Ecological trends and concern over pollution and climate change are putting more and more pressure on the global textile market. Rated as one of the most carbon-polluting industries in the world, the textile market creates more CO2 emissions than international flights and maritime transport combined.

As new wood-based textile fiber technologies mature, could they be a viable, ecologically sound replacement for oil- and cotton-based textile fibers, and an attractive profit opportunity for the pulp and paper industry?

Creating textiles from wood is not a novel idea. Invented at the end of the 1800s, viscose, a cellulose-based fiber, was the first man-made textile fiber. Although its original intent was to replace cotton, oil-based fibers, and natural silk, costly production and low wet-strength have historically limited its use.

As the demand for textiles has steadily increased and the technology has improved, the consumption of viscose and related fibers (like Lyocell) has gradually increased. Still, the current share of wood-based textiles is only about 6 percent of the almost 100 million tons of textile fiber produced annually.

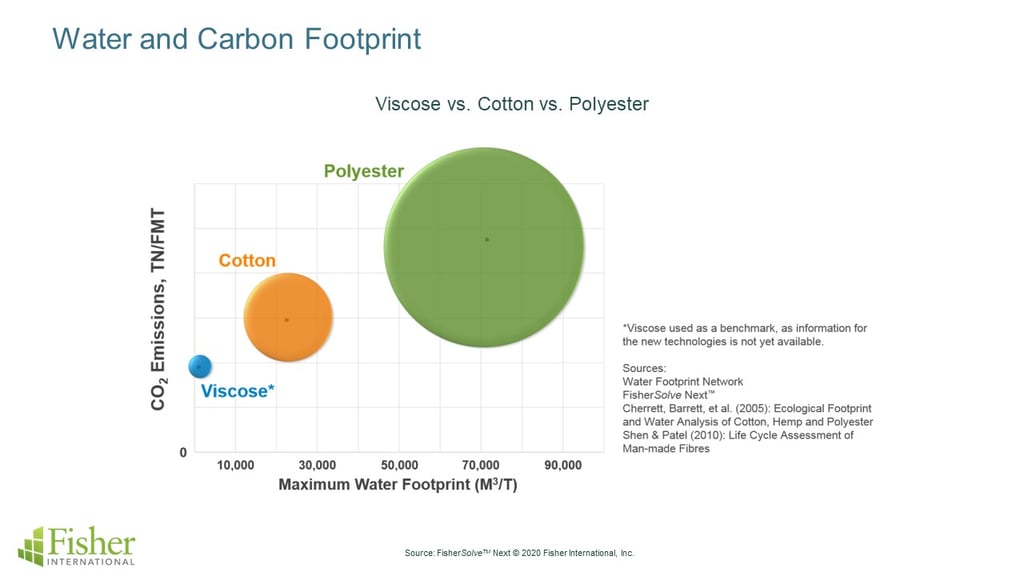

And as the following graph illustrates, the average dissolving pulp producers’ footprint is much smaller than those of cotton textiles. (Viscose was used as a benchmark, as information for the new technologies is not yet available.)

If new wood-based textile technologies prove to be ecologically feasible, how much wood would the textile market end up using, and would it be a profitable alternative?

Cotton production for 2018-19 was projected to be about 120 million bales (USA), corresponding to approximately 26 million tons of cotton. Imagine if crop failures become more common, let’s say, by losing 5 percent of the annual crop. There would then be a need for 1.3 million additional tons of fiber from other sources (for simplicity’s sake, we used a 1:1 ratio of cotton weight to other fibers required to substitute, including dissolving pulp).

If viscose dissolving pulp made up the shortfall, the pulp industry would need to add almost 25 percent of annual viscose dissolving pulp capacity to meet demand.

Market growth is also a huge factor, as the projected need for textiles in 2025 is 140 million tons per year. Even if only a third of this growth is fulfilled by cellulose-based textiles, this translates to 11 modern pulp lines supplying solely to the textile industry.

So, any way one looks at the market, the opportunities could be significant. But how about profitability?

The price of polyester has historically been about 50-60 percent of viscose, and cotton prices some 90 percent of viscose. Even if we expected the production cost of the new wood-based fibers to be somewhat higher than viscose due to improved water handling and more environmentally friendly chemicals, it’s still possible to achieve a reasonable end price in the market with the savings from raw materials.

“The economy of scale is a huge advantage for wood-based textile fibers in comparison to other emerging technologies,” said Emmi Berlin from Finland-based Spinnova, which completed its pilot facility for wood-based textile fibers in 2018.

The forest industry has a significant competitive advantage of being able to produce sustainable, stable quality raw material in bulk quantity year-round. This is something that could eventually pose a threat even to oil-based fibers and open an unprecedented profit opportunity for the industry.

The drawback is that technology development is relatively slow. With the first technologies still in pilot stage, it is likely to take years before consumers will start seeing the new fibers at the retail level. As solutions are needed now, early adopters are likely to win the game.

Will the forest industry move quickly enough to take advantage of the opportunity?