In a recent blog we discussed how the impacts of the novel coronavirus (COVID-19) have rewritten how the Pulp and Paper industry will function and survive in the coming months.

Nobody knows the exact toll the mysterious disease will take on our industry, but with comprehensive data, we can make prepared, informed, strategic decisions to ensure profitability and survival.

But the time is now to understand what will happen to different mills and why suppliers of the industry should be prepared. A number of mills will close in the coming months and some companies will go bankrupt because of COVID-19’s impact. The strong will become stronger and the weak will face increasing headwinds.

(Read more: Forecasts Show Coronavirus Has Rewritten Strategy & Financial Targets)

The success of any mill is always a relative measure. With this lingering pandemic, metrics are rapidly changing. Yesterday’s “OK” is no longer evidence that a mill will be successful in the future.

In the next recession we’re likely to say business intelligence played a bigger role than ever in mitigating risk and exposure. Long periods of rather stable business have caused many corner-room executives to think they have things under the control. This assumption is being challenged perhaps faster than ever. In my experience, most companies have gaps on how they utilize business intelligence and analyze their own business data against universal market data — not just against their previous year’s sales bookings.

(Read more: Global Printing & Writing: Are More Storm Clouds Ahead Amid COVID-19?)

For more than 15 years, Fisher International has studied all pulp and paper industry line and mill closures, company bankruptcies and the reasons leading to those closures. Each instance has been analyzed by our experts and each instance influences our models. In other words, we have prepared ourselves for a situation like COVID-19.

FisherSolve™ Next, which now includes data on COVID-19, provides powerful industry data to help you analyze your unique situation(s). Fisher International can also help you develop forecasts for the virus impact on the paper industry. Supplier risk can be assessed on machine line and site level as well.

How do we do this in practice?

Each site has unique assets, location, and input costs with little or no possibility to make adjustments in the short term. They make specific paper grades and their assets require different amounts of capital to operate. Mills have variations in productivity determined by their asset size, age, speed, and automation level. Fisher International has all these factors listed for each site.

From this data, we create a matrix to analyze how any mill in the world ranks against other mills producing similar products. We call this matrix "FisherSolve™ Viability Benchmarking." Depending on this ranking, a mill can be rated “viable = low risk” or “not viable at all = high risk” or anything in between.

This data is adjusted quarterly for all mills. Relative mill ranking changes if any input data changes, cost of electricity changes, if the mill recently invested into a new machinery, etc.

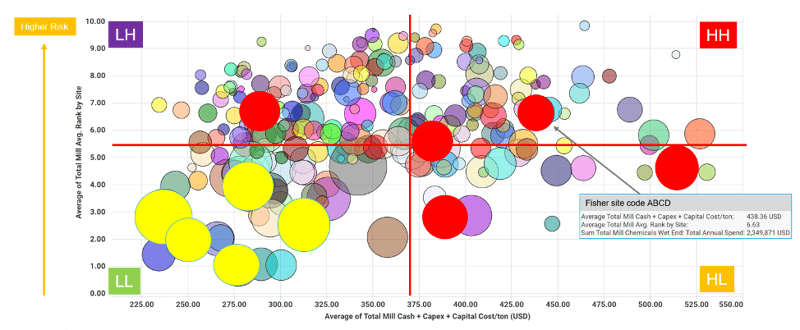

In the chart below I have one practical case example to start risk evaluation:

The chart above includes all mills producing the same grade in one region with each bubble representing one mill. The size of the bubble represents how much each mill spends on wet end chemicals. The X-axis shows each mill’s cost position (ability to generate cash during a crunch), while the Y-axis shows viability (includes capital requirements, technical age, size, productivity of assets, etc.).

Each quadrant can be read as follows:

- LL = Low cost/low viability risk: Can you find more mills like this in your portfolio?

- HL = High cost/low viability: Watch carefully, or extend terms if needed to help customer survive through the down cycle.

- LH = Low cost/high viability: Watch carefully, could be subject to unexpected shuts due to older equipment, poor automation, quality gaps etc.

- HH = High cost/high viability: Manage accounts receivable in this segment lower, reduce inventories.

I included the details of one red site in the HH quadrant. This site has high costs and capital requirements and its overall risk is high among volume spenders of wet end chemicals.

If a supplier of these chemicals has high market share of total spending among red-marked mills, it may give a false feeling of sustainable success without this type of data and analysis. Meanwhile, suppliers should recognize yellow-marked mills in the LL quadrant as targets.

(Read more: Are We Really Running Out of Toilet Paper During Coronavirus Crisis?)

If you ignore the impact of data, consequences can be severe. “Making it up as you go” will create a negative loop of constantly putting out fires that lead to suboptimal results. The slow reactions to COVID-19 from governments around the globe should serve as a cautionary tale to those who ignore expert advice and data.

Moreover, spending your time putting out fires will result in less time to focus on developing a winning strategy and implementation, which allows your competitors to take advantage of your business opportunities.

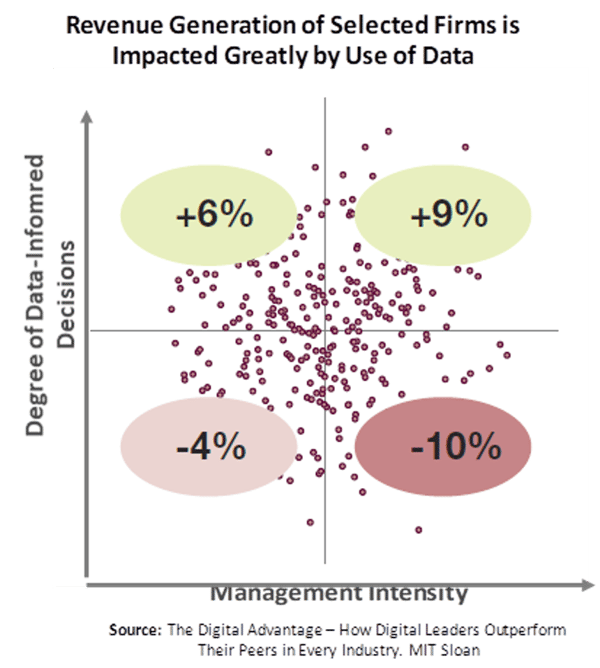

Companies that use data to inform their strategic decisions outperform companies that don’t. There is science behind this:

If you're among those who believe data and business intelligence are not really important and would rather go by gut feeling, intuition, what you’ve mastered over the years, or your network of connections and clients — this might be the last time you have an option to re-consider.

We at Fisher International look forward talking about your business intelligence needs and how we can work together to optimize your performance.

Marko Summanen is a career paper industry professional with over 20 years of experience across strategic, tactical, engineering, and sales functions as well as a worldwide scope that includes China, Southeast Asia, the U.S., Canada, and several European countries.