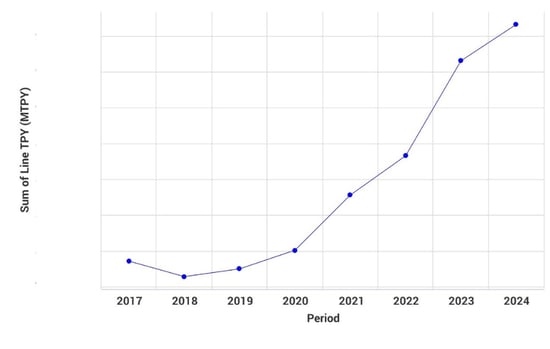

Cartonboard has experienced significant growth over the last couple of years. It currently makes up about 17% of the global paper and board market – the second leading grade behind containerboard. The consistent growth within this sector is due to a combined result of a number of factors such as the economy, urbanization, population, sustainability concerns, and government policies and regulations. As we can see in the image below, cartonboard capacity experienced a substantial increase in 2021 (+5% YoY) and 2022 (+3% YoY), with an even more impressive increase expected to occur in 2023 (+8% YoY).

When producing cartonboard, there are different types of grades that can be used to do so depending on the finished product – Folding Box Board (FBB), Coated Recycled Paperboard (CRB), Solid Unbleached Kraft (SUK), Solid Bleached Sulphate (SBS), Coated Unbleached Kraft (CUK) and Uncoated Recycled Paperboard (URB).

Global Cartonboard Capacity 2017-2024 (Actual and Announced)

Source: FisherSolve

Source: FisherSolve

Factors Impacting Cartonboard Growth

As mentioned earlier, there a number of combined factors at play contributing to the annual growth of cartonboard. One major factor is the growth and popularity of frozen foods. Frozen food has been a pandemic powerhouse and growth already outpaced total food and beverages in the three years preceding the pandemic. In 2Q of this year, the frozen food category experienced another surge amid increasing inflation – outgrowing the fresh food category by 230% at that time.

This trend has created a great opportunity for companies that produce the paperboard used in frozen foods packaging as demand has significantly increased. SBS and SUK, both virgin fiber-based grades, are the preferred paperboard grades for frozen food packaging due to their wetting resistance and superior stiffness.

However, CRB has also been gaining wider acceptance amongst consumers due to the growing preference for recycled-based packaging. Production capacity for SBS, coated SUK and CRB has increased as more consumers continue to purchase frozen meals.

Another major factor impacting the growth of cartonboard is the increased consumer awareness about excessive plastic pollution and its hazardous effects to the environment. We are beginning to see more countries begin to impose bans in an attempt to significantly reduce plastic pollution. For example:

- The European Union implemented a €.80/kg tax on non-recycled plastic packaging waste.

- India’s ban on single-use plastic items went into effect on July 1, 2022.

- Several states in the US have some form of plastic bag legislation enacted.

- On June 20, 2022, Canada’s government announced its plan to ban the manufacture and importation of single-use plastics by the end of the year.

- Earlier this year, Heads of State, environment ministers and other representatives from 175 nations, endorsed a historic resolution at the UN Environment Assembly in Nairobi to end plastic pollution, and forge an international legally binding agreement, by the end of 2024.

- On January 19, 2020, China announced a five-year plan to rid the nation of single-use plastics.

This means that we will see a significant increase in cartonboard demand as paper food-grade containers and paper cups replace plastic over the next several years.

Today, however, we are going to focus on FBB and SBS and discuss the differences between the two as well as its potential future.

What Is the Difference Between Folding Box Board (FBB) and Solid Bleached Sulfate (SBS)?

The main difference between FBB and SBS is that FBB is always multi-ply and utilizes a combination of chemical and some form of mechanical pulp (MP) or thermomechanical pulp (TMP). Whereas SBS can be either single or multi-ply board but is always comprised of 100% chemical pulp.

What Is FBB?

FBB is layered with mechanical pulp that is sandwiched between outer layers of chemical pulp with an optional coating. Being virgin fiber paperboard with consistent purity for product safety, the combination of inner layers of mechanical pulp and outer layers of chemical pulp creates a low-density, bulky board with excellent folding and printing characteristics. Major end uses of FBB include:

- Frozen and chilled packaged foods

- Liquid packaging board

- Take-out boxes

- Health and beauty products

- Electronic packaging

- Confectionary

The leading regions of FBB include Europe, South America and Asia. It is also India’s primary packaging substrate used by businesses.

What Is SBS?

SBS is purely constructed of bleached chemical pulp with a coated top side that creates excellent printing characteristics with moderate strength. These boxes are popular with most industries and used to package:

- Pharmaceutical products

- Food

- Cosmetics

- Tobacco

- Frozen food

North America is the leading region for SBS production, and over half of the world’s supply of SBS comes from North America and is used for packaging retail products.

What Does the Future of FBB and SBS Look Like?

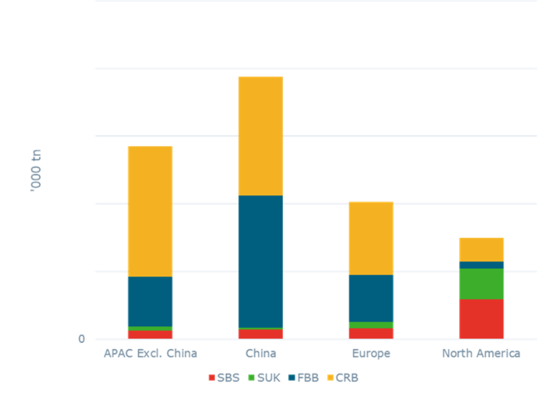

As we can see in the image below, China is the dominant market for coated cartonboard and is expected to remain the leader for the foreseeable future. This makes sense considering majority of coated cartonboard capacity is targeted to the Asia Pacific region. In fact, Asia’s cartonboard capacity will continue to boom as 8 million MT of new capacity has been announced through 2025.

Estimated Capacity by Grade, 2022

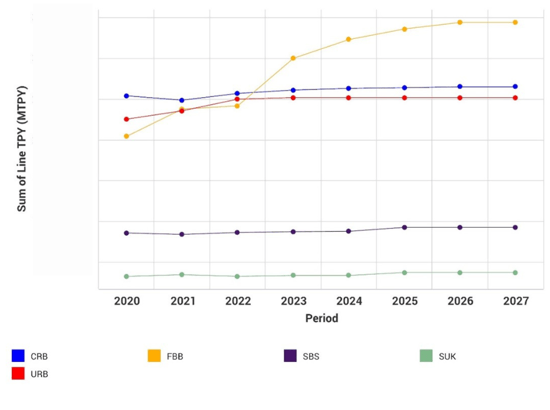

As we can see in the image below, FBB is the fastest growing global cartonboard grade with a 24% increase YoY in 2023 to kick things off. This is a big and recent shift considering it was only the third leading cartonboard grade this year.

Global Cartonboard Capacity by Grade (Actual and Announced)

Source: FisherSolve

Source: FisherSolve

FBB is experiencing such significant growth due to many of the factors previously identified, i.e. increased frozen food demand and plastic substitution. However, it’s also important to note that $1.5 billion of investment is flowing into North American cartonboard production – with some of that going towards FBB production.

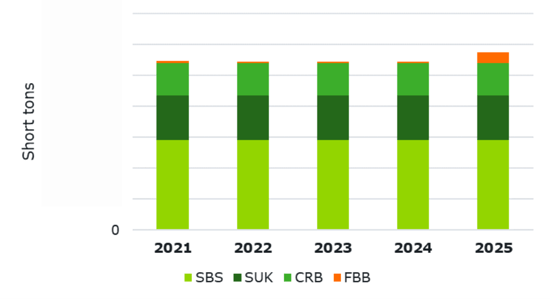

North American bleached paperboard capacity has been flat to declining for the last decade. As noted earlier, the US is one of the few markets that heavily focuses on producing SBS. However, in December 2021, Swedish pulp and paper manufacturer BillerudKorsnäs AB (now referred to as Billerud) announced its acquisition of North American coated papers producer Verso Corporation. Since demand is decreasing for SBS, as many of the assets used to produce the grade are older and have higher costs, Billerud is currently planning to convert the Escanaba mill into a scale-size FBB mill, with the first machine expected to be converted by 2025 and another by 2029.

NA Announced Cartonboard Capacity by Grade

Source: FisherSolve

Source: FisherSolve

However, on November 10, 2022, Sappi North America announced the approval of a $418 million capital project to convert its PM2 (a coated freesheet machine) at its Somerset mill in Skowhegan, Maine to increase its capacity and produce SBS products. The planned project at the Somerset mill is slated to come online early in 2025. As we discussed earlier, with the increased awareness about excessive plastic pollution, Sappi’s goal is to pursue the growing area that is plastic replacements, and SBS is a more environmentally sustainable alternative to plastic packaging.

After looking into the cartonboard market and some of the different announced investments, a number of questions arise, such as:

- Is there long-term demand to support 2.5 MMTPY in North America and 6.4 MMTPY in new capacity without significant machine shutdowns?

- Will some of the folding carton business, i.e. SBS and FBB, switch to recycled or brown fiber in the name of environmental sustainability?

- With the entry of FBB production in the North American market, will it turn out that imports have paved the way for rapid growth in this efficient substrate? If so, in which products?

For a deeper look into answering the questions, talk with an expert at Fisher International who can help your business formulate an actionable plan with a high degree of accuracy.

You can also learn more about how Fisher International’s analytics platform, FisherSolve, can provide you with detailed information on every paper and pulp mill in the world for both market and competitive analyses.