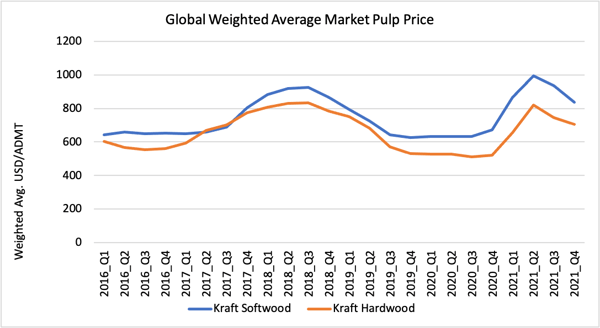

Market pulp is a critical global commodity within the pulp and paper industry. As such, it is a constant fixture in global trade flows because of its primary role in manufacturing numerous paper grades. Market pulp prices have always been volatile and kraft market pulp, in particular, dropped to a 10-year low point in 2020.

However, as illustrated in the graph below, the global weighted average prices for kraft softwood and kraft hardwood pulps increased significantly in 2021, with skyrocketing spot prices in the second quarter. And while prices have since decreased from those levels, they have still remained substantially higher; in 4Q2021, kraft softwood prices climbed 25% and kraft hardwood prices jumped 35% compared to 4Q2020. This has left buyers wondering what is driving high prices and when they will subside.

Source: FisherSolve

Source: FisherSolve

What Factors are Influencing These Price Increases?

- Supply chain issues: The start of the pandemic sparked what has evolved into the current global supply chain crisis, which has had cascading impacts across virtually every industry. The lack in availability of reliable shipping has been one of the most challenging outcomes to the global P&P Industry. According to FourKites, a supply chain consultancy, container ships unloading goods remained at American ports for an average of seven days during December 2021 through February 2022 – a 4% increase compared to all of 2021, and a 21% increase compared to the start of the pandemic. This has caused a significant delay in paper imports, especially from Asia into Europe and North America.

As a result, European and North American producers have been forced to move production closer to the customers they service, as they’ve been experiencing more demand than was initially predicted at the end of 2021. According to the New York Times, the mayhem at factories, ports and shipping yards, combined with the market dominance of major companies, is a key driver for rising prices. - South American producers: South American producers are facing difficulties in changing shipping contracts from Asia into Europe where prices are more attractive. Additionally, logistics costs have been increasing in the US, where there are ongoing difficulties due to a lack of trucks and drivers.

- Challenges in recovered paper market: While demand for recovered paper was relatively strong at the start of the new year, continued logistics issues have contributed to rising high-grade prices – specifically for sorted office paper (SOP) as facilities compete for supply. Many are anticipating a difficult export year for recovered paper as local mills are experiencing such high demand, which means there is less tonnage going to export.

- UPM strikes: On January 1, 2022, the Paperworkers’ Union’s strike begun at most of UPM’s Finnish mills. As the strike continues to be extended, dozens of UPM workers have resigned in various parts of Finland, which means it may be difficult to start up all of UPM’s paper machines once the strike comes to an end. Since UPM is a global provider of label materials, these strikes are exacerbating the paper shortages that were already depleted from last year’s growing demand and lack of resources – damaging the recovery of the supply chain issues that have been plaguing the global economy since the start of the pandemic. According to ImportYeti, sales of UPM products plummeted from 306 sea shipments in October 2021 to barely 53 shipments in January 2022. As a result, some of the largest US manufacturers of release liner and face sheets have indicated growing issues with obtaining certain raw materials – pushing the demand and price of market pulp even higher than it already was.

- The war in Ukraine: While the war hasn’t yet affected the pulp market directly, embargos to Russian markets may make some additional pulp tonnage available to European markets. However, due to the recent lack of chemicals, Russian unbleached pulp will be diverted into Asian markets – which will more than likely decrease pulp prices within the region.

As of now, it’s been several months since producers and customers have been waiting for a price drop in the pulp market – however, they may be waiting for a while. In a global market, it’s important to stay on top of these trends - especially those that are so critical for manufacturers in the paper industry. To see what’s happening in individual pulp markets around the world, talk with a Fisher expert today about the unique modules available via FisherSolve such as our STE Analytics module which can be used for pulp forecasting. Our STE module, along with the rest of modules, are designed to help you improve your decision-making process with the most robust pulp and paper data available to the market.