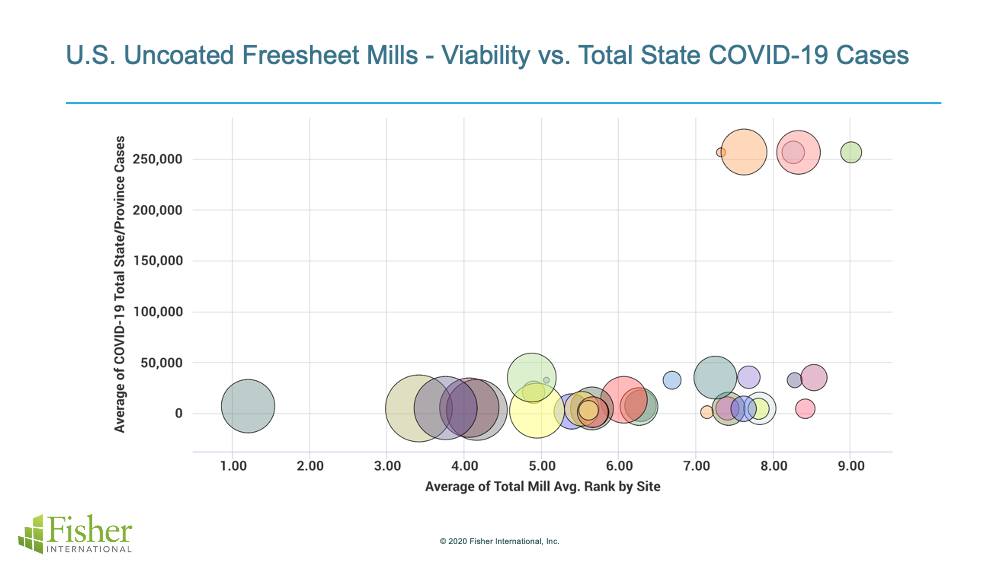

Below, we correlated the viability ranking of uncoated freesheet lines in the United States with their location and COVID-19 infection rates in their respective state.

So, what does this mean? Given the amount of time the American workforce (and students) remains at home and grows accustomed to fewer printouts more cloud-based documents, the less demand we’ll see for printing and writing paper. Those mills producing those grades in greatly impacted parts of the country can be expected to lose production demand (assuming most of their products remain relatively local).

The mills in the top-right corner of the previous chart were already at-risk before COVID-19 and now face even more challenges. Suppliers to these mills may need to make plans for potential shutdowns and understand how it can affect their bottom line.

3. What does increased demand for consumer tissue mean for market pulp?

While the meteoric rise in people staying at home has hurt the printing and writing sectors, demand for consumer tissue products has skyrocketed.

Fisher has published multiple blog posts exploring the future for tissue and towel production and explored how the industry can meet demand by converting other lines to produce toilet paper and other household tissue products. However, we haven’t discussed the production of market pulp need to make coveted at-home tissue.

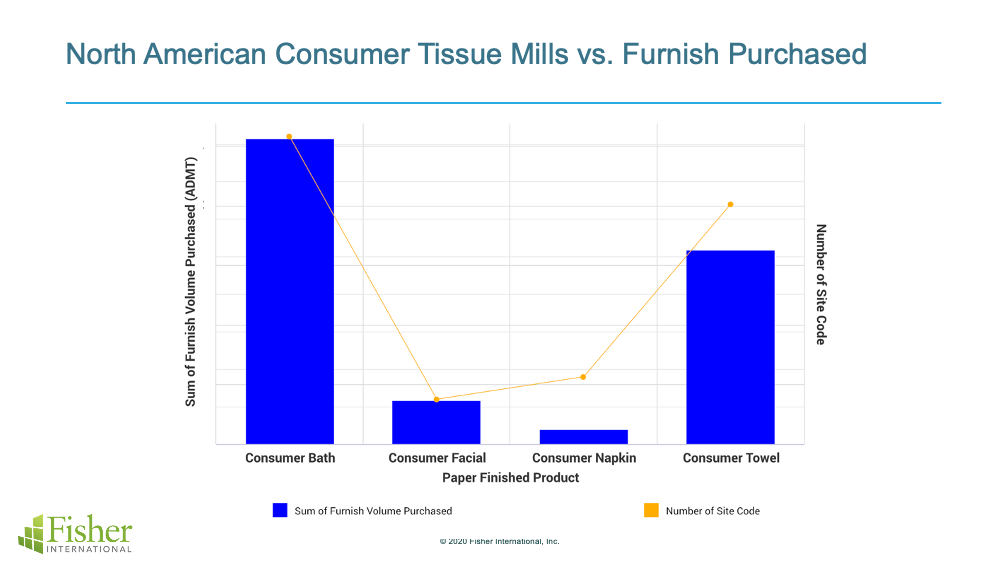

The bars in the combo chart below show the amount of furnish that is purchased in North American consumer tissue mills. The line shows the number of mills producing those products.

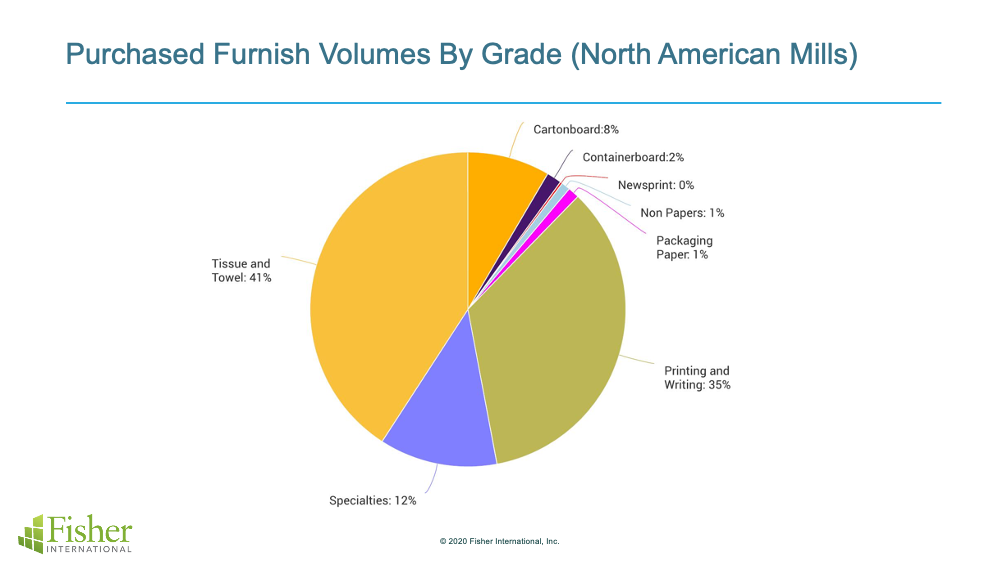

The next chart below shows how tissue and towel dominate the amount of furnish purchased by major grade in North America.

Now, if we bring COVID-19 into the picture, we understand how disruption in the production of market pulp can strain production of consumer tissue.

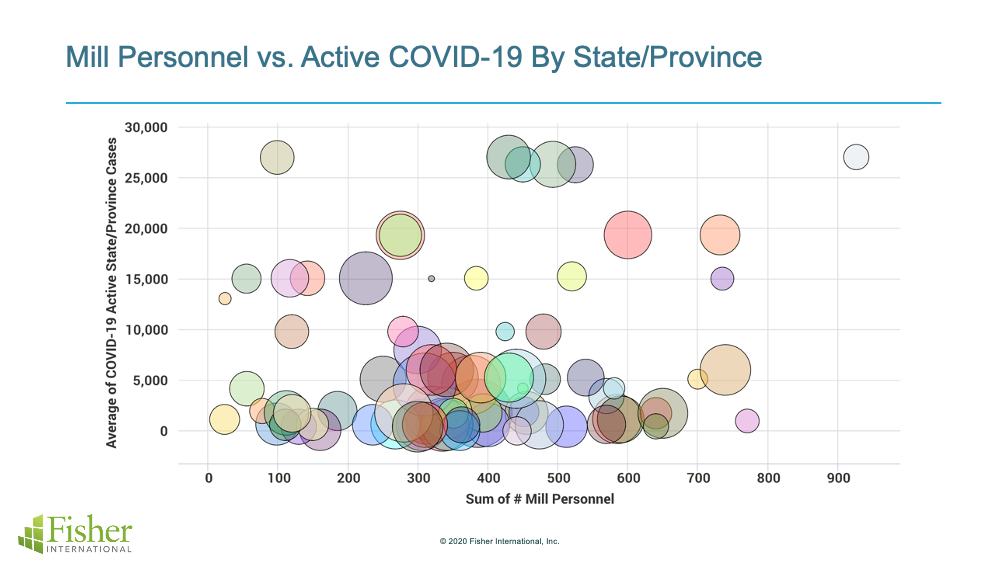

Similar to how we analyzed the size of a mill and its susceptibility to COVID-19 infection, we can use FisherSolve™ to plot market pulp mills in North America with the number of active COVID-19 cases by state and the number of personnel. The bubble size indicates the tons per day production.

For tissue producers, you have to hope your furnish doesn’t come from a mill with a large bubble near the top-left quadrant of that chart. An outbreak of COVID-19 cases at those mills would certainly be felt further down the supply chain.

For more information regarding COVID-19 data and the newest features in FisherSolve™ Next, please fill out the form on our Contact Us page.

Joanna Wilhelm has more than 20 years of paper industry experience and brings exceptional project management and operational leadership skills to her position as a Senior Consultant. Her experience in providing project management guidance and leadership for cross-functional and cross-division projects makes her a strong asset to the Fisher team. She balances diverse competencies including manufacturing processes, audit and metrics tracking, needs assessment, training, and team-building with a keen ability to meet or exceed budget and cost-saving goals on the various projects with which she is involved.