The Pulp and Paper industry is under a historical stress test right now. Coronavirus has infected every part of the industry as demand in some grades is melting like sugar in rain.

Some countries have stopped all non-essential production. International trade has halted. Delivery delays are long. Suppliers can’t send their people into pulp and paper mills without risking production. Spare parts and critical items to run machines are difficult to find. If prolonged, it will be near impossible for some mills to continue business.

Even after the current impacts of coronavirus itself disappear, multiple disruptions will likely follow for suppliers.

Already beaten, graphic and copy papers are facing declining demand as those working from home are no longer using office printers and copiers on a whim. Some of this impact may be permanent as mills that produce stressed grades, have high capital cost, old assets, below average productivity, or high production costs may find it difficult to recover.

Despite the shock, there are some grades experiencing high demand in the middle of this storm, most notably packaging and tissue papers. In the short term, some mills may come out of this pandemic stronger than before, but what will happen in the long run depends on economic recovery and speed, and unpredictable consumer habits

E-commerce, home-delivered restaurant food, and changes in personal hygiene standards can drive paper products demand despite the slow economic recovery.

(Read more:Are We Really Running Out of Toilet Paper During Coronavirus Crisis?)

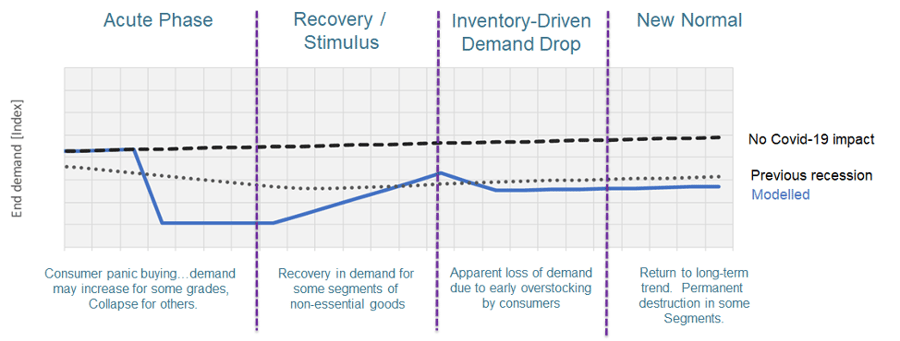

Together with our partner STE Analytics, we’ve built market models and forecasts for various paper products. Those forecasts include not only price, but also end demand, capacity utilization, and stock level for future development.

Below is a chart with a set of scenario elements, including COVID-19 development, as an integral part of this forecast for a group of paper products in one region:

As illustrated, a supplier’s strategic goals and financial targets have been rewritten by COVID-19.

I believe this period will also cause disruption and consolidation in the supplier segment.

Like some producers, some suppliers will also go bankrupt. Those suppliers who already focus on delivering high customer value and understand the value of client base quality (regardless of the business cycle) will win. This is because all companies have limited resources, and efficiency in utilization is an important success factor.

If you already work with future winners creating high customer value, it makes it hard for competitors to penetrate. It’s even better if a supplier has standardized solutions which can be easily multiplied. A supplier focused on big capital projects and forgetting service business is now exposed to a bigger risk because investments will be reconsidered in turbulent times with limited visibility.

(Read more: Global Printing & Writing: Are More Storm Clouds Ahead Amid COVID-19?)

Over the next few months you should make changes into your business that makes you strong for years to come. As a supplier, you should spend your time, effort, and limited resources increasingly with clients that will survive and be the future winners. This is even more so important for those suppliers who didn’t make those efforts in good times.

Understanding risk related to your portfolio early on allows you to optimize your resources and minimize losses.

Whatever your situation, Fisher International, with its best-in-class datasets, insights, and business intelligence system FisherSolve™ Next, can help adjust your strategy and understand optimal tactics to get over this canyon and to the other side with minimal damage.

Marko Summanen is a career paper industry professional with over 20 years of experience across strategic, tactical, engineering, and sales functions as well as a worldwide scope that includes China, Southeast Asia, the U.S., Canada, and several European countries.