The 2019 edition of the United Nations Economic Commission for Europe (UNECE) and the Food and Agriculture Organization of the United Nations (FAO) Forest Products Annual Market Review provides a comprehensive assessment of global forest market developments in 2018 and 2019, as well as the policies that continue to drive those developments.

The global UNECE forest region is divided into three subregions: Europe, the Commonwealth of Independent States (CIS), and North America. The total region stretches from Canada and the US in the west through Europe to the Russian Federation and the Caucasus and Central Asian republics in the east.

It encompasses roughly 1.7 billion hectares (4.2 billion acres) of forestland, which includes just under half of the world’s total forested area.

How do #forests products & management relate to the #CircularEconomy & how can they contribute to reaching the #SDGs?

— UNECE (@UNECE) February 16, 2020

Find out in the @UNECE/@FAO Forest Products Annual Market Review https://t.co/cqcwyH8WV5 pic.twitter.com/E2VQPeq11e

The following are the highlights from the latest Review using data from 2018 and 2019:

— Paper and paperboard production rose in the CIS (by almost 4%) in 2018, was flat in Europe and dropped slightly in North America.

— Overall paper demand declined in the UNECE region by 1.2%, with packaging and tissue grades partially offsetting reduced demand for graphic grades.

— Wood pulp production rose in Europe in 2018 due to increased demand and capacity but fell slightly in North America on unplanned downtime. Woodpulp production was higher in the CIS due to increased capacity and a weak Russian rouble.

— The apparent consumption of wood pulp was stable in Europe and North America despite higher prices and declining graphic-paper demand. Wood pulp for the packaging, sanitary and household paper segments is increasingly being supplied from South America.

(Read more: Wood Pulp is a Sustainable Cotton Replacement, but Is It Profitable?)

— Graphic-paper capacity in the UNECE region fell by 1.4 million tonnes in 2018 and is expected to decline by another 4.4 million tonnes in 2019.

— Graphic-paper production in North America fell by 1.74 million tonnes in 2018, an 8.4% decline from previous years due to higher prices; however, the higher prices, imposed to cover rising costs for pulp, energy and transportation, also caused a drop in demand (enabled by the ongoing shift to electronic communication).

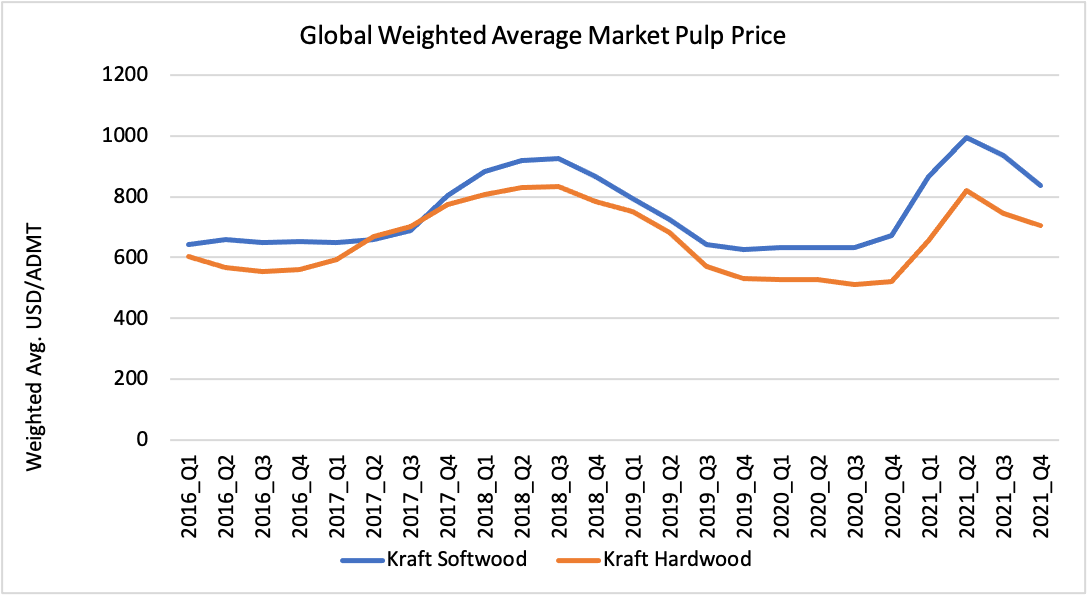

— Prices for wood pulp rose in the first half of 2018, with strong demand prompting a flurry of buying as consumers tried to bear successive price increases. By the end of 2018, overcapacity driven by record high prices and falling graphic-paper demand and a weakening Chinese economy caused a price correction that continued into mid-2019.

(Read more: Five Predictions for Global Pulp and Paper Industries in 2020)

— China’s recovered-paper imports fell by 34.8% in 2018, to 17.0 million tonnes, as customs officials enforced quality controls.

Click here to read the full report that includes detailed data for each sector of the global forest products industry.

Pulp and paper producers use Fisher’s business intelligence resources for both market and competitive analysis. From strategic decisions about products and assets to tactical decisions like where to spend sales time, we support the entire decision chain with the FisherSolve™ platform.