Toilet paper has stepped into the spotlight during the coronavirus pandemic. Either you have hordes of it, or you’re down to your final roll and can’t find a 4-pack in a 20-mile radius.

Given the increased demand for tissue and towel products brought on by COVID-19, it’s a perfect time to revisit where these products actually come from and what impact this surge can have on the environment.

The following analysis is an excerpt from a Fisher analysis piece titled “Is Bath Tissue Really Wiping Out North American Forests?” available for download here.

Is There an Issue With Tissue?

A February 2019 report from the Natural Resources Defense Council (NRDC) resulted in several news articles and stories stating, “The Issue with Tissue.” The NRDC report focused criticism on North American bath tissue producers for the amount of virgin fiber used in their products and the impact on the environment resulting from the cutting of boreal forests for the virgin fiber supply.

So, are commercial and consumer bath tissues the worst offenders when it comes to the quantity and percentages of virgin hardwood and virgin softwood fibers used? How do North American bath tissue producers stack up compared to the rest of the world in their use of recycled and other environmentally friendly fibers?

What is a Boreal Forest?

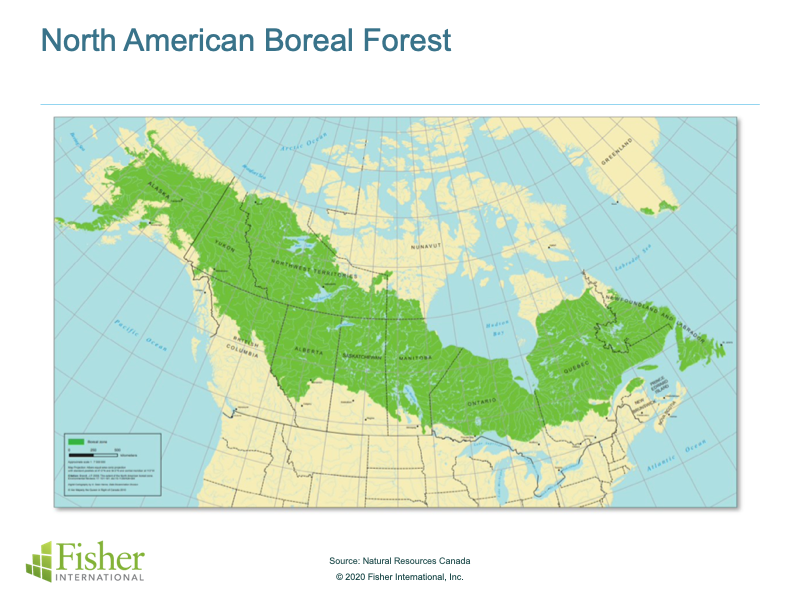

We hear the words “boreal forest” often when environmental issues around the paper industry are raised. What makes a forest a “boreal” forest? Primarily, it is the location, identified as a northern forest which will also influence the growing period and cycles, and the species (typically more softwood).

Boreal forests can be divided into northern and southern zones, including territory on the Canadian border and into the northern-most parts of Minnesota and Michigan. Southern boreal zone forests are productive enough to produce timber and fiber for paper pulp.

Natural Resources Canada (NRCan) defines boreal forests in the covering shown on the below map, which means that many Canadian market pulp and paper mills are going to have a tough time sourcing locally without getting into boreal growth.

There is some debate as to whether boreal forests can contain working forest, where seedlings are planted to reforest, or whether it is entirely unaided growth with no seedling plantings. Since the practice of planting in Canada and the northern U.S. is very small, then for the purposes here, we will consider boreal forest to be regenerating naturally, without aid.

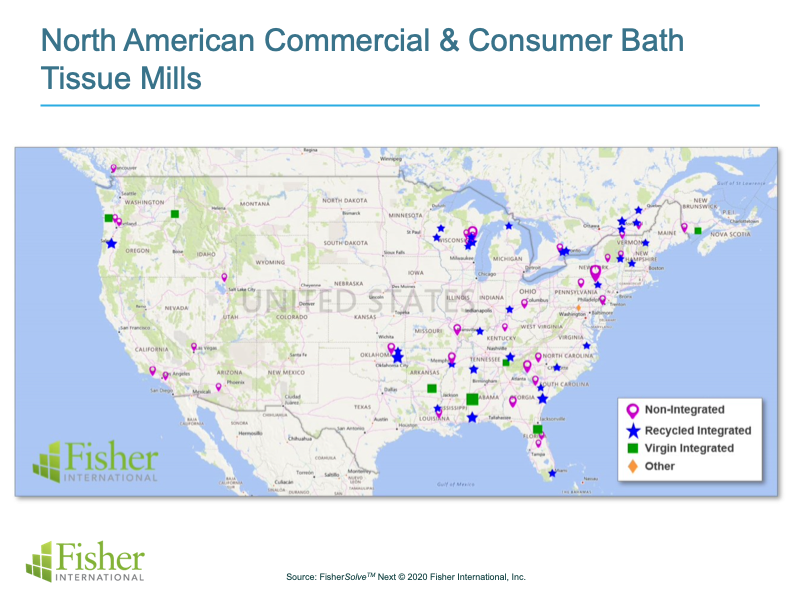

The next map shows the operating commercial and consumer bath tissue mills in the U.S. and Canada, where symbol size indicates volume of furnish consumed (ADMT).

There are very few Canadian tissue mills compared to the number of tissue mills in the U.S., and without knowing exactly where the mills are sourcing their logs, chips, or purchased market pulp from, it is hard to know exactly what percentage of their virgin hardwood or softwood fiber is ultimately coming from what would be considered boreal forest versus timber plantations.

However, it is safe to assume it to be a large percentage, as timber plantations in Canada and the northern U.S. are rare compared to the southern U.S.

So, it becomes a question of how much wood, chips, and/or market pulp are the U.S. mills importing from Canada, versus buying from U.S. market pulp producers, using boreal forest-sourced wood. In my experience, U.S. mills don’t often import logs or chips from Canada, unless there is some urgent need, so that use of boreal forest is likely low.

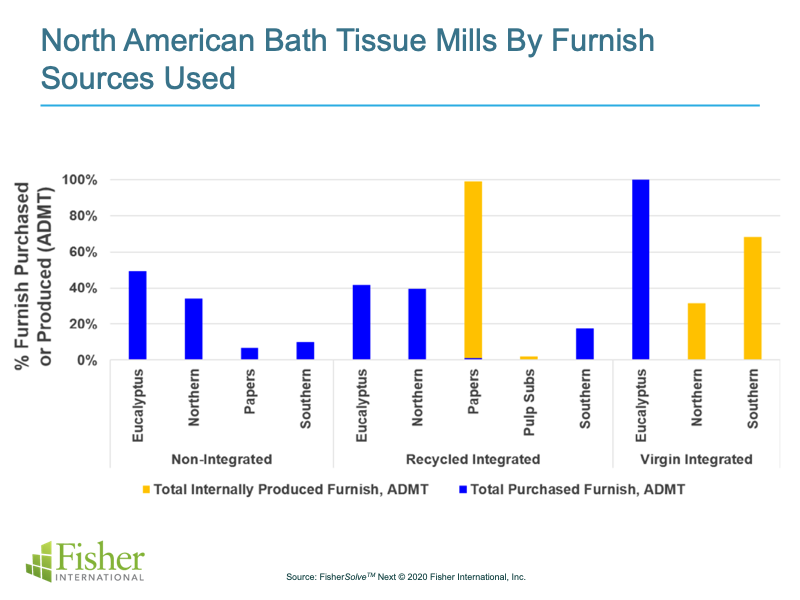

However, many of the bath tissue producing mills are non-integrated, and even the integrated mills will use purchased pulp in their furnish. This also means that 77 percent of the purchased furnish supplying North American bath tissue producers are other types of fiber, with 54 percent being bleached eucalyptus kraft (BEK).

And although we see a low purchased deinked and bleached recycled fiber percentage, keep in mind that many of the bath tissue mills are recycled integrated mills, so they are processing recycled papers into recycled furnish on-site.

A Breakdown of North American Furnish

In the case of kraft market pulp, northern bleached softwood kraft (NBSK) accounts for 23 percent of the purchased furnish used by North American commercial and retail bath tissue producing mills.

Since there are few U.S. NBSK producers, the U.S. tissue mills must import this from Canadian producers to a large extent, which in turn means the use of logs and chips from boreal forests is likely. Still, tissue and towel grades consume less purchased virgin northern softwood and hardwood than other grades produced.

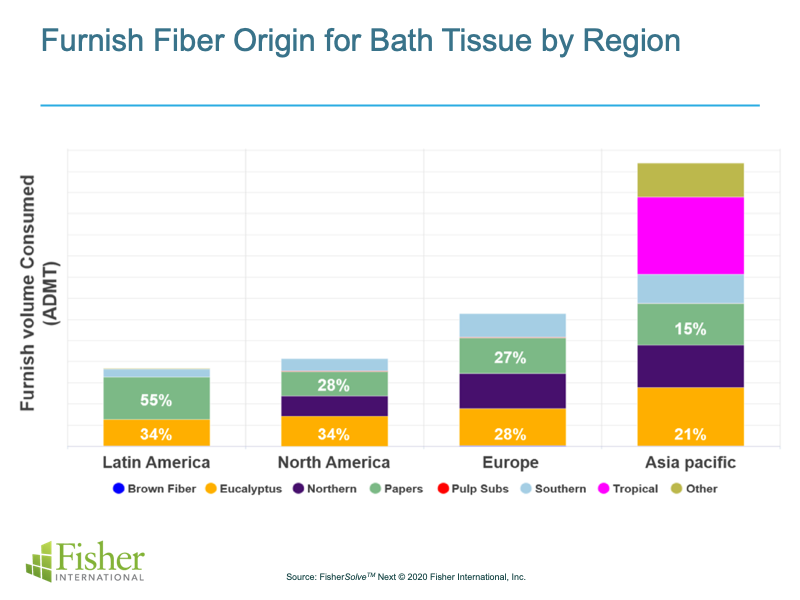

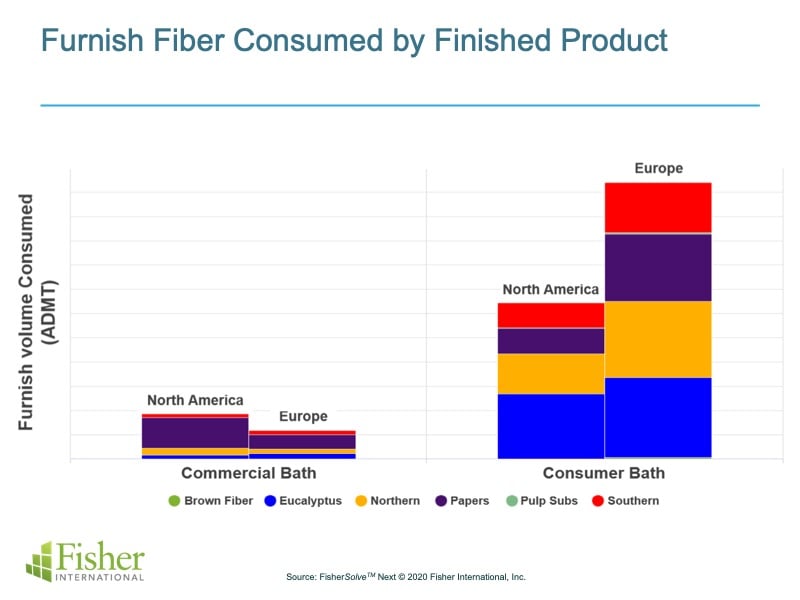

Of that commercial and consumer bath tissue production, recycled papers already account for over 25 percent of the furnish used in North America and Europe and about 55 percent in Latin America.

Eucalyptus fiber accounts for approximately 30 percent of the fiber used in those three regions as well, further closing the gap in virgin hardwood and softwood fiber from boreal or tropical forests. It is worth noting that eucalyptus falls into the hardwood bucket, and as a result, often gets overlooked as an alternative fiber source. Given that it is harvested on plantation farms and has a fast growth cycle, it is considered a respectable and more environmentally friendly option to traditional hardwood and softwood.

So, in total, North American bath tissue mills are already using at least 60 percent recycled and eucalyptus furnish for their production, as are European mills, which is more respectable than perhaps one might have expected.

Given the increased demand for tissue and towel products brought on by COVID-19, it’s a perfect time to revisit where these products actually come from.

The full Fisher analysis piece titled “Is Bath Tissue Really Wiping Out North American Forests?” is available for download here.

Joanna Wilhelm has more than 20 years of paper industry experience and brings exceptional project management and operational leadership skills to her position as a Senior Consultant. Her experience in providing project management guidance and leadership for cross-functional and cross-division projects makes her a strong asset to the Fisher team. She balances diverse competencies including manufacturing processes, audit and metrics tracking, needs assessment, training, and team-building with a keen ability to meet or exceed budget and cost-saving goals on the various projects with which she is involved.